10 Alternative Asset Platforms Shaking Up The Market

The Currency © Damien Hirst 2022

The Currency © Damien Hirst 2022Live TradingFloor

In recent years the alternative assets market - encompassing passion and luxury collectible assets - has experienced a remarkable transformation. Once considered a niche segment, this burgeoning industry has captured the attention of those seeking to diversify their portfolios and indulge in their hobbies. Passion assets including fine art, vintage automobiles, rare wines and luxury watches, have become increasingly attractive investment opportunities, while luxury collectible assets, such as sports memorabilia, designer handbags and limited-edition sneakers, have amassed dedicated followings. The popularity of these trends can be attributed to the advent of online selling platforms, which have disrupted the status quo and revolutionised the way in which these assets are traded.

In the past, procuring knowledge about the value, rarity and provenance of passion assets or luxury collectibles was a time-consuming process. However, with the rise of online selling platforms, investors can now access a wealth of information and market data at their fingertips, empowering them to make more informed decisions and fostering a sense of trust and confidence in the market. In addition, these platforms often provide ancillary services such as authentication, appraisals, and storage, further simplifying the process for collectors.

As alternative assets platforms continue to gain traction and reshape the landscape of the passion and luxury collectibles market, they not only enable investors to capitalise on the potential returns but also bring together like-minded enthusiasts, fostering a global community of collectors passionate about preserving and celebrating these unique and treasured assets.

Image © Subdial

Image © SubdialWatches - Subdial and Chrono24

Watches have long been considered valuable collectible assets beyond their ability to display status and wealth. Two platforms have emerged as leaders in the collectible watches market: Subdial and Chrono24.

Chrono24 has been a leader in the market since its inception in 2003, with 9 million monthly users currently on the platform. Its mission is to be “the global home of luxury watch enthusiasts,” with its website existing in 22 languages. In order to maintain its standards of quality, it has strict guidelines for watch dealers who wish to join the platform, although professional authentication is always encouraged in any case. The website also offers its own buyer’s protection, which offers payment via the escrow service, an authenticity guarantee, a global money-back guarantee, insured shipments and quality and security team. Currently, it offers over 500,000 watches on its website, with a combined value of over £3.5 billion.

Subdial is a relative newcomer on the market, having been founded in 2018, yet it has already proved itself to be a serious contender. The British start-up uses a strongly data-focused approach, even partnering with Bloomberg in order to create a type of “FTSE 100 of watches, showing the global market cap and growth of the top model references.” The company also personally inspects every single watch, ensuring that it meets its standards for sale, and offers insured delivery.

Image © Net-A-Porter

Image © Net-A-PorterLuxury Fashion - Reflaunt

Collecting luxury fashion is a hobby for many, with treasured pieces often selling for several times their original sales price. Reflaunt is a platform that aims to “define the future of circular fashion,” with over 50 million shoppers across their global network. They have partnered with large players in the fashion game, including Net-A-Porter and Harvey Nichols, boosting their assortment of over 50 thousand luxury second-hand products.

As opposed to being their own platform, Reflaunt caters its product to businesses instead, relying on famous companies to make an impact. Being associated with such reliable platforms means that buyers have immediate confidence in the authenticity and pricing of their products. It can also make the experience easier for the seller, since they do not have to list and ship the items. Instead, Reflaunt collects customers’ items from their home or picks them up at drop-off locations, then handles the rest: everything from photographs, to authentication, to listing and pricing. Sellers only have to choose how they wish to get paid once their product gets sold.

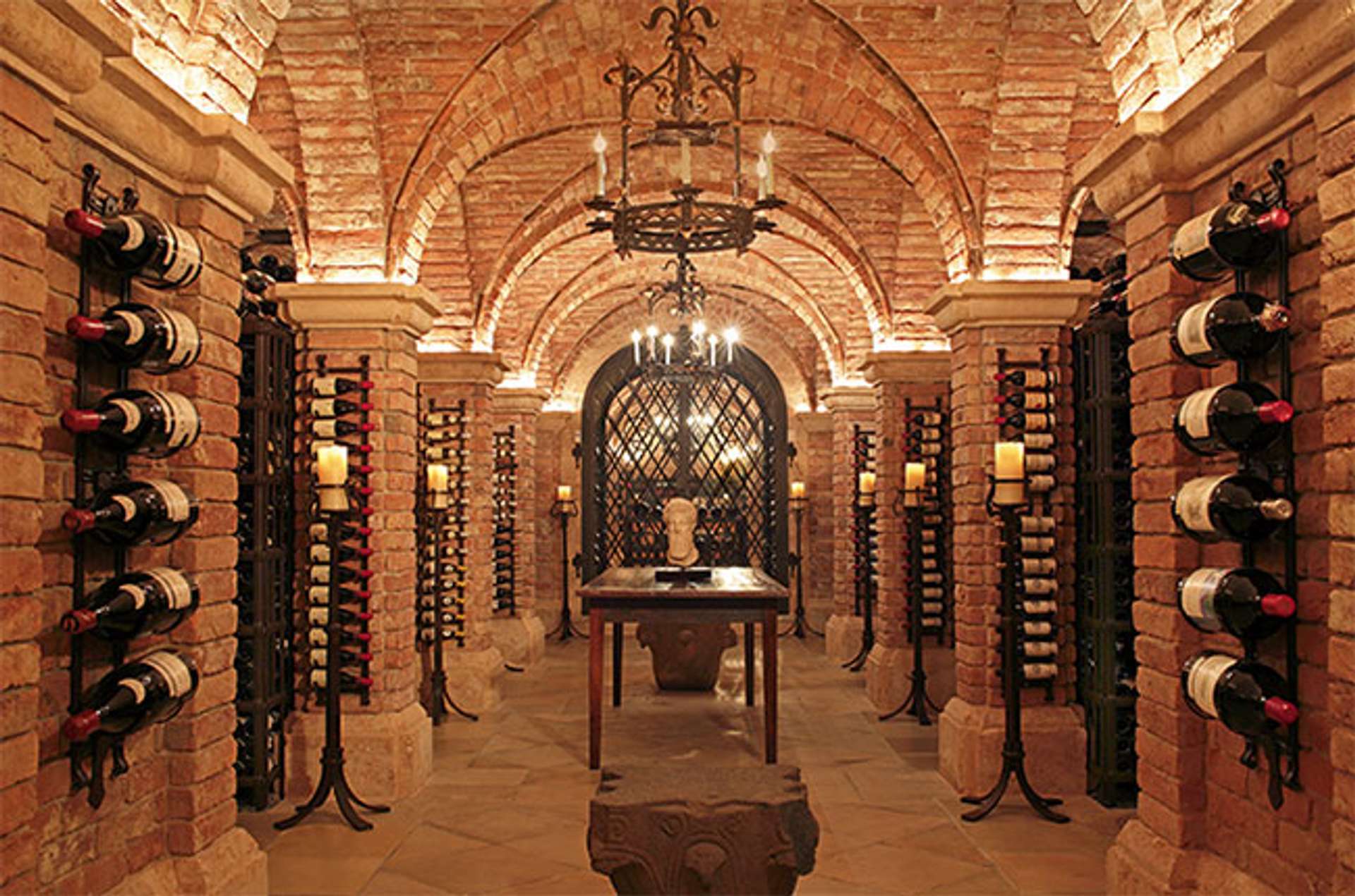

Image © Bordeaux Index

Image © Bordeaux IndexWine - VinoVest and Bordeaux Index

For many, wine is more than something to be enjoyed, it is a passion and an investment. For those who particularly wish to have the latter, enter Vinovest – a platform that aims to democratise the process of investing in fine wines. It offers a personal advisor, who helps you diversify your portfolio using advanced insights and insider pricing. It can store wines for their users, simplifying the infrastructure that this type of investment traditionally demands. However, if you wish to enjoy your bottle, they can ship it to your house too.

The Bordeaux Index is the world’s biggest fine wine trader, and offers a more traditional option. Since 1997, through their platform users can choose from several of their services: buying, selling and investing. They also offer bespoke cellar management, brokerage and even can provide their own storage. They have achieved support from important players in the industry, too: in 2019, the Family Group behind Bollinger Champagne agreed on a strategic partnership with a minority investment into Bordeaux Index. This collaboration further cemented their impact and credentials in the business, as they are now one of the most reliable companies to invest in wine.

Image © Bordeaux Index

Image © Bordeaux IndexWhisky - Bordeaux Index and Whisky Me

The Bordeaux Index is not exclusively a wine platform. In 2017, it entered the world of spirits, which offers “distillery exclusives, highly collectable spirits and cask/whisky investment opportunities.” Their spirits department offers the same high standard of service that they became known for in the wine industry.

Whisky Me is a platform that emphasises community, fostering connections between enthusiasts who partake in their subscription tasting service. It allows users to rate their recent drams, join monthly online tastings and discover new drops before purchasing from their online cellar. Their interface is contemporary and colourful, making the whisky purchasing experience more accessible and, in their words, “snobbery-free.” Their main mission is democratising the whisky world, one that they have been accomplishing since 2016.

Image © Rebag

Image © RebagLuxury Handbags - Rebag

In the past few years, handbags have emerged as a reliable investment as a passion asset – some brands such as Hermès and Chanel have been declared “recession-proof” by Credit Suisse, and handbags are some of the assets most likely to retain value. The platform Rebag has been at the forefront of this market growth, which has risen by 15% in the last year. While they sell luxury items beyond just handbags, they are most well-known for the important role they have played in democratising the second-hand bag purchasing experience.

Founded in 2014, the platform allows for users to sell and buy from over 50 brands, as well as offering a wide variety of services. The company’s transparency policy is one of its most attractive attributes, and all of their items undergo an in-person review process by their in-house team of experts. As such, they are able to authenticate every bag sold on their website, allowing their users to have peace of mind when purchasing a handbag or another luxury item.

Image © Collecting Cars

Image © Collecting CarsClassic Cars - Collecting Cars

Classic cars are more than just a mode of transportation: they are a symbol of status and style, can also be a solid investment and usually are a source of great pride for their owners. Collecting Cars is one of the biggest auction companies of its kind, offering their services across four continents and allowing its users to bid on cars from all over the world. After having been founded in the UK in 2018, they reached the milestone of £1 million in sales only three months later. Since then, it has continued to experience quick growth over the past five years and has been praised for revolutionising the market.

They also offer articles on their website, sharing information and expertise with its users. In 2023, Top Gear presenter Chris Harris chose the platform to auction off his own car, illustrating just how much trust the website has been able to garner.

Image © Netflix

Image © NetflixSports Cards and Memorabilia - Goldin, Alt and Neustreet

During the pandemic, when many of us were leaning hard into our hobbies, sports enthusiasts drove up the value of memorabilia. From worn jerseys to autographed equipment and trading cards, these items have been experiencing a newfound appreciation within the collectibles market.

The platform Goldin is one of the most trusted ones in the collectibles market, and has recently received attention in their Netflix series King of Collectibles – The Goldin Touch. Over the years they have sold over £1.5 billion in collectibles, ranging from comic books to videogames, and from single cards to larger sports memorabilia.

Alt, on the other hand, has a more focused market and only sells trading cards. Apart from buying and selling, they also offer other services such as their Vault – a secure storage facility with state-of-the-art technology – and their Borrowing services, which allows its users to borrow cash against the equity of their trading cards. This allows great flexibility for collectors.

Neustreet is a website that has collectibles from many categories, including sports memorabilia. They use data to back up their market research, allowing for its customers to have absolute transparency about their collections and transactions. It also produces podcasts, including one with MyArtBroker where our experts discussed how to navigate the collectibles market.

Image © KickGame

Image © KickGameSneakers - Sneaker Brokers, Kick Game and Neustreet

The sneaker market has exploded in recent years, as collectors seek out limited-edition releases and collaborations. Sneaker Brokers was ahead of its time, having been founded in 2013 and sold over 25,000 pairs since then. Sneakers sold through their platform and their eBay page are thoroughly vetted by their experts, who ascertain their authenticity. The platform, however, is only available in the USA. In the UK, brand Kick Game was also founded in 2013, and has expanded into brick-and-mortar stores after generating revenue of over £40m last year.

Apart from sports memorabilia, the aforementioned platform Neustreet also uses real-time data to help its users monitor the sneaker market, allowing them to make informed decisions about their collections.

Image © 1stDibs

Image © 1stDibsVintage Furniture - 1st Dibs

Investing in vintage furniture is a unique way for collectors to own a piece of decorative history. However, when looking to purchase these items, it is crucial to work with renowned sellers to ensure your antique furniture has been ethically sourced and authenticated. 1st Dibs has long held a large share of the market, having been founded in 2000 and remaining an important platform ever since.

In the past, sourcing antique and vintage furniture was a time-consuming activity that required dedication and personal expertise. However, with platforms such as 1stDibs buyers have access to the selection and know-how of dealers worldwide at the touch of a finger. The platform has also shown itself to be influential in trend-setting, with their 1stDibs 50 list becoming a benchmark for successful designers everywhere.

Art - MyArtBroker, MyPortfolio and the Trading Floor

Art is the top-performing collectible asset, and has been for the past decade. MyArtBroker is a specialist art brokerage service that can provide guidance on building a collection and help you discover prints from trusted sources. When working with MyArtBroker, you have access to a global network of over 30,000 collectors looking to buy and sell art daily on our Trading Floor, which gives you access to market data in real time. If looking to purchase, you are assigned your own personal broker, who will work with you to find the piece you are looking for at the price you are willing to pay. Our experts condition check and authenticate artworks so buyers can have confidence before purchasing, and we also help arrange delivery.

Our website has 75,000 visitors every month, and we keep them up to date with new works, auction results and news. We regularly publish informative essays that discuss artists’ biography, style and market performance. We also offer a range of services that can be helpful for collectors at all levels, including free valuations and portfolio management via MyPortfolio.

At MyArtBroker, our goal is to simplify the process of purchasing prints. Through providing you with real-time market data, we are able to offer a unique level of blue chip market transparency.

These platforms have had a profound impact on the alternative assets market by making information more accessible and transparent for potential investors. They have also streamlined the buying and selling process for collectors, making it more convenient and efficient than ever before. With the ability to browse a vast array of assets from around the world, engage in real-time auctions and complete transactions securely, collectors can now acquire their coveted pieces with ease.