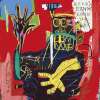

A Seller’s Guide To Jean-Michel Basquiat

Interested in buying or selling

Jean-Michel Basquiat?

Market Reports

Key Takeaways

How to Sell A Jean-Michel Basquiat Print

- Identify which tier your print sits within: estate edition, Anatomy, 1983 lifetime screenprint, or signed canvas edition.

- Assess imagery strength – crowns, skulls, and text-driven compositions consistently attract the strongest demand.

- Confirm edition size, publisher, and documentation before approaching the market.

- Align placement strategy with rarity and value level.

- Prioritise condition – surface integrity and colour retention materially influence outcome.

Jean-Michel Basquiat’s print market operates within a rare structure: extreme lifetime scarcity at the top, imagery-driven demand across estate editions, and sustained institutional visibility reinforcing value at every tier. From blue chip gallery placement to major evening sale results, his cultural centrality translates directly into collector confidence.

This guide outlines how Basquiat’s market functions in 2025 – and how sellers can position estate editions, Anatomy works, and lifetime prints strategically within a disciplined, placement-led environment.

Is Now a Good Time to Sell a Jean-Michel Basquiat Print?

Basquiat’s print market in 2025 is stable, active, and selective.

Estate editions continue to transact consistently, forming the core of the market with disciplined pricing across the £40,000–£100,000 range depending on imagery. Liquidity remains steady, with buyer engagement holding firm even as availability fluctuates from season to season.

At the upper end, lifetime works remain tightly held and surface infrequently. When strong examples do appear, they attract concentrated competition.

Current conditions favour well-preserved impressions with strong visual identity. Outcomes are being shaped less by market momentum and more by how and where a work is introduced – a market defined by strategic placement rather than urgency.

Jean-Michel Basquiat Market Performance – What Is Driving Value In The Basquiat Market?

Basquiat’s market is powered first by art-historical positioning.

His originals remain among the most sought-after works in the contemporary sector, consistently anchoring major evening sales. That visibility creates a halo effect across his editions. When a major canvas appears publicly, attention flows through the market – reinforcing demand for related imagery at every price level.

Basquiat Exhibition Presence

To name a few recent examples: the Fondation Beyeler’s presentation of the Modena Paintings, prominent dealer showcases at Art Basel including Jeffrey Deitch’s presentation of Valentine and the monumental shaped canvas Now’s the Time, and luxury-backed collaborations linking Basquiat with figures such as Andy Warhol under the LVMH umbrella.

Basquiat’s market is also closely associated with blue-chip representation at the highest level, including Larry Gagosian’s long-standing involvement in placing and exhibiting major works. Institutional exhibitions, dominant gallery presence, and cross-sector cultural partnerships ensure that his name remains continuously visible within both the art world and the wider luxury sphere.

Why This Matters For Sellers

This sustained institutional and commercial visibility reinforces Basquiat’s cultural centrality and underpins cross-generational demand. When his paintings command attention at the top of the market, confidence extends through his editions.

Lifetime prints remain exceptionally scarce and attract concentrated competition when they appear. Estate editions – reproducing his most recognisable imagery – provide active liquidity at accessible tiers.

Rarity at the top and volume below operate together. Ongoing institutional exposure sustains demand, and that demand supports resilience and pricing stability across the print market.

How Much Is My Jean-Michel Basquiat Print Worth?

Value in Basquiat’s print market is determined first by category – estate edition, Anatomy work, or 1983 lifetime print – and then by imagery and condition within that tier.

Basquiat Posthumous Estate Editions

Estate prints form the core of the market and often achieve higher price levels than Anatomy works due to scale and subject. Here, value is primarily imagery-led. Crown motifs, skull compositions such as Cabeza, and text-heavy works aligned with Basquiat’s most recognisable visual language consistently command stronger results.

Pricing responds to supply visibility. When multiple impressions of the same image surface close together, results stabilise; when supply tightens, competition intensifies.

Basquiat Lifetime Signed Prints

The 1983 signed screenprints sit at the top of the print hierarchy. Issued in very low editions and signed during Basquiat’s lifetime, they are extremely scarce. Their value is driven by rarity and signature rather than recent mid-market comparables, and they often transact privately.

The Anatomy series, while lifetime-signed and structurally rare, trades at a more accessible level due to scale. These works have shown steady value progression, with condition playing a decisive role.

Across all tiers, preservation materially affects outcome. Surface quality, colour retention, and margin integrity can create significant variance between impressions from the same edition.

How to Prove Your Jean-Michel Basquiat Print Is Real Before Selling

Basquiat prints are verified through documentation and publishing history, not through an active authentication board. That makes proof of purchase, traceable provenance, and publisher alignment the foundation of resale value.

Basquiat Estate Signatures and Certificates

Most estate-authorised editions are not hand-signed by Basquiat. Instead, they were released with estate-authorised signature markings, which can vary depending on when the edition was produced and who was managing estate oversight at the time. Those signature differences do not typically change value on their own; the market weights imagery, condition, and edition structure more heavily.

Some estate releases were accompanied by additional documentation (and in certain cases an authentication certificate issued at the time of release), while others were sold without anything beyond the standard publishing information and edition marks. For resale, what matters is that any paperwork you do have matches the work precisely (title, year, edition number, publisher, dimensions, and any stamps or marks).

Publisher and Printing Records

For both lifetime and posthumous editions, buyers look for consistency between the physical print and documented production details: publisher, printer/studio, paper, edition size, numbering format, blindstamps/chops, and release history.

This is where provenance becomes practical: proof of purchase, gallery invoices, correspondence, prior auction records, and known distribution channels do more to support liquidity than generic “authenticity” claims.

Basquiat Catalogue Raisonné and Enrico Navarra Archive

The most widely referenced catalogue raisonné-style resource remains the Enrico Navarra catalogue raisonné project, which is treated as a major archival reference point and a serious publication in its own right. It is not something sellers can always access or “check” casually, so it functions more as a credibility layer than a step-by-step solution.

Forgery Risk and Why Documentation Matters

Basquiat’s market carries meaningful forgery risk, particularly with works that lack clean publishing records or come with vague provenance. Unauthorised prints and misattributed editions do circulate, and this is exactly why resale confidence is built from verifiable documentation rather than informal assurances.

How to Conserve Your Jean-Michel Basquiat Print to Retain Value

Lifetime prints may show signs of age. Light exposure, paper toning, handling marks, or margin wear can influence buyer confidence. Preserving full margins and avoiding over-restoration is important, as alterations are closely scrutinised at resale.

Estate editions were produced more recently and are generally expected to be in strong condition if properly stored. Discolouration, surface abrasion, or framing damage on newer works can affect perception and pricing.

Across all works on paper, UV-protective glazing, stable humidity, and acid-free mounting are advisable. Trimming margins, applying adhesives, or undertaking undocumented restoration can reduce resale appeal.

For screenprints on canvas, surface stability and stretcher condition should be maintained, and any conservation should be professionally documented.

Where Can I Sell My Jean-Michel Basquiat Print?

Basquiat’s market is unique in its structure: lifetime scarcity at the top, imagery-led demand across editions, and sustained liquidity within posthumous releases.

Auction Versus Private Sale In Basquiat’s Market

Auction visibility has served many editions well, particularly estate prints where public comparables reinforce pricing confidence. However, increasingly, both posthumous editions and high-value lifetime signed works continue to trade off-market. Supply is limited, and buyer pools at higher tiers are concentrated, therefore discreet placement can protect value and align a work directly with qualified demand.

Choosing where to sell depends on tier, rarity, and current supply conditions. In Basquiat’s market, strategy is not uniform – placement should reflect how the specific edition behaves within the current market context.

Why Sell Your Jean-Michel Basquiat Print with MyArtBroker

Selling a Basquiat print requires discretion, informed pricing, and access to serious buyers.

A Dedicated Expert

We specialise in blue-chip prints and editions, with a particular focus on artists whose markets operate across public and private channels. Our team provides data-led valuations grounded in live demand, not speculative pricing.

0% Seller’s Fees, 100% of the Time

We operate on a 0% seller’s fee model. There are no commission deductions from your side of the transaction.

Extensive Network, Advisory & Recommendations

Through our global collector network, works are introduced directly to active buyers rather than exposed indiscriminately. For higher-value or scarce editions, this controlled approach can be critical.

Every sale is managed end-to-end, including buyer vetting, contracts, logistics, and insurance – ensuring clarity and security throughout the process.

If a work is better suited to an alternative route, we advise accordingly. The objective is not volume – it is outcome.