Market Watch: Market Editor Report April 2025

Sunset F. & S, II.85-88 (TP) © Andy Warhol 1972

Sunset F. & S, II.85-88 (TP) © Andy Warhol 1972Market Reports

The April 2025 prints and multiples auctions at Christie’s, Sotheby’s, and Phillips closed on a steady note, marking a confident entry into Q2 ahead of the May New York sales. While the 2025 Art Basel & UBS Market Report points to growing momentum at lower price points, these sales underscored continued appetite for top-tier editions.

Together, Christie’s, Sotheby’s, and Phillips brought in just over $14.3 million at the hammer in April - down 20% year-on-year (YoY). The dip mirrors a 17% reduction in lots offered and reflects broader caution in the art market amid economic jitters and tariff talk following Trump’s proposed “Liberation Day” duties. Still, New York held its ground.

House By House: April Auction Totals Across Christie’s, Sotheby’s and Phillips

Christie’s once again led the trio, pulling in $6.8 million - down 12% from last year’s $7.7 million, but still landing 28% above its low presale estimate, a vote of confidence for top-tier lots. Sotheby’s underwhelmed by comparison. Despite offering the fewest lots (119), the house (perhaps mistakenly) set a higher estimate range from the previous year, and brought in just $3.7 million, a 34% drop YoY - a result that likely still signals consignor hesitancy amid recent internal shifts for the auction house.

Phillips edged ahead of Sotheby’s with $3.8 million, down 15% YoY but finishing 24% above its low estimate, buoyed by sharp curation and demand for trending editions.

Across Christie’s, Sotheby’s and Phillips, 542 of 584 offered lots sold - yielding a 92% sell-through rate. Compared to last year’s equivalent season, the number of unsold lots dropped by nearly 50%.

April Print Sales Price Above $100,000 © MyArtBroker 2025

April Print Sales Price Above $100,000 © MyArtBroker 2025What the 2025 UBS Art Basel Report Says About Pricing and Demand

In the lead-up to April’s print sales, much of the art world was still digesting the 2025 Art Basel & UBS Art Market Report. Its key takeaway was that auction volume is rising, but overall value is falling - driven by a marked pivot toward lower-priced works.The research found that in 2024, 95% of all lots sold at auction were priced under $50,000, accounting for 17% of total sales value - both metrics up YoY. Against that backdrop, it was no surprise to see competitive bidding for works focused in this range, a trend I’ve tracked closely throughout Q1. But this isn’t a trend completely centred on affordability - it’s one of discernment.

To paint an example, a six-figure editioned print might be passed over if the variant, colourway or condition isn’t just right - but lower-priced works by the same artist are seeing strong demand. Placing the April New York sales into context, Hockney prints in the $20,000–$40,000 bracket moved well. Helen Frankenthaler and Louise Bourgeois saw record-setting activity, and Banksy’s signed editions showed upward pressure.

But equally important, the top end hasn’t gone quiet - buyers are being strategic but far from passive. Even when high-value works landed below estimate, they still sold within healthy ranges. $100,000+ results from Andy Warhol, Roy Lichtenstein, Jean-Michel Basquiat, and David Hockney showed that collector confidence in blue chip names remains intact. The upper market is holding its ground - it’s just moving with a sharper eye on quality and timing.

Basquiat Print Sales Show Market Rebound: Record-Setting April

Basquiat, in particular, staged a standout return. After a muted showing in 2024 and a sluggish Q1 this year, his posthumous prints roared back in April. All five on offer sold, most at a premium. Sotheby’s led with Superhero Portfolio achieving $190,500, while Daros Suite smashed its $80,000 high estimate, setting a new auction record at $177,800. Christie’s delivered even stronger results, with Portfolio I commanding $403,200 and Undiscovered Genius setting a new record at $30,240. Phillips rounded it out, matching Sotheby’s on the Superhero Portfolio result.

These are serious numbers in a market otherwise dominated by demand for sub-$50,000 prints. The $403,200 achieved at Christie’s was the highest valued Contemporary lot of Christie’s sale, second only to a full suite of Matisse drawings - and outpaced every lot at Sotheby’s. It’s a strong showing for Basquiat, reinforcing momentum in his print market and undoubtedly building anticipation for Baby Boom, which is set to headline Christie’s May sales with a $30-40 million estimate.

A New Look at Abstraction in Warhol’s Market: Sunset Prints

Warhol led the April print sales - but not with his signature portraits of celebrities or consumer icons. Instead, it was the Sunset series that delivered the most luminous moment in his market early into this year. A marked departure from Warhol’s fame-centric imagery, the Sunset series is a rare exploration of abstraction and colour theory. Originally commissioned for a hotel project and stamped HOTEL MARQUETTE PRINTS, each work in the series is uniquely hued - making them conceptually distinct and highly collectible.

At Christie’s, six variations were offered, each with its own estimate - likely reflecting condition and demand for specific palettes. The top result reached $277,200, closely followed by a dedicated proof that achieved $201,600 - 46% above its high estimate. More than just a strong result, dedicated proofs offer a rare glimpse into the artist’s hand and underscore the originality that editioned works can hold. Four additional Sunset prints outperformed expectations, selling between $138,000 and $214,000, including a rare trial proof. These uniquely hued works reaffirm that in today’s market, individuality within editions (especially Warhol’s market) continues to command a premium.

Other top Warhol results included a rare Double Mickey Mouse edition at Phillips, which secured the highest valued work across all three sales. Last seen in 2024 - and before that in 2022, when it set a record at $819,000 - the work hammered at $500,000 this April and achieved $635,000 with fees, a strong result in today’s more measured market. At Christie’s, Chanel brought in a solid $226,800 with fees, while Tree Frog from the Endangered Species series outpaced its high estimate, landing at $157,500. Marilyn (F. & S. II.30) also didn’t go unnoticed, setting a new record at $139,700 - 75% above its $80,000 estimate.

Hockney In Focus

With Hockney in the spotlight following his blockbuster Paris show at the Fondation Louis Vuitton, his print market remains one to watch - especially after a marked softening in 2024. As seen in Q1 sales, the upper end of the Hockney market has cooled slightly, reflecting the current climate of selective buying. But that hasn’t meant a lack of interest - quite the opposite. What we’re seeing is a shift in collector behaviour that’s sustaining liquidity across Hockney’s lower- to mid-tier editions. In the April sales, several prints sold for under $50,000, with White Porcelain setting a new record at $25,200 and Celia in a Polka Dot Skirt following at $16,380 - both through Christie’s.

Higher up the ladder, Hockney’s Flower Etchings continued to gain momentum. Untitled (No. 852) (Dandelions) sold for $81,900 - up from £50,400 just a year ago. Works from the Moving Focus series also delivered strength: An Image of Celia soared past its $100,000 high estimate, hammering at $170,000 ($214,200 with fees), breaking its 2019 record, and An Image of Gregory followed suit, fetching $139,700 with fees at Phillips.

Resale Performance of Hockney's Arrival of Spring Prints © MyArtBroker 2025

Resale Performance of Hockney's Arrival of Spring Prints © MyArtBroker 2025Arrival Of Spring Hits $254,000 At Sotheby's

But the most anticipated lot was Arrival of Spring, 25th March 2011 - a previously unseen variation from Hockney’s 64-print series - offered at Sotheby’s with a $300,000–$500,000 estimate. It hammered just below at $200,000 ($254,000 with fees), yet still ranked among the highest-valued works of the season. At this price point, success depends on matching a rare work with a collector who values scarcity, cultural cachet, and has the liquidity to move quickly. In that context, landing below estimate isn’t a sign of weakness - it’s a reminder of how finely tuned the high end of the market has become.

Over the past decade, only 36 of the 64 Arrival of Spring variations have surfaced at auction, meaning nearly half the series has yet to be seen publicly - a scarcity that points to strong potential for future debuts. Even on the resale front, the data holds strong: of the 60 total auction sales to date, 16 were repeat appearances of the same variation, with only three reselling below their original price. It’s a clear indication that collector confidence in the series remains high, with sustained demand even in second-market cycles.

Lichtenstein’s Building Momentum

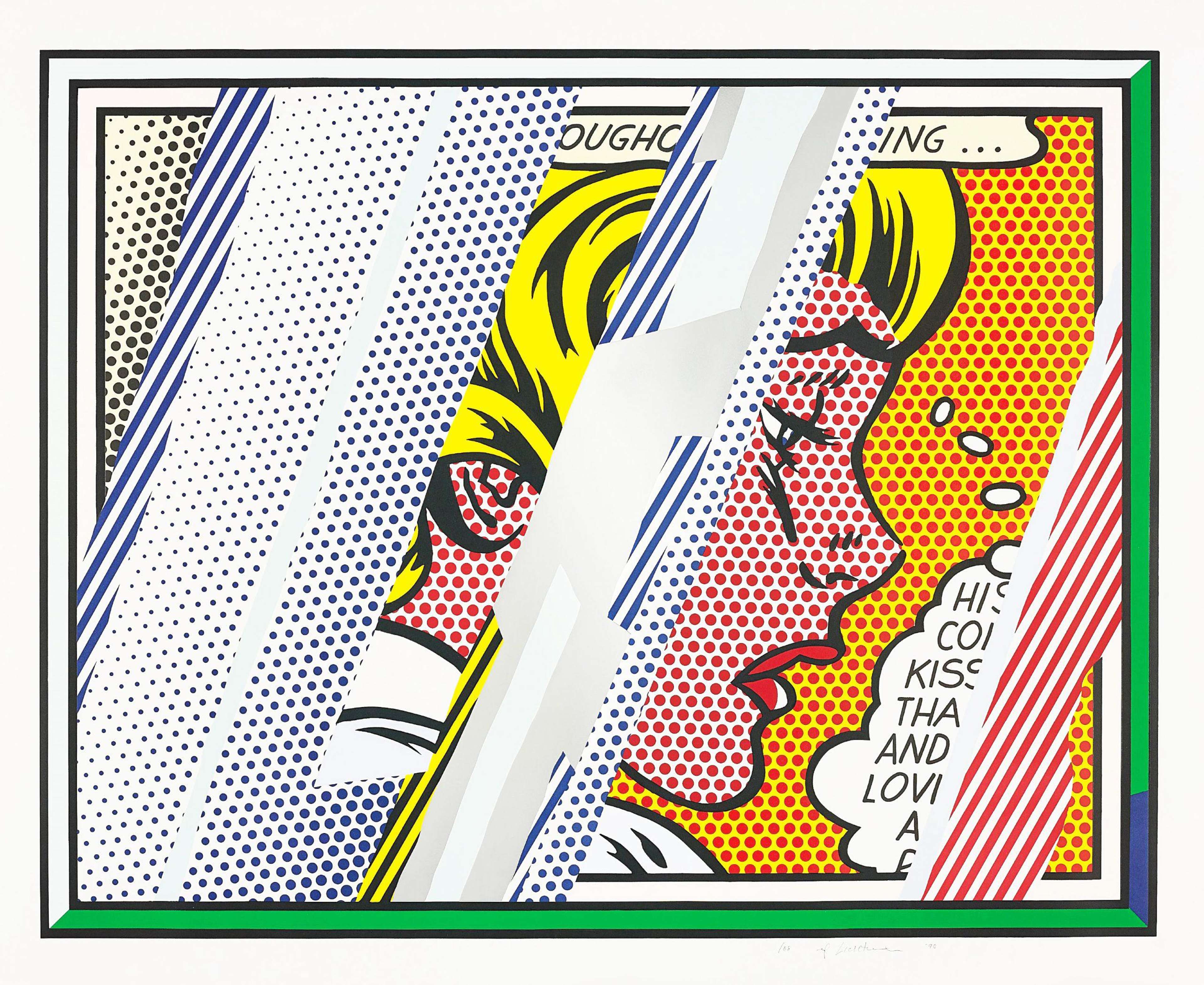

And finally, Lichtenstein - confidently gaining traction and edging closer to the yearly momentum of Hockney by sales value. While still pacing behind Warhol in market velocity, his performance in these April sales came through with energy. Of the 33 Lichtenstein works offered across Christie’s, Sotheby’s, and Phillips, several stood out for both depth and demand. From more affordable price segmentation, Christie’s saw This Must Be The Place reach $23,940 with fees - a new record - while the Bull Profile series was broken into individual lots, with seven works offered, including several APs. Every one of them hammered above the high estimate, with five setting new records, underscoring a growing appetite for rare variants.

For works that hit above $100,000, Sotheby’s landed a top Lichtenstein result with Landscape With Boats, hammering above its high estimate and selling for $139,700 with fees - a new auction record. Phillips also offered two Reflections series prints: Reflections On Girl and Reflections On Conversation, which achieved (with fees) $177,800 and $152,400 respectively. While they hovered near the low estimate, the works in this series are gaining market weight - visually ambitious and conceptually sharp, these works represent Lichtenstein at his most self-reflexive. Layered with screenprint, foil, and gloss, they are technical feats and witty critiques of image culture, reproduction, and the mediated self.

Looking Ahead: Tariffs and Market Direction

April’s print sales delivered a nuanced snapshot of the current art market: not a runaway surge, but anything but stagnant. Top-tier works held firm at estimate, while lower-value prints continued to set records, pushing up the average and proving that demand hasn’t disappeared - it’s just become more deliberate.

In a market where policy noise is growing louder, particularly around U.S. tariffs and their potential impact on global art trade, it hasn’t drowned out buyer appetites - yet. With May’s marquee auctions fast approaching, the real test will be whether collector confidence holds. But for now, the data points to a market still very much in motion, not in retreat.