MyArtBroker Talks: Navigating the Collectibles Market

The Currency © Damien Hirst 2016

The Currency © Damien Hirst 2016Live TradingFloor

The collectibles market has experienced a boom since the Covid-19 pandemic, with digital market spaces making it easier to buy, trade, and collect. Charlotte Stewart speaks with Anthony McGuire from Neustreet and discusses how online markets are making collecting more transparent and accessible.

In conversation with Anthony McGuire, Editor in Chief at Neustreet, we consider the benefits of digital markets when collecting alternative assets. Online markets have transformed in the past five years, and have given investors and collectors more data, access, and transparency. Here we discuss how digital markets are giving more and more people the opportunity to collect, with information and insight on their side.

Q: Charlotte Stewart: Today we’re joined by Anthony McGuire, the Editor in Chief of Neustreet, a company that brings together data and media in the physical and digital collectibles market space. Can you tell us a bit about the background of Neustreet and why it exists?

Anthony McGuire: I think it might be best to start with the personal story of our founder, Eric Witschen. Eric is a long-term financial technologist, spending most of his career at Bloomberg. Eric is also a collector himself. Since childhood, he has collected baseball cards, he’s a big fan of art, and he’s a big fan of sneakers.

When Covid hit, Eric started to notice that people started trading, buying, and collecting more of these things. Sports cards became popular again, as did Pokémon cards, and – of course – NFTs became really big. When Eric tried his own hand at collecting baseball cards, he overpaid and wasn’t even sure that what he’d bought was authentic. So, Eric thought about putting together his own collector passion and marrying them with data analytics and advice – and so he created Neustreet.

While we want to provide data and analysis, we also want to connect to culture and talk about the stories behind collectibles. People collect not just for financial reasons, but also for emotional reasons. We're finding this world where people are buying and collecting and investing in passion, and we want to be a company that's at the forefront of that - starting with sneakers, trading cards, and NFTs.

Q: CS: Tell us about Neustreet's data and how you come up with fair market value.

AM: It's not like we've got it all figured out so far, but some of the challenges about pricing boil down to just knowing where these things exist. Where can I buy these sneakers? Where can I buy this kind of baseball card? At Neustreet, we've been getting as much comprehensive data around price and product for these different collectibles - to be released in the form of APIs.

What we want to do is bring more data, transparency and access to give tools to collectors and investors. Right now, that transparency is very limited. Working with other companies, we're working towards a longer-term vision to make the collectibles market more transparent.

CS: There are so many parallels in our market. When it comes to prints & multiples, most people work off of public auction figures because it's all in the public space. However the reality - particularly since Covid - is that most of these have been traded on the private market.

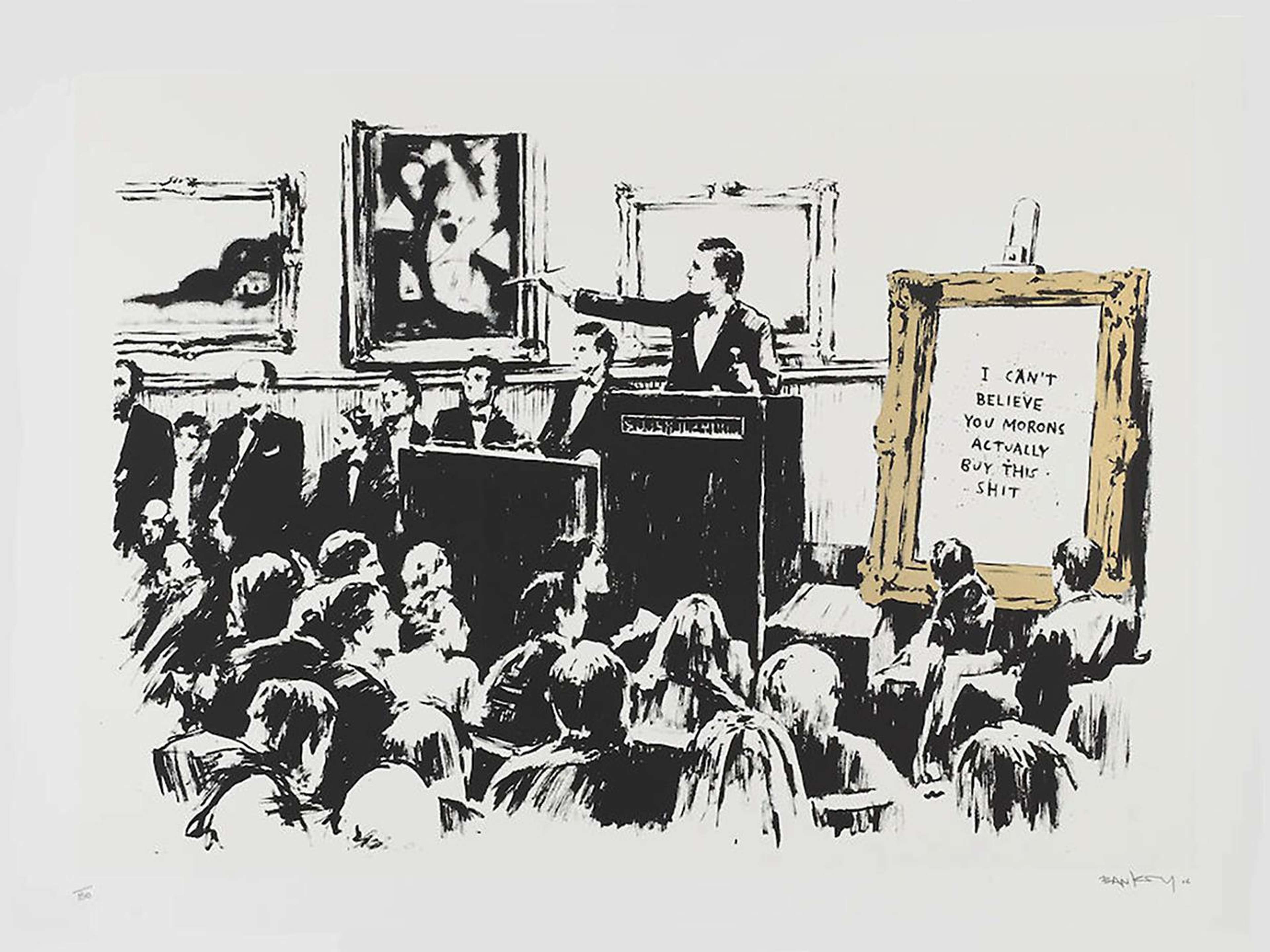

At MyArtBroker, we've blended public data with our private data, which goes back 10 years. We've been valuing prints for 10 years, we've been selling prints for 10 years - so we've got private data on what's been happening in the private market, especially in the Banksy market.

Q: CS: How do NFTs fit into this story of digital market spaces?

AM: I'd like to emphasise that we cover physical and digital collectibles because I think those two worlds are coming together. A lot of artists these days will create both a physical version of their work, and a digital version in the form of an NFT - like Damien Hirst's The Currency.

CS: Yes, this is the fundamental evolution of what Andy Warhol was doing in his Factory in the 1960s. Artists originally produced prints to give people access. Though it's a difficult concept to get our heads around, NFTs are allowing more people to access and collect art. Like physical prints & multiples, it is the scarcity of NFTs which contributes to their value.

Q: CS: In our space, there are a lot of similar platforms that just offer data, but not necessarily connection to other collectors. They don’t offer the ability to see what’s in demand, what’s in supply. What is Neustreet’s mission around community?

AM: Our data is meant to help people who want to build in this industry. If you wanted to start a trading platform or marketplace for sneakers or NFTs tomorrow, an element of building that is getting the right data. Getting that right data is actually underrated in terms of difficulty. What we want to do is be the backend data provider.

In a broader picture, we believe in a world where - at some point in the future - everyone in the world should have the opportunity to invest in passion and culture. That's an empowering message because gatekeeping has existed throughout traditional financial markets. Today, however, we're getting to the point where people are able to invest in things like baseball and basketball cards. The more people understand that you can buy these collectibles as a reflection of culture, the more a community of collectors will grow.

Image © WIFR / Mickey Mantel Baseball Card 1952

Image © WIFR / Mickey Mantel Baseball Card 1952Q: CS: What happened in Covid to the sneaker, trading card, and NFT markets?

AM: During the pandemic, we saw a rise in e-commerce, people spending more time inside, and people maybe spending their money on things other than physical events. On of the beneficiaries of that was a cultual movement towards more retail investing. As a result, people started thinking: where do I spend my money?

We have also seen a coming of age of people and collectors driven by nostalgia since 2021. This has led to a huge boost in, specifically, the card market going up in terms of average price. The things people wanted to buy as kids, like baseball cards and Air Jordan shoes, they now have the income to buy. Likewise with NFTs, people found digital collectibles a more understandable and palatable way to figure things out like crypto, Web3, and the blockchain. It was a way to attach yourself to a community - and a lot of it was very much driven by hype and culture.

CS: This rings true of the Banksy market during the pandemic. 2021's market was very much hyped with memorabilia - the things that we don't trade in - that went through the roof. This, in turn, pushed up the value of unsigned prints. Since then, there's been a correction in the Banksy market - but it's interesting to see how our markets are connected

Q: CS: We're passionate about connecting specialism with market data and tech, which brings me back to the word: “Collectech”. What does this term mean for our markets?

AM: This is a term that will become more and more common as time goes on. Collectech is leading to bigger things, as we saw with Nike's acquisition of RTFKT in 2021 and their launching of NFTs. We're hurdling in the direction of the marriage between physical and digital - because our lives are becoming more and more physical and digital.

Q: CS: How do Neustreet advise on collecting?

AM: I think the smart decision is to be diversified. Collectibles aren't just about finances. Sometimes the calculus is purely financial. Sometimes the calculus is purely emotionial. We respect both of those behaviours equally. No matter who you are, you'll need data. We want to be a tool for any collector, no matter who you are.

CS: That's similar for buying art: buy what you love and what's in low supply. At the end of 2020 and 2021, the financial audience in our market went sky high. On the other side of our database is people who are buying for passion - and then risk doesn't really come into it. It's the perfect investment: if you love it, what could be better?