Probate and Art Assets: What Executors Need to Know

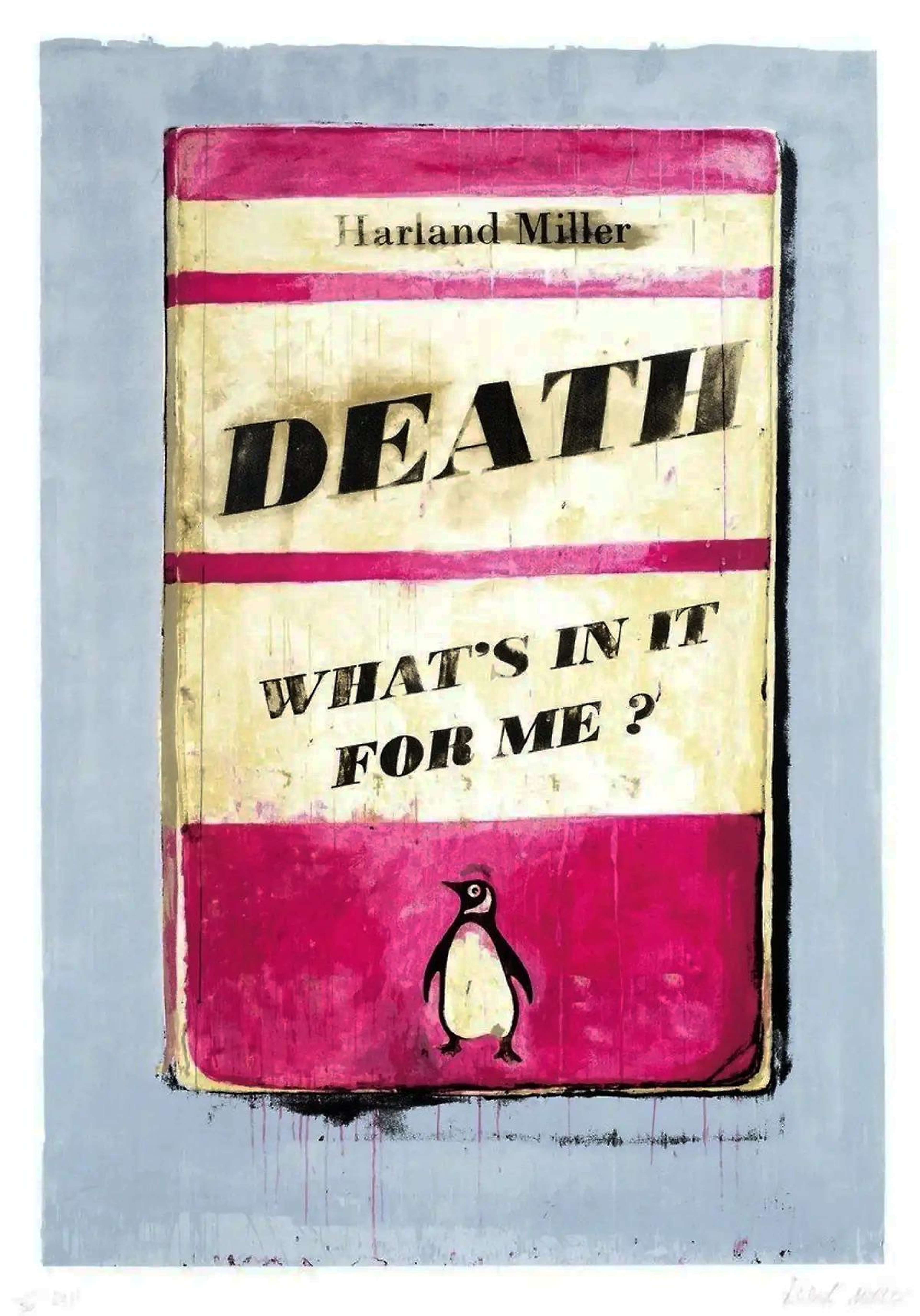

Death What's In It For Me? © Harland Miller 2011

Death What's In It For Me? © Harland Miller 2011Live TradingFloor

Probate is the formal legal process through which a deceased person’s assets are identified, debts and taxes settled, and inheritances distributed according to their will or by the rules set out by law. When the estate includes significant artworks, the executor’s role takes on added complexity. Executors must liaise with specialists to secure accurate valuations, preserve provenance records, manage storage, and ensure the correct application of tax reliefs. Every decision influences not only the financial value of the estate but also the long-term stewardship of its cultural legacy.

The Role of Executors in Managing Art Assets During Probate

Executors entrusted with art-rich estates must blend several areas of expertise: legal procedure, financial oversight, and art-sector know-how. After confirming their appointment (either by the will or by applying to the court) they begin by compiling a comprehensive inventory of every artwork, noting provenance, condition, and storage location. Alongside this documentary work, they assemble a team of trusted advisors, including art appraisers accredited by recognised bodies, conservators to assess condition risks, legal counsel versed in cultural-property law, and tax advisers familiar with inheritance reliefs. Open dialogue with beneficiaries throughout this process builds trust and minimises misunderstandings, while clear timelines and regular updates ensure that all stakeholders remain informed and engaged.

Understanding the Probate Process for Art Assets

The probate journey starts with identifying all estate assets and applying for the relevant grant; known as the Grant of Probate in England and Wales or the Grant of Confirmation in Scotland. Once authorised, the executor is empowered to settle outstanding debts, including inheritance tax liabilities, and to discharge any creditor claims.

Artworks then require special attention: they must be appraised by independent experts who reference current market data, recent auction results, and economic trends. Only when liabilities are paid and valuations approved can art pieces either be passed directly to beneficiaries, sold to equalise inheritances, or retained as part of a charitable gift.

Duties and Responsibilities of Executors

At every stage, executors bear the responsibility of thorough record-keeping. Detailed files should include photographically documented condition reports, provenance research, valuation certificates, insurance policies, transport receipts, and all court filings. Executors must ensure that artworks remain secure, opting for climate-controlled storage when delays in distribution are anticipated, and arranging specialist couriers for transit. They balance these logistical tasks with financial stewardship: monitoring market conditions to decide whether to sell assets immediately or to hold them for potential appreciation, and liaising with tax advisers to claim any applicable reliefs - such as Business Property Relief or cultural gifts programmes - that can reduce the estate’s tax burden.

Legal Requirements for Art Assets in Probate

Since April 2025, UK inheritance tax rules have shifted from a domicile basis to one centred on long-term residence, altering eligibility for certain reliefs. Individuals who have been UK tax residents for 10 out of the previous 20 years are classified as “long-term residents” and are now subject to IHT on worldwide assets - including artworks - regardless of legal domicile. For those who later leave the UK, their worldwide estate remains subject to IHT for a “tail” period of between three and ten years, based on the total years of residence.

Valuation and Appraisal of Art Assets

Executors should engage an accredited appraiser for each medium represented and consider a second opinion for high-value or contested items. Appraisers will analyse comparable auction results, review catalogue raisonnés, and consult proprietary sales databases to determine fair market value. The resulting reports become pivotal both for tax reporting and for maintaining transparency with beneficiaries. By documenting every step of the appraisal process, executors safeguard against later disputes and provide a detailed audit trail for court scrutiny.

Preserving and Protecting Art Assets During Probate

Maintaining an artwork’s condition is fundamental to preserving its value. Executors should arrange storage in facilities that regulate temperature, humidity, and light exposure, especially when probate delays prolong custody. Regular inspections by conservators help detect early signs of deterioration so that preventive measures can be applied. Insurance policies must be aligned with up-to-date valuations and cover transit risks, theft, fire, and accidental damage. When works are loaned to institutions or moved between sites, executors oversee condition reports before and after transit to ensure accountability at every stage.

Distributing Art Assets to Heirs

When it comes time to distribute artworks, the executor refers first to the will’s specific bequests; if the will directs that items be sold, the executor must arrange auctions or private sales and distribute proceeds equitably. In cases where multiple heirs wish to retain particular pieces, mediation can help negotiate fair exchanges or co-ownership arrangements. Transparent sharing of valuation reports and estate accounts fosters agreement, while legal oversight ensures that any settlement or proposed sale complies with both the decedent’s wishes and statutory obligations. By engaging beneficiaries early and listening to their concerns, executors can often avoid costly legal challenges and preserve family goodwill.

Challenges and Considerations in Managing Art Assets

One of the greatest challenges in art-asset probate is preempting disputes among heirs, which can arise over perceived value, sentimental attachment, or future market prospects. Effective communication, supported by concrete valuation data, can defuse tension. Executors must also stay abreast of evolving legal and market developments: changes in tax reliefs, shifts in the global art market, or new digital-asset regulations can suddenly affect strategy. Building a network of reliable advisers equips executors to respond swiftly and protect the estate’s interests.

Best Practices for Executors Handling Art Assets

Art-asset probate requires early planning, meticulous documentation, and the assembly of a multidisciplinary advisory team. Executors who prioritise transparent communication, secure professional valuations, and adhere to legal requirements - including the latest inheritance tax reforms and cultural-property regulations - will navigate the probate process more smoothly.