Jean-Michel Basquiat Print Market Investments © MyArtBroker

Jean-Michel Basquiat Print Market Investments © MyArtBroker

Interested in buying or selling

Jean-Michel Basquiat?

Jean-Michel Basquiat

59 works

Key Takeaways

Jean-Michel Basquiat’s investment outlook in 2026 is best read through auction trends, average value movement, and the behaviour of key market segments. Use these signals to assess risk, pricing stability, and long-term positioning in the print market.

Jean-Michel Basquiat’s print market behaves differently to most blue chip peers because it is structurally constrained by supply. Unlike artists with large, regularly circulating print catalogues, Basquiat’s lifetime production was limited, and genuinely signed prints surface infrequently. As a result, annual market performance is shaped less by changes in demand and more by what enters the market in any given year.

Periods of elevated sales value have coincided with the appearance of rare signed works or tightly held collections, while years dominated by estate-released editions show lower aggregate value but broader participation. This creates a market that can appear volatile at the headline level, yet remains active and resilient beneath the surface, supported by sustained interest in posthumous prints tied to Basquiat’s most recognisable imagery.

Is Buying a Jean-Michel Basquiat Print a Good Investment?

From an investment perspective, Basquiat’s print market is best understood as a two-tier structure. At the top end sit signed lifetime prints, which are exceptionally scarce and can materially reweight annual performance when they appear. These works often trade privately, and their public auction appearances tend to be sporadic rather than cyclical.

Beneath this sits the posthumous market, which provides liquidity, price discovery, and continuity. Estate-authorised prints allow the market to function year-on-year even in the absence of signed material, widening participation and sustaining collector engagement. For investors, this means upside is driven by scarcity and provenance, while stability is underpinned by broader access to estate editions. The result is a market that rewards selectivity rather than momentum.

What Happened in Jean-Michel Basquiat’s Print Market at Auction in 2025?

Basquiat’s print market showed a measured rebound in 2025, driven not by the return of major signed works but by sustained activity across posthumous editions and selective higher-quality releases. Only a small number of signed prints surfaced publicly, and no million-dollar signed example reappeared after 2023. Despite this, total sales value stabilised as demand shifted laterally across available material.

Several posthumous complete sets traded during the year, while individual prints tied to Basquiat’s most recognisable motifs achieved record results. This allowed pricing to recalibrate through hierarchy rather than retrace. Different edition formats absorbed demand at multiple levels, reinforcing a market structure where value can move across supply tiers when top-end material remains scarce.

What Is the Average Value of My Jean-Michel Basquiat Print?

Average values in Basquiat’s print market are driven by format composition rather than volatility. Years that include one or two rare signed works show sharp increases in average selling price, while periods dominated by posthumous editions naturally produce lower averages despite healthy trading activity. This does not reflect discounting or weakening demand; it reflects a wider distribution of transactions across estate material when signed works are absent. For investors, this makes format differentiation critical in that headline averages can obscure materially different risk, liquidity, and return profiles between signed and posthumous prints.

Top Performing Print Collections in Jean-Michel Basquiat’s Current Market

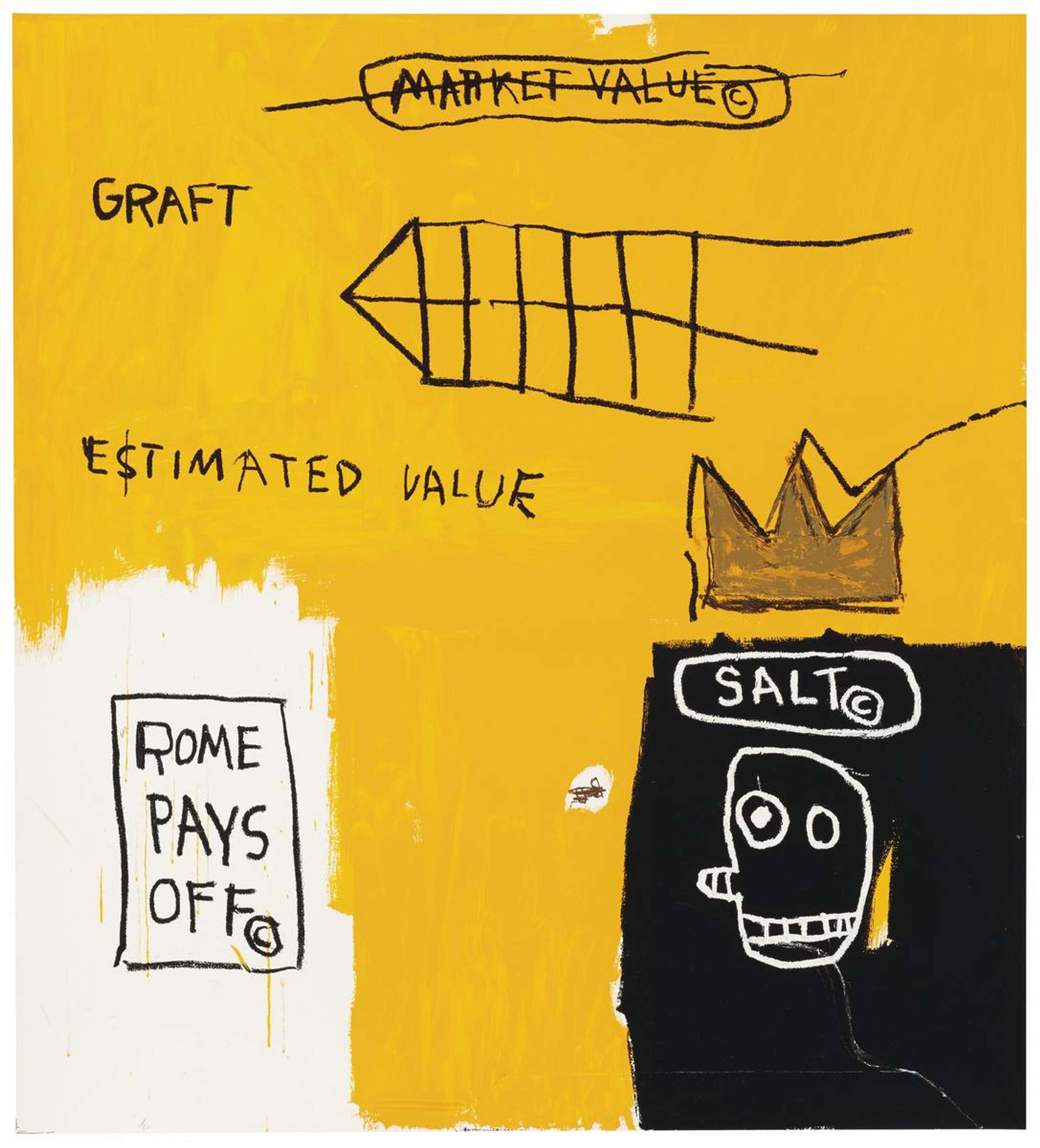

Basquiat’s top-performing print collections are defined by imagery alignment with his highest-value originals and structural scarcity, rather than by volume. Across the market, collections that reference his most recognisable visual language – skulls, anatomy, crowns, and aggressive line work – consistently command the strongest pricing.

Among posthumous editions, Cabeza and Flexible stand out as the most reliable performers. Both draw directly on Basquiat’s skull and anatomical motifs and have demonstrated sustained demand across auction and private transactions. Their performance is reinforced by limited proof variants and strong cross-market comparability with his original paintings.

Only a small number of posthumous portfolios operate at a collection level rather than as individual prints. Daros Suite and Superhero Portfolio are the only estate-produced works that consistently appear as complete sets of four, creating episodic value concentration when intact examples surface. Outside of these, most posthumous collections perform best on an individual-work basis.

At the signed end of the market, the Anatomy series remains structurally important. These works are often sold individually but are frequently grouped in pairs or larger combinations, allowing value to concentrate without requiring a formal complete set. Their extremely small edition sizes and direct connection to Basquiat’s hand underpin their long-term performance.

The Most In-Demand Jean-Michel Basquiat Prints from Investors

At the top of Basquiat’s print market sit two works that define pricing authority: Back of the Neck and Untitled (black). Both date to 1983 and were produced in exceptionally small editions – 24 and 10, respectively. These are the highest-valued prints in Basquiat’s market and are now largely absent from public auction, with most transactions occurring privately.

Beyond these two works, a small number of other signed prints surface sporadically at auction. When they do, pricing is often influenced by factors including condition, celebrity provenance or early exhibition history. However, supply is extremely limited, and these appearances tend to be episodic rather than cyclical, reinforcing the scarcity-led nature of the signed segment.

For investors operating below the ultra-rare tier, the Anatomy prints have become an increasingly important focus. While historically more affordable than posthumous prints, these works have seen measurable appreciation as collectors reassess their rarity and early production date.

Taken together, investor demand in Basquiat’s print market is stratified rather than broad. Top-tier value is locked into a handful of works best accessed privately, while liquidity and growth potential below that level are concentrated in early signed editions that remain comparatively accessible but increasingly competitive.

What Are the Top Performing Blue Chip Artist Markets?

Within the blue chip print market, Basquiat sits at the opposite end of the spectrum to scale-driven markets such as Warhol and sentiment-driven markets such as Banksy. Where Warhol’s value is sustained through volume and repeatability, and Banksy’s through cultural momentum, Basquiat’s pricing is event-driven and supply-sensitive. Market value expands materially when rare signed works surface, and contracts when they do not.

Compared to peers like Haring or Lichtenstein, Basquiat’s print market is narrower but more price-reactive. Fewer works trade annually, but individual results can disproportionately influence total value. This positions Basquiat as a higher-volatility, higher-scarcity blue-chip market, where performance is tied less to turnover and more to the availability of exceptional material.

Liquidity In Jean-Michel Basquiat's Print Market

Basquiat’s print market displays highly segmented liquidity, with activity spread across multiple price tiers rather than concentrated at a single entry level. By volume, a substantial share of works trade in the mid-market range, reflecting steady circulation of posthumous editions and accessible formats. At the same time, pricing power is heavily skewed toward the upper tiers, where a small number of transactions account for a disproportionate share of total market value.

This divergence highlights a key structural feature of Basquiat’s market: liquidity and value operate independently. Public auctions provide consistent turnover through estate-released prints, supporting accessibility and ongoing engagement. However, the highest-value signed works – including Back of the Neck and rare Untitled editions – rarely surface publicly and are more effectively placed through private sale. For investors, this indicates a market where entry and exit are readily available at the mid-level, while the most significant value opportunities require off-market sourcing rather than reliance on auction visibility.

This guide is intended for informational and research purposes only and does not constitute investment advice. All analysis and commentary reflect MyArtBroker’s interpretation of historical and current market data at the time of writing. As market conditions evolve, our views and analysis may change. Individual artworks and editions can perform differently depending on factors such as condition, provenance, timing, and market context. Readers are encouraged to conduct their own research and consult with a specialist before making any acquisition or sale decisions.