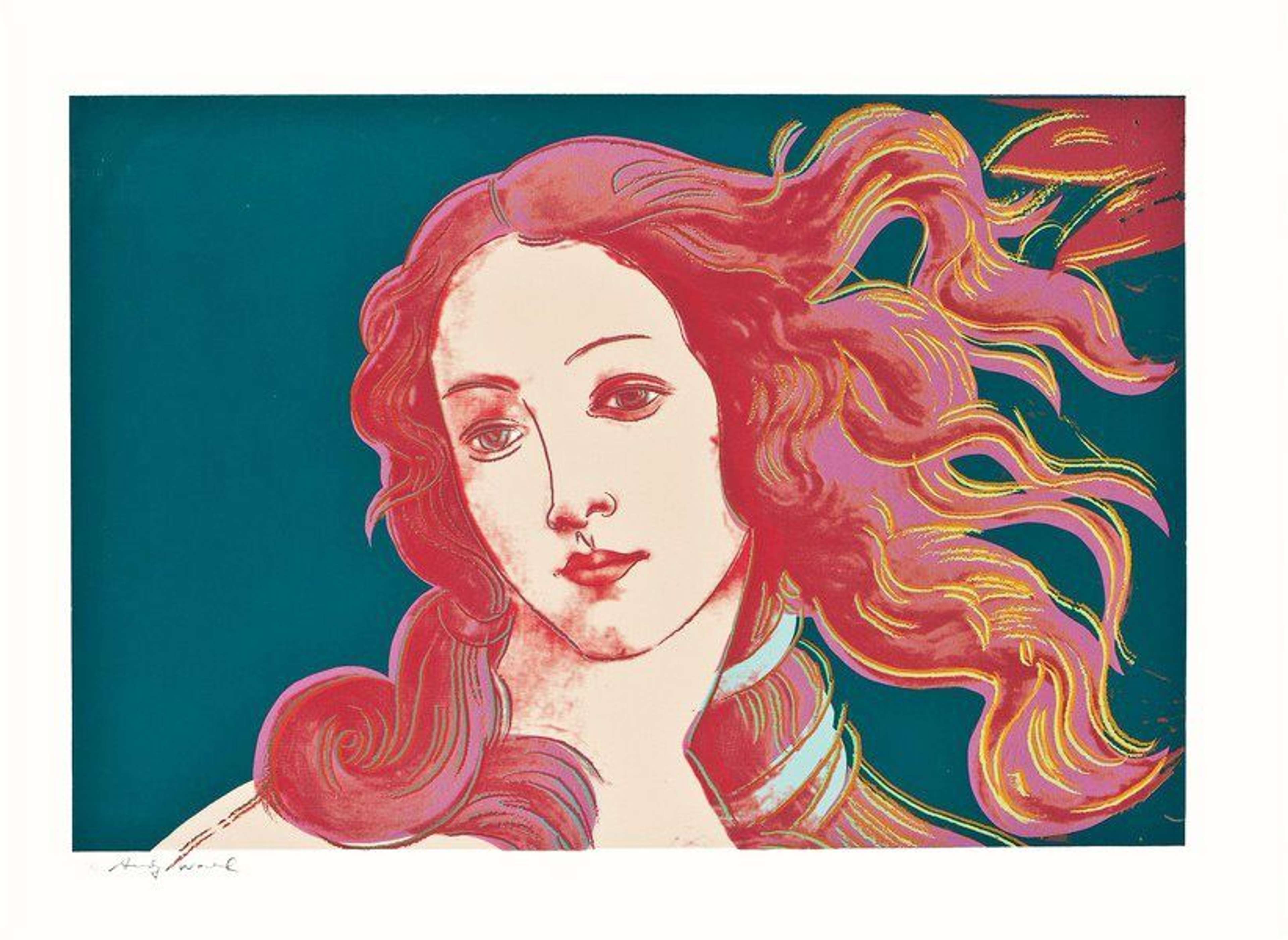

Details Of Renaissance Paintings (Sandro Botticelli, Birth Of Venus, 1482) (F. & S. II.316) © Andy Warhol 1984

Details Of Renaissance Paintings (Sandro Botticelli, Birth Of Venus, 1482) (F. & S. II.316) © Andy Warhol 1984Live TradingFloor

As July comes to a close, the art market gears up for the summer season, with buyers often on holiday and auction houses taking a break from marquee sales until autumn. However, this doesn't mean the art world is quiet. We’ve noticed Jean-Michel Basquiat in the spotlight, and the formidable Andy Warhol is always in the limelight. We’re watching other artists, including Thierry Noir, who has seen several successful sales in July, continuously pushing past the high estimate. We're also watching Tracey Emin, particularly for her commanding presence at the National Portrait Gallery. And of course, all eyes are also on the enigmatic Banksy, anticipating his next move after the Cut & Run Exhibition.

Summer Art Market Performance: Highlights, Trends and July Sales

The art market's online July sales offer a mix of paintings, and prints and editions, marking the first round of Q3 sales. Two exceptional works were offered by Jean-Michel Basquiat–Anti-Product, a unique print, selling at $50,400 USD (fees included), an impressive 7.4 times its estimate, and Flexible (after Basquiat) realising $126,000 USD (fees included) and was the highlight in Christie's Contemporary Edition sale. Meanwhile, Banksy made a mark at Phillips with two notable screenprints– Rude Copper, achieving £60,960 (fees included), and CCCP Love Is In The Air, fetching £53,340 (fees included). Also, at Sotheby’s, a Basquiat Anatomy print performed exceptionally well. Offered with no reserve, the sale of this work realised $40,640 USD (fees included) against a 7,000 high estimate.

Explore our American Pop Print Report, which provides comprehensive data insights for Jean-Michel Basquiat's market and other iconic American Pop Artists. Understand market trends and patterns for these artists' works.

July Art Market Total Sales

In July, Christie's and Sotheby's conducted online sales, while Phillips held an additional live auction alongside online sales. Across London and New York in the post-war and contemporary art categories, 1430 works were sold, generating £14.9 million with a sell-through rate of 82%.

Christie's, Sotheby's, and Phillips July Sales © MyArtBroker 2023

Christie's, Sotheby's, and Phillips July Sales © MyArtBroker 2023Current Art Market Stories

In July, the art world buzzed with discussions on financial underpinnings, particularly after Simon Lee Gallery entered administration, impacting smaller London galleries specialising in emerging contemporary artists amid Brexit dynamics. Despite this, London gallery week saw increased visitors. Auction figures were lower overall, but Sotheby's turning the Whitney Museum's prior space into a showroom and Bonhams achieving its best-ever first-half year results showed resilience. Read our take on the latest auctions in our June Auction reports which analyses the profits yielded on an increased amount of resale works.

Also in July, The New Yorker released an intimate biography of mega-gallerist Larry Gagosian, highlighting his keen understanding of wealthy individuals' desires for art as a passion asset, driving demand and creating a liquid and lucrative art market. Gagosian's relentless approach in the secondary art market and his lavish art-filled dinner parties and events demonstrated his passion and influence. While controversies surrounding Gagosian were mentioned, including phone calls to women, sales to oligarchs, and a potential bidding ring with the Mugrabi family, his significant impact on the art market, especially contemporary art, was acknowledged and, as we see it, formidable. To learn more about the history of the art market and the prime performance years to Gagosian helped build, subscribe to MyArtBroker's Edition Magazine.

Top In-Demand Artists: MyArtBroker Trading Floor

MyArtBroker's Trading Floor relies on real-time data sourced from our extensive network of over 25,000 collectors in the print market. Looking at the year-to-date performance of our most in-demand artists, Banksy stands out with the most consistent presence. Despite a drop in Banksy's market performance after the 2020 boom, there is enduring demand for his work, representing an undervalued trend. The decrease in sales turnover for his most sought-after prints corresponds to reduced availability, as collectors are holding onto these pieces, anticipating the right moment to sell. Similarly, Andy Warhol maintains a steady presence, while Stik, Alex Katz, and David Shrigley have shown upward trends in our data since June.