Investing in Alternative Luxury Assets: Community, Connection, and Long-Term Growth

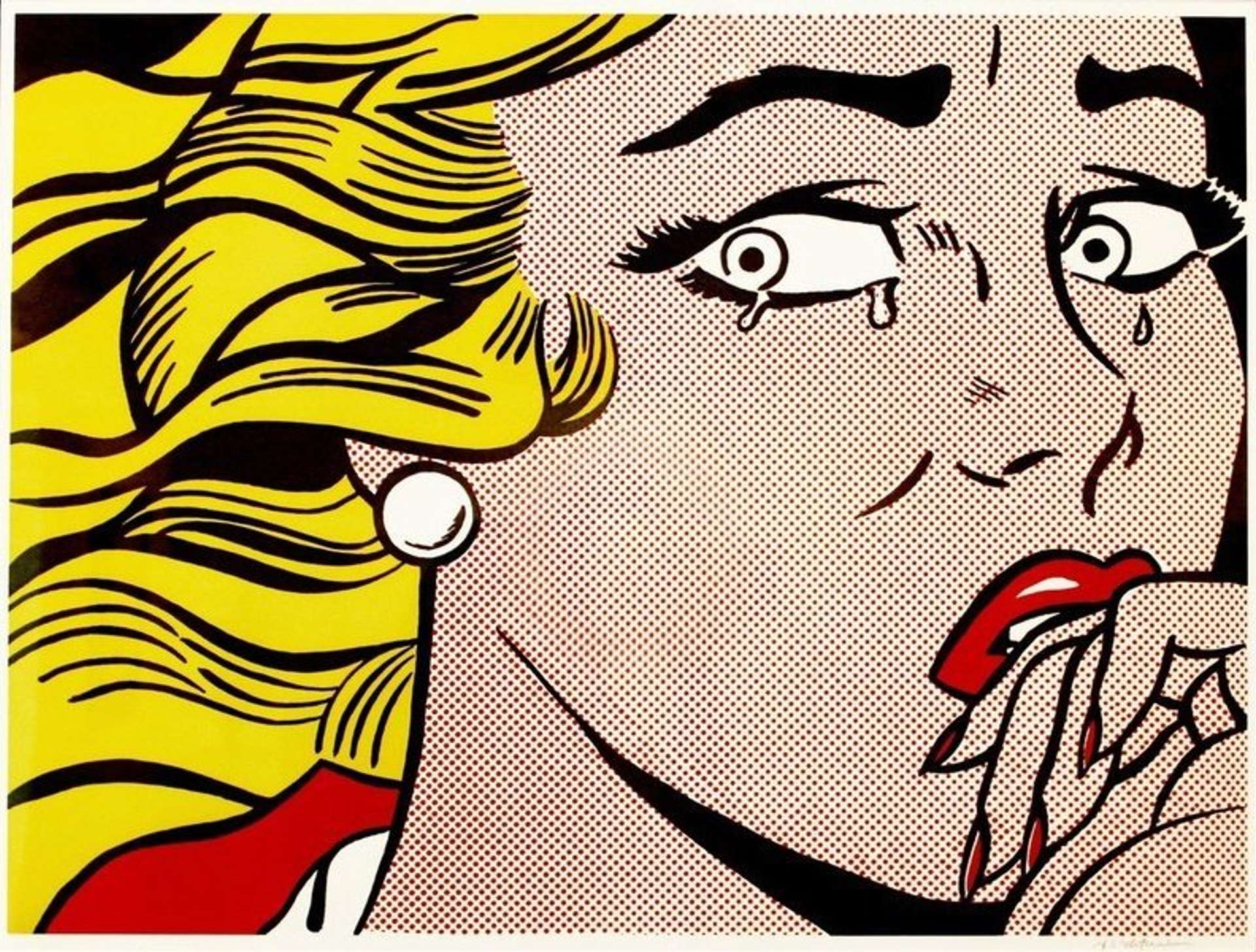

Sometimes The Dress Is Worth More Than The Money © Tracey Emin 2001

Sometimes The Dress Is Worth More Than The Money © Tracey Emin 2001

Interested in buying or selling

work?

Live TradingFloor

The Rise of Passion Assets

As investors seek alternative investments to diversify their portfolios, passion assets have gained prominence in the world of finance. These tangible assets offer a unique blend of personal fulfilment, community, connection, and potential long-term growth. By investing in art, collectibles, and other passion assets, individuals can expand their investment portfolios while connecting with like-minded enthusiasts and benefiting from social capital.

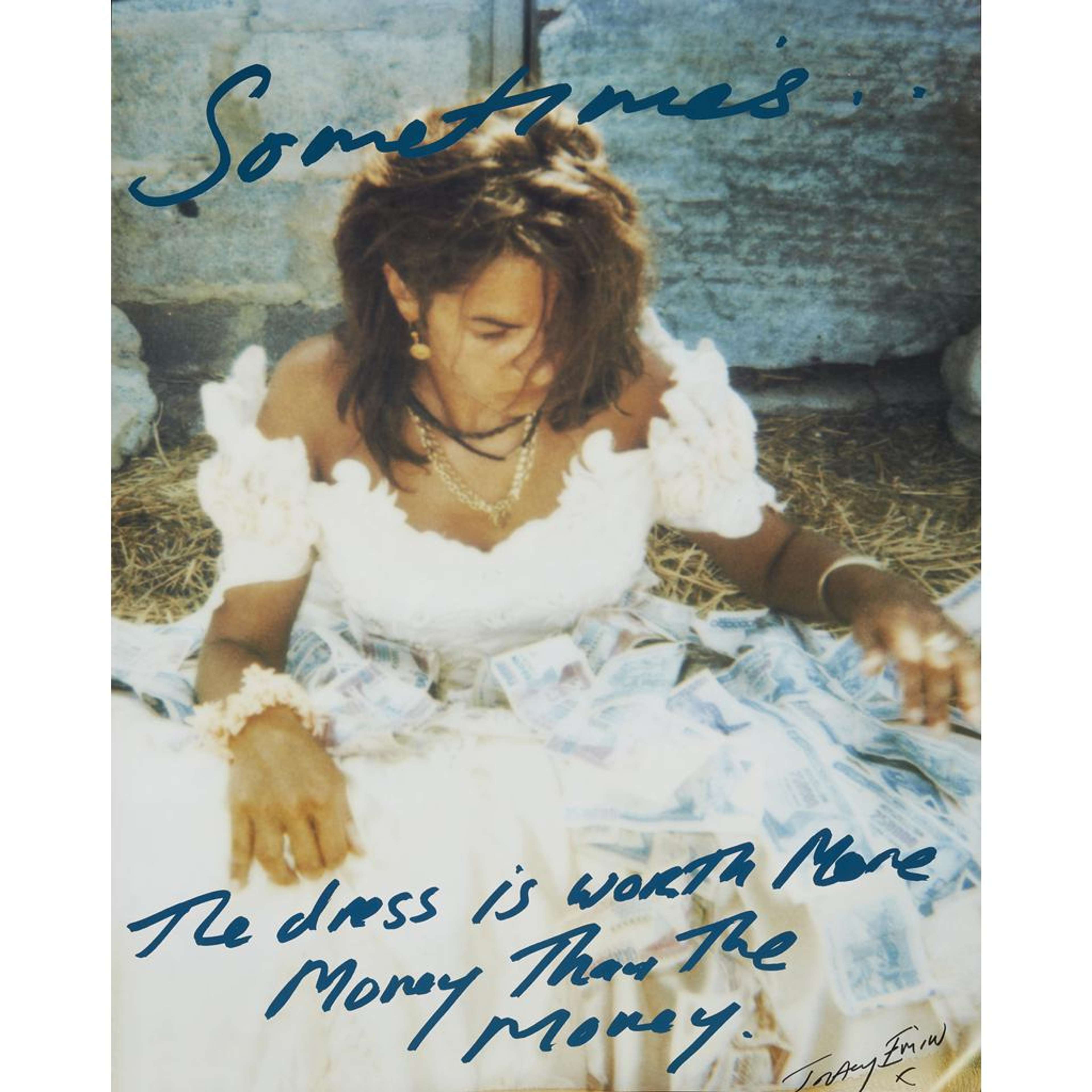

Image © Chanel 2023

Image © Chanel 2023Types of Passion Assets: From Art to Collectibles

Passion assets or Alternative Luxury Assets encompass various tangible items that have cultural, historical, or emotional value, making them attractive investments. Some popular passion assets include: art, collectibles, classic cars, wine and whiskey, luxury watches, handbags, sneakers, jewellery or sports memorabilia. Art remains the top-performing collectable asset, with a thriving investment market driven by demand from art collectors seeking works by both emerging and established artists. NFTs have also recently begun to make waves in the market, democratising the buying experience and impacting the way we think about collecting art. However, many other types of assets have recently gained exposure, offering opportunities for diversification and investment growth.

Collectibles, for example, can include stamps, coins, vintage toys, and other items with dedicated collector bases, such as classic cars. Vintage cars are sought after for their rarity, design, and craftsmanship, making them valuable additions to an investment portfolio. Wine and whiskey are also significant, since high-quality, rare vintages and distillations can appreciate in value over time, offering a unique investment opportunity.

Other types of luxury items have also recently become popular. Watches are a notable investment, with renowned brands like Rolex, Patek Philippe, and Audemars Piguet being considered both status symbols and appreciating assets. Handbags such as Birkins and Chanel are also some of the assets most likely to retain their value. In fact, a recent report by Credit Suisse and Deloitte states that both handbags and watches are “recession-proof”, a distinction that is incredibly valuable for investors in recent years.

The Evolving Passion Asset Market: Opportunities and Challenges

As the passion asset market expands, new investment opportunities and challenges will continue to emerge. For example, the growing interest in sustainable, vintage and eco-friendly collectibles presents an opportunity for investors who wish to align their investments with their environmental and social values. To navigate these evolving markets and stay ahead of the curve, investors should keep a close eye on industry developments, technological advancements, and changing consumer preferences. This attentiveness will enable them to identify new investment opportunities and adapt their investment strategies accordingly.

The complexity of the passion asset market makes the role of experts especially important. From art advisors and appraisers to classic car specialists and watch connoisseurs, professionals offer invaluable insights into the intricacies of their respective fields. By seeking expert advice and guidance, investors can better understand the factors that drive asset appreciation and make more informed investment decisions. Furthermore, experts can help investors navigate the unique challenges associated with passion asset investments, such as authentication, provenance, and asset maintenance. By working closely with these specialists, investors can ensure they are well-equipped to manage the risks and complexities of passion asset ownership.

Maximising Returns in Passion Assets: Strategies for Success

To ensure success in passion asset investments, investors should focus on financial planning and investment education. Individuals should consider employing a well thought-out investment strategy that includes thorough research to understand the market, diversification across various passion assets to minimise risk and maximise potential returns, a long-term perspective that recognises that asset appreciation may take years, and working alongside a team of trustworthy experts to gain insights into market trends, valuations, and potential investment opportunities.

One of the critical factors in successful passion asset investing is cultivating a balanced investor mindset. While passion and enthusiasm are essential, it is equally important to approach investments with a sense of pragmatism and objectivity. It is pivotal to understand the risks associated with passion asset investments, such as market volatility and asset liquidity. By staying informed about market trends, auction results, and industry news, investors can make informed decisions and protect their investments, using appropriate insurance coverage and proper maintenance and storage.

It is also crucial to conduct thorough due diligence when investing in an asset, considering the potential risks and rewards, and adopting a disciplined approach to buying and selling. When striking a balance between passion and pragmatism, investors can enjoy the emotional and social benefits of their investments while maximising their financial returns.

Building a Community: The Power of Connection and Social Capital

Investing in passion assets also provides opportunities to build a community of like-minded enthusiasts, offering social capital, connections, and a sense of belonging. In fact, most people find this to be the most rewarding part of investing in assets. By connecting with others who share similar interests, investors can exchange knowledge, insights, and experiences that enhance their enjoyment and understanding of their chosen passion assets.

For many investors, passion assets also represent more than just financial investments – they are also an opportunity to leave a lasting legacy for future generations, and enjoy a shared hobby. By investing in art, collectibles, and other tangible assets, people can share their passions and values with their children and grandchildren, creating a sense of connection and continuity across generations. Moreover, as some passion assets, such as art and classic cars, have the potential to appreciate in value over time, they can also serve as a means of wealth preservation and transfer. In thoughtfully curating and managing their portfolios, individuals can ensure their investments continue to provide enjoyment, connection, and financial growth for generations to come.

Investment Communities and Clubs: Opportunities for Diversification

As we have seen, collecting passion assets is often a sociable activity, in which buyers have to rely on all sorts of expertise. Investment communities and clubs, for example, offer a structured way to connect with other passion asset investors, providing opportunities for networking, diversification, and collaborative investing. By pooling resources and expertise, members can gain access to a wider range of investment opportunities and benefit from the collective wisdom of the investor network. Many investment clubs also offer educational resources, networking opportunities, and expert guidance, further enhancing the investment experience.

The Enduring Appeal of Passion Assets

As the passion asset market continues to grow, investors can benefit from the unique combination of personal fulfilment, financial growth, community-building, and social capital that these investments offer. By embracing the power of community-building, diversification, and expert advice, investors can navigate the complexities of the passion asset market and reap the rewards of these alternative investments. As the market evolves, the enduring appeal of passion assets will undoubtedly remain a powerful tool for those seeking a meaningful and rewarding investment experience.