What Happens to an Artist’s Market When They Die?

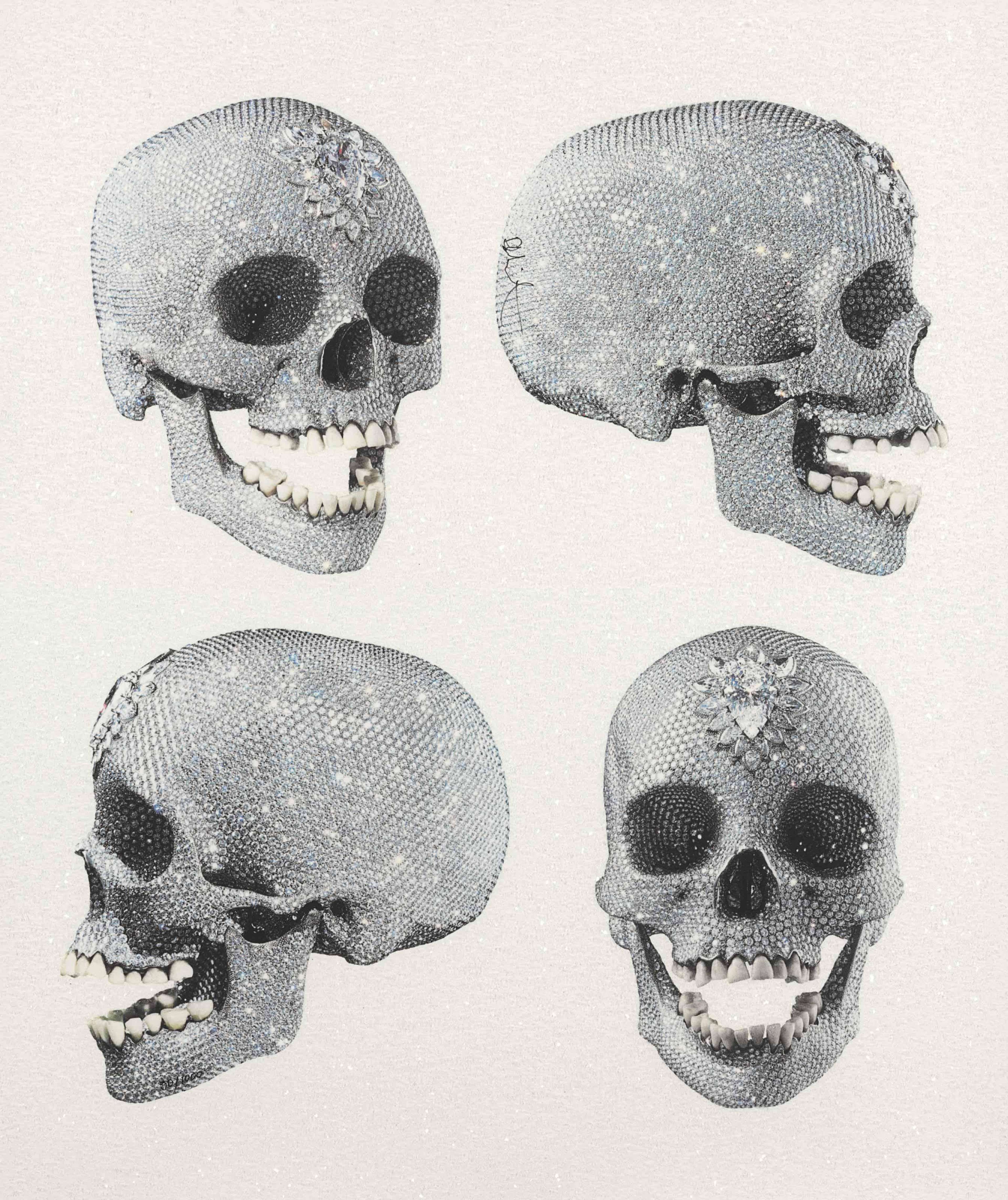

Image © Sotheby's / Bowie/Collector Part I: Modern And Contemporary Art, Evening Auction © 2016

Image © Sotheby's / Bowie/Collector Part I: Modern And Contemporary Art, Evening Auction © 2016Market Reports

In the art world, the adage that “the best career move for an artist is to die’’ conceals a far more intricate reality. While an artist’s passing often sparks headlines and a renewed hunger among collectors, the true long‑term effect on an artist’s market depends on a delicate interplay of scarcity management, estate stewardship, and narrative curation. Nowhere is this interplay more pronounced than in the prints and editions market, where reproducibility collides with strict edition controls to create a posthumous landscape that diverges sharply from that of unique originals.

What Happens Immediately After an Artist’s Death?

In art markets, the so‑called “death effect” has long been believed to trigger dramatic posthumous price surges, yet research economists Robert B. Ekelund and John D. Jackson suggests that it actually manifests most strongly in the final five years of a living artist’s career, when collectors, aware that no new work will follow, bid more aggressively to secure finite supply. Once an artist dies, the inevitable influx of works often counteracts that scarcity premium, resulting in modest price adjustments rather than sustained spikes. Whether values subsequently stabilise or resume an upward trajectory hinges on factors such as the artist’s stature, the context of their passing, and the calibre of legacy stewardship.

While exceptional cases like Van Gogh and Gauguin demonstrate how cultural reappraisal and institutional endorsement can ignite enduring late blooms, such stories are the exception rather than the norm. In most instances, posthumous market movements reflect a nuanced interplay of genuine scarcity, prevailing demand, and the narratives that frame an artist’s life and work.

Does Death Increase an Artist’s Market Value?

Andy Warhol (1987)

Andy Warhol’s death in February 1987 marked the end of the artist who famously declared that "making money is art." Warhol’s career-long embrace of prints and multiples - Marilyns, Campbell’s Soup Cans, Flowers - meant that his death instantly rendered all future prints immutable in number, triggering a rush among collectors.

In the months following Warhol’s death, the May 1987 auction season saw unprecedented bidding as collectors raced to secure works that could no longer be produced. The newly formed Andy Warhol Foundation managed his estate with an eye toward both philanthropy and market stewardship: a high‑profile Sotheby’s auction of personal items in 1988 fueled public fascination, while gradual placements of artworks in galleries and institutions maintained a controlled supply. Although the early 1990s brought a modest market contraction, Warhol’s value trajectory remained upward. By 2014, his works had generated more than $569 million in a single year of auction sales, representing over one‑sixth of global art auction volume.

Today, Warhol prints occupy a supreme position in the market thanks to their enduring icon status.. Individual editions, complete sets, and the much-coveted proof prints continue to break records at auction, demonstrating that even substantial supply cannot satisfy a worldwide collector base hungry for the instantly recognisable.

Yet the “death bump” isn’t universal, it’s not just the death of an artist that affects market demand - iconic subjects can do the same. Warhol created his Marilyn screenprints in 1967, five years after Monroe’s death in 1962, and originally sold them for as little as $250; they only began to climb dramatically decades later as their cultural resonance deepened. By contrast, Warhol’s 1985 Reigning Queens series surged almost immediately in the wake of Queen Elizabeth II’s passing in 2022. Prints that had sold for around £150,000 - 200,000 rose rapidly, with one example exceeding £500,000 at auction within days - setting new records and proving the impact of immediate market sentiment. This divergence shows that market spikes are not simply a function of loss, but of timing, context, and collective memory. Sometimes the emotional logic of tragedy translates into immediate value, and sometimes a work must wait years. The so‑called “death bump” is therefore less a rule than a variable phenomenon, shaped by the interplay of scarcity, sentiment, and the enduring power of an image. (edited)

Jean‑Michel Basquiat (1988)

Jean‑Michel Basquiat’s sudden death at age 27 in August 1988 sent shockwaves through New York’s art scene. Already celebrated as a graffiti‑turned‑gallery artist, Basquiat’s market experienced a pronounced recalibration, particularly for his sparse lifetime editions. Within a year of his death, auction prices for his paintings had soared into the high six figures, with some works reaching around $400,000 at auction, a remarkable figure for someone so young and with such a brief career.

His prints were especially scarce - Basquiat devoted himself mainly to painting and drawing, issuing only a handful of editions during his lifetime, with the Anatomy series the sole signed collection he personally oversaw. Rare examples such as Untitled (1983) and Back of the Neck (1983), with their small editions and iconic SAMO imagery, now command six- to seven-figures when they appear at auction. Their scarcity, combined with Basquiat’s burgeoning posthumous reputation, has fueled a collector hunger that transcends mere investment.

Recognising this dynamic, the Estate of Jean‑Michel Basquiat introduced carefully curated posthumous editions in the early 2000s. Collaborations with publishers such as Flatiron Editions gave rise to screenprints like Flexible, Rinso, and Hollywood Africans, each limited to fewer than 100 impressions and authenticated by estate signatures and stamps. These releases have provided an accessible entry point for collectors, while preserving the aura of exclusivity that defines his market. By announcing editions unpredictably and in small runs, the estate generates anticipation and ensures that scarcity remains intact - a strategy that has kept Basquiat’s prints both alive in the market and insulated from the oversupply fears that can plague other posthumous editions.

Keith Haring (1990)

When Keith Haring died of AIDS‑related complications in February 1990 at age 31, the art world mourned the loss of an artist whose very practice was defined by public engagement. Haring’s subway chalk drawings, exuberant line drawings, and Pop Shop prints had democratised his imagery, allowing a broad audience to own works that might otherwise have been beyond reach.

In the early ’90s, a market downturn meant that Haring’s death did not immediately trigger dramatic price surges. Yet his prolific, lifetime‑signed silkscreen editions have steadily appreciated as his cultural significance has grown. The Andy Mouse series (1986) - a playful set of works combining Warhol’s iconography and Mickey Mouse - soared in value, with the complete set rising from $133,000 in 2010 to just over $1 million by 2022. Other prints - Dog, Radiant Baby, Retrospect - have attained six-figure sums, reflecting both the scarcity of certain editions and the broad collector base that spans American Pop aficionados, Street Art enthusiasts, and new generations drawn to Haring’s messages of unity and social consciousness.

The Keith Haring Foundation once oversaw an official Authentication Committee that vetted works and issued certificates of authenticity until it disbanded in 2012 amid rising forgery disputes and legal costs. Today, collectors must authenticate Haring prints through careful provenance research rather than a direct foundation seal. While prints bearing Haring’s own signature continue to command a premium, estate‑authenticated or well‑provenanced prints still retain strong value, reflecting a market built on rigorous documentation and the enduring appeal of his imagery.

How Today’s Artists Are Engineering Immortality

Damien Hirst’s Posthumous Play

In May 2025, Damien Hirst - very much alive - surprised the art world with a plan as audacious as any of his works. Describing a series of 200 notebooks, each corresponding to a year after his death, Hirst announced that collectors could purchase certificates granting rights to realise a specific “posthumous drawing” on its assigned anniversary. A pig sculpture in formaldehyde conceived in 1991 but never fabricated might emerge 145 years after Hirst’s passing, dated “1991” and authenticated by his descendants.

Reactions have been mixed: some hail it as visionary legacy‑planning, others as a cynical market ploy. The model echoes posthumous bronze casts of Rodin or estate screenprints of Basquiat, yet propels the concept into the realm of serialised, centuries‑long rollout. In essence, Hirst is transforming his own mortality into a durational performance piece, ensuring that supply is metered at one work per year for 200 years. Whether this strategy will establish a new paradigm for posthumous markets - or simply become a singular Hirstian spectacle - remains to be seen. What is certain, however, is that it reinforces a fundamental lesson: artists who proactively shape their posthumous pathways wield immense influence over how, when, and at what price their work will endure.

Other Key Players Shaping a Legacy in the Art Market Today

As the generation of post‑war pioneers who established contemporary art’s foundations enters the later stages of their careers, the market must confront questions of legacy, scarcity and valuation with care. Icons such as David Hockney, Yayoi Kusama and Bridget Riley have each developed instantly recognisable visual languages while maintaining vibrant practices over many decades. Hockney’s printmaking spans from landmark lithographs such as A Bigger Splash (1967) to his recent iPad drawings, including The Yosemite Suite (2010). Kusama’s immersive installations and signature polka‑dot environments continue to attract record‑breaking audiences, and Riley’s work is increasingly reassessed for its influence on abstraction and perception, and command strong auction results.

As these artists advance in age, the conversation inevitably turns to the shape of their markets once they are no longer with us. Historically, an artist’s death prompts a surge of sales driven by perceived scarcity, yet a simultaneous influx of works can briefly depress prices. Their sustained productivity and institutional recognition underscore the importance of measured stewardship: ensuring that their long‑term legacies are preserved, celebrated and sustainably supported in today’s ever‑evolving art market.

An artist’s death marks a pivotal juncture, but the true arc of value unfolds over decades of legacy curation, estate decisions, and evolving market psychology. For collectors, understanding the subtle distinctions among lifetime‑issued prints and estate‑authorised editions is vital. For sellers, the temptation of a postmortem spike must be weighed against the enduring returns generated by long‑term narrative and scarcity management.

Above all, the print market after an artist’s death demands both rigor and discernment. Estate‑issued editions can democratise access to blue‑chip names, but only if they preserve the scarcity, authenticity, and narrative that underpin a robust market. As with the experiences of Basquiat, Haring, and Warhol, the true art of posthumous value lies not in the moment of an artist’s passing, but in the thoughtful stewardship of their work.