Ingrid Bergman With Hat (F. & S. II.315) © Andy Warhol 1983

Ingrid Bergman With Hat (F. & S. II.315) © Andy Warhol 1983

Interested in buying or selling

work?

Market Reports

Art has long been a valued alternative asset, both emotionally and financially. While the primary art market experienced challenges in the wake of global economic factors, the secondary market has shown remarkable resilience and continues to evolve. In this article, we will take a closer look at the various ways to invest in art in 2025 and beyond, and the benefits and risks associated with each.

According to the 2025 Art Basel & UBS Global Art Market Report, 2024 saw an adjustment in overall market value. However, this was largely influenced by a cooling at the top-end of the market and a supply slowdown in major auction consignments, which account for only a small fraction of the global art market. Crucially, transaction volume remained high, driven by significant growth in the lower-priced segments. The market under $5,000, for instance, grew by 7% in value and 13% in lots sold. The largest segment of sales, those below $50,000, saw an 8% increase in transactions.

A notable shift in 2024 was the robust demand for private sales, which advanced by 14% year-on-year to $4.4 billion, partially offsetting declines in public auction sales. This highlights a broader trend where much of the market's activity and liquidity is happening away from traditional auction spotlights, increasingly on digital platforms. Demand for blue chip artists, prints and editions, and emerging talent remains strong, with prints and multiples now representing 24% of high-net-worth collectors' holdings.

Amid the great wealth transfer and shifts in the global economic landscape, we are witnessing a turning point in the art market. With increased transparency, new investment models like fractional ownership, and AI-driven market insights, 2025 presents both challenges and opportunities for those looking to invest in art. MyArtBroker's algorithm, for instance, plays a crucial role in shaping valuations and providing data-driven insights. Our Instant & Expert Valuation services empower collectors with the crucial information needed to make informed decisions in this dynamic market.

Is Art a Good Investment?

Q: What is the alternative asset class and how does art fit within that category?

A: An alternative asset falls outside traditional classes such as stocks, bonds and cash. They appeal as a secondary investment in addition to the former, as they can strengthen and diversify traditional portfolios by seeking returns independent from equity and bond markets. Art is classified as an alternative asset because its market is not correlated with other assets.

To learn more about the concept of prints as an investable asset, watch our panel: Prints as a Portfolio.

Image © Christie's / Christie's London 1987 - record breaking sale of Van Gogh's Sunflowers for £22.5million

Image © Christie's / Christie's London 1987 - record breaking sale of Van Gogh's Sunflowers for £22.5millionBut despite popular conception, there are many ways to invest in art other than paying nearly $40m for a Van Gogh painting of Sunflowers at auction. Investing in art is now more accessible than ever, with options available to suit a range of budgets, from the modest to the infinite. In addition, newer art investment initiatives that rely on technological progress are attracting a younger and more diverse group of art enthusiasts who are interested in trying something innovative and exciting.

However, it is important to remember that investing in art carries risks, just like any other investment. Before taking any steps to invest in art, it is crucial to consider your budget, intentions, art tastes, and risk tolerance. Seeking expert advice is also recommended, as the art market requires a certain level of expertise to navigate the complexities and fair market value of artworks correctly. Most investments will come with tax implications which are always best worked out in advance; for more on this, read our guide to Art Investment, Tax, Inheritance, and Pensions.

Despite these risks, we can be grateful for the fact that the art market has seen greater transparency in recent years, thanks to the shift to online marketplaces, the flavour offered by the technological advancement of blockchain, as well as the shift towards a more demographically diverse audience.

How to Invest in Art: Key Strategies

1. 100% Art Ownership

This is the most traditional way to invest in art, where an individual or organisation purchases a piece of art and becomes the sole owner. This can be done by buying art on the primary or secondary market via an auction house, or privately, through an individual, dealer, brokerage, or gallery. There are benefits and disadvantages to both auctions and private sales. A number of different mediums of art can be bought, with their own price-points and potential returns, their value determined by the artist, quality, rarity, and primary and secondary market sales.

Buying on the Primary vs. Secondary Market

In addition to deciding what artwork you will invest in, an important consideration is where to buy it, either the primary or secondary market. The primary market deals art from artists directly to buyers, often through a representative gallery, while the secondary market involves buying and selling art that has previously been sold before.

So long as you are purchasing art through a reputable dealer, gallery, or auction house, it is generally understood to be less of a financial risk to buy art on the secondary market if your intention is to net return. This is because previous sales will have established a value for the artwork, meaning that your investment is likely to be more predictable. Knowing the sale history of an artwork helps to make informed decisions on the trajectory of an artwork when purchasing. It is relatively simple to research the sale history of an artwork if it has been sold at auction; private sales are more difficult to obtain information on.

MyArtBroker is at the forefront of providing this crucial transparency. Our data-driven MyArtBroker algorithm analyses extensive past sales data to establish benchmarks for artwork valuation, even for pieces with limited historical sales records. This commitment to data transparency ensures that collectors are well-equipped to navigate the complexities of the art market and secure valuable acquisitions.

Trust is key - whether it’s a gallery, an auction house, or an online broker, buyers need experts they can rely on.

Who is 100% Ownership For?

In Bloomberg’s article, from their hypothetical ‘Where to invest $1 Million’ series, Robert Arnnott, co-founder of Research Affiliates, advocating for art as a valuable alternative asset stated: “With a modest slice of your $1 million, you can get a pretty good portfolio of limited edition lithographs for four- to five-digit prices and they are fun and hilarious to look at.” Yet, collecting art is not only for UHNWI as accessibly priced prints and multiples are a profitable segment of the market. They are also a comparable market - meaning the works come with comparative price points for other works in the same series.

Thanks to the status of many blue-chip artists as adept printmakers, owning an original artwork can be accomplished on a more modest budget. Modern and Post-War and Contemporary art are the most profitable and stable genres in the art market today, accounting for a combined share of 77% of the global fine art auction market in 2021 (according to Art Basel’s 2022 Art Market report with UBS).

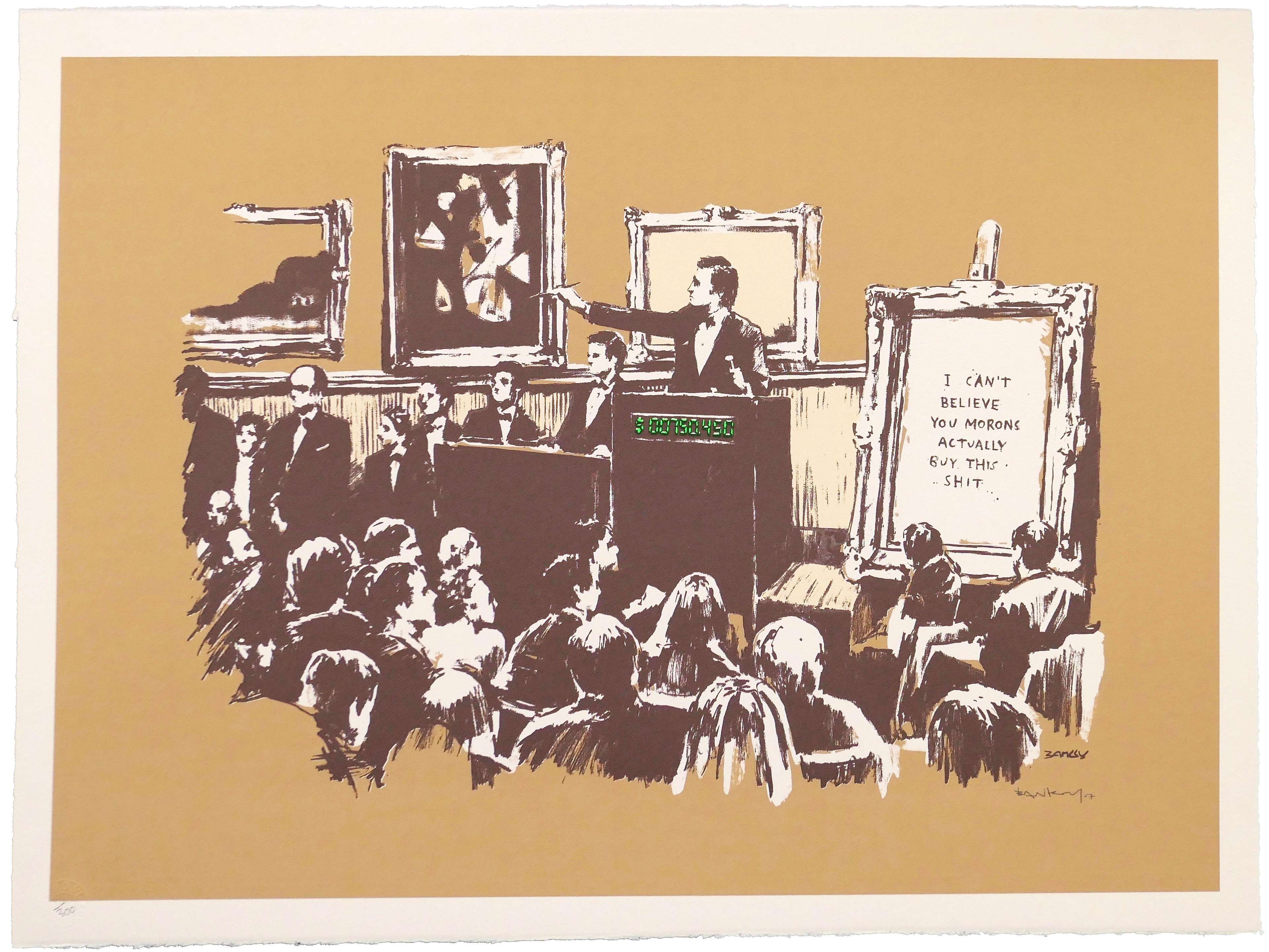

Within the Modern, American Pop, Post-War and Contemporary, and Urban Contemporary markets, many of the best established markets belong to artists such as Andy Warhol, Keith Haring, Damien Hirst, Banksy and David Hockney. Conveniently, all these artists produced or produce prints of their work, creating excellent opportunities to invest in blue-chip prints and multiples– artworks with a proven track record of stable returns, that are considered to be comparatively low-risk investments. At MyArtBroker, we keep a close eye on the print market; read our 5 Year Print Market Report for more.

Browse Modern and Contemporary Prints for sale, and explore supply, and growth rates demand for artworks on our TradingFloor.

Over the last few years, we have seen the rise of many auction houses offering art financing solutions: using your existing art collection as collateral against a loan can release liquidity from your assets. One thing about contemporary art is that it is an illiquid asset: artwork tends to appreciate with age, moreover finding a buyer can take a long time. These lending opportunities might be used to fund further investment in art, without having to yet sell the artwork. You can learn more about Art Financing here.

2. Digital Art

Strictly speaking, digital art is just another medium of art that might be owned completely, invested in as part of a fund, or partially owned. But given how fresh the market for digital art and NFTs (non-fungible tokens) is, it is not yet comparable to the traditional art market, from an investment perspective. The reasons for this are twofold: the market is more volatile, and NFTs can only be purchased with a cryptocurrency (such as Bitcoin, Ethereum, or Tether). This latter fact means your transaction and new digital artwork will be subject to the value of these currencies, above all other factors.

Auction houses have gradually embraced the ‘hype’, with both Sotheby’s and Christie’s allowing payments in cryptocurrencies on certain sales since early 2021, and Christie’s offering the first purely digital work of art ever at a major auction house sale in March 2021– the sale of an NFT by Beeple for $69 million. Investing in digital art follows a similar procedure as traditional art: Digital art can be purchased, through a marketplace or auction, and owned privately just like traditional art, though it has the added advantage of being much more easily transported and stored. Most NFTs are typically bought and sold on online NFT marketplaces such as Opensea or Nifty Gateway.

Outside of NFTs, Christie’s is set to host its inaugural artificial intelligence (AI) art auction in 2025, offering a range of artworks created or enhanced with AI tools. While the auction has received rather damning backlash from artists who are concerned over the copyright licensing issues surrounding AI-generated imagery, the dedicated sale is a testament to a new segment of the market which is likely to grow in volume as AI infiltrates the art world more and more.

Everydays — The First 5000 Days © Beeple 2021

Everydays — The First 5000 Days © Beeple 2021NFTs are exciting not only for novelty’s- sake but also as they offer a more secure way to authenticate authorship and ownership of an artwork. This authentication of authorship is not completely watertight, however. Already, the capacity of third parties to effectively mint an NFT of someone else's art has caused controversy– look at the case of the burnt Banksy that was turned into an NFT, for example– but at the very least, simply uploading a jpeg of somebody else's art and minting it as one's own NFT will rarely make much money in the vast majority of cases.

Perhaps, someday, NFTs may even be more liquid than traditional art, owing to the fact that the logistical aspects of traditional sales would be missing. For now, though, they are arguably less liquid than traditional art, as the market is more niche and finding a buyer is harder. Moreover, NFTs are still new, meaning they're subject to high degree of market volatility. For example, the prices of Bitcoin and Ethereum – two of the most popular cryptocurrencies – have been known to fluctuate rapidly, for example during 2022’s ‘Crypto Winter.’ This volatility can make it difficult to predict the future value of an NFT. Additionally, while the market has grown over the last five years, it's still relatively small compared to other segments of the art market. Not only does this mean that a small number of people can have a large impact on the price of an NFT, but you may have trouble finding a buyer if you need to sell your NFT in a hurry.

Who is Digital Art Ownership For?

Digital art is a suitable investment for those who are adventurous, have a high financial risk tolerance, and are interested in exploring the potential of the growing digital art market.

For more on investing in NFTs, read our Guide to Getting Started with NFT Investment, or our article, The Benefits and Risks of NFT Investing.

3. Art Investment Funds

Much like equity funds, Art funds are mutual investments in which multiple investors share returns on a curated portfolio. As the name suggests, however, the crucial difference is that the fund managers invest in artworks on behalf of the clients. Art funds are a great way for investors to invest in art and diversify their portfolios, without worrying about the maintenance and insurance costs of directly owning artworks.

Depending on the minimum investment set by the specific fund, Art funds can appeal to investors with a smaller budget, with lower entry-points than 100% ownership. Moreover, compared with ownership, where an investor may only have funds to purchase one or two works, investing in an art fund can spread risk by investing in many different artworks.

According to Deloitte and ArtTactic, 90% of the 435 art and finance stakeholders they surveyed in 2023 believed that art and collectibles should be part of an investment portfolio, up from 53% in 2014. In their latest report they added, “the conversation has shifted from whether art should be part of a wealth management offering to how it can be implemented effectively.”

Who Are Art Investment Funds For?

They are great for anyone interested in art and in nurturing the art expertise involved in this business. They’re not so great for collectors who would like to enjoy their artwork in person.

4. Fractional Shares

Similar to art investment funds, fractional shares are a new innovation on the art scene, which offers potential investors the opportunity to buy a share in one or more individual artworks. This investment type has seen a rise in interest, thanks to blockchain technology, which allows fractional companies, such as Particle, to mint NFTs corresponding to the investor’s physical share in the artwork. Fractional shares are not always managed via Blockchain, however, with other companies offering a more traditional receipt for your financial stake.

Who Are Fractional Shares For?

Great for those who are looking for something different to traditional private ownership, and popular among a younger demographic, fractional ownership appeals for the chance to own part of a masterpiece that would likely otherwise be unattainable. But you should approach these investments with caution; as well as having limited control over when the artwork is sold, the value of fractional shares are liable to fluctuate dramatically as this sector of art investment remains relatively new and small. Moreover, purported returns advertised by companies may be skewed to look more appealing than reality, as well as demanding quite high fees.

In conclusion, there are many ways to invest in art, from traditional ownership to digital art and fractional shares. Each method offers its own advantages and disadvantages, and it's up to the individual investor to decide which method is right for them. Investing in art requires research, knowledge, and patience. The value of art can fluctuate, thus as with any investment, it's important to seek the advice of experts before making any decisions.

While the market offers more entry points and greater accessibility, success in art investment still hinges on a combination of diligent research, patience, and, crucially, expert guidance. Understanding an artist's trajectory, historical sales data, and key motifs is paramount for making informed decisions. The art market is dynamic and constantly evolving, making expert insights invaluable for navigating its complexities and identifying genuine opportunities.

In this increasingly data-driven landscape, platforms like MyArtBroker play a crucial role. MyArtBroker's algorithm, combined with our valuations services, provides investors with the data-driven insights and professional assessments needed to manage risk and make strategic acquisition and sales decisions. Our specialist brokers are always happy to answer any questions you may have regarding buying or selling artworks and can offer a complimentary valuation service. Just get in contact here.