The Role of Emotions in Art Investing

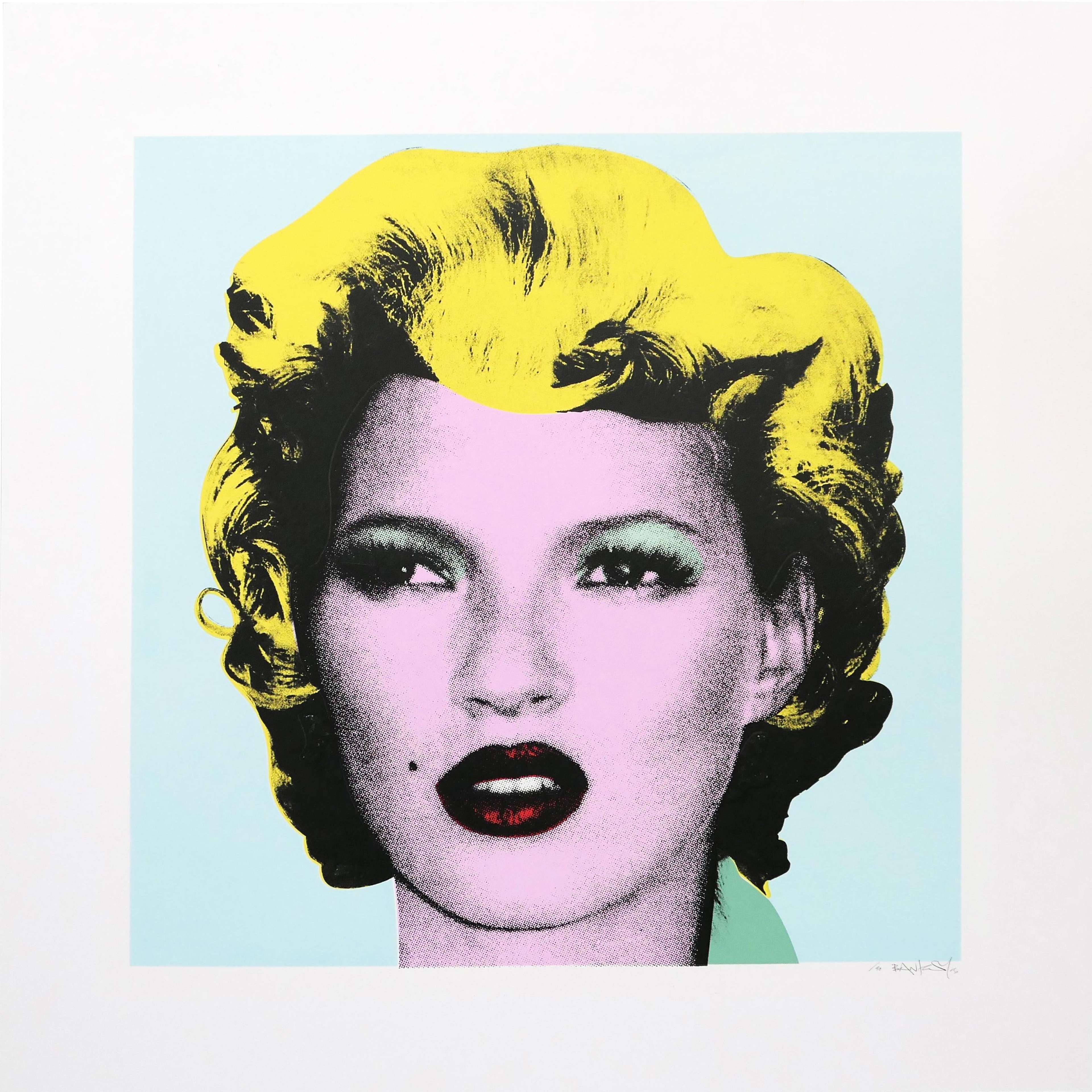

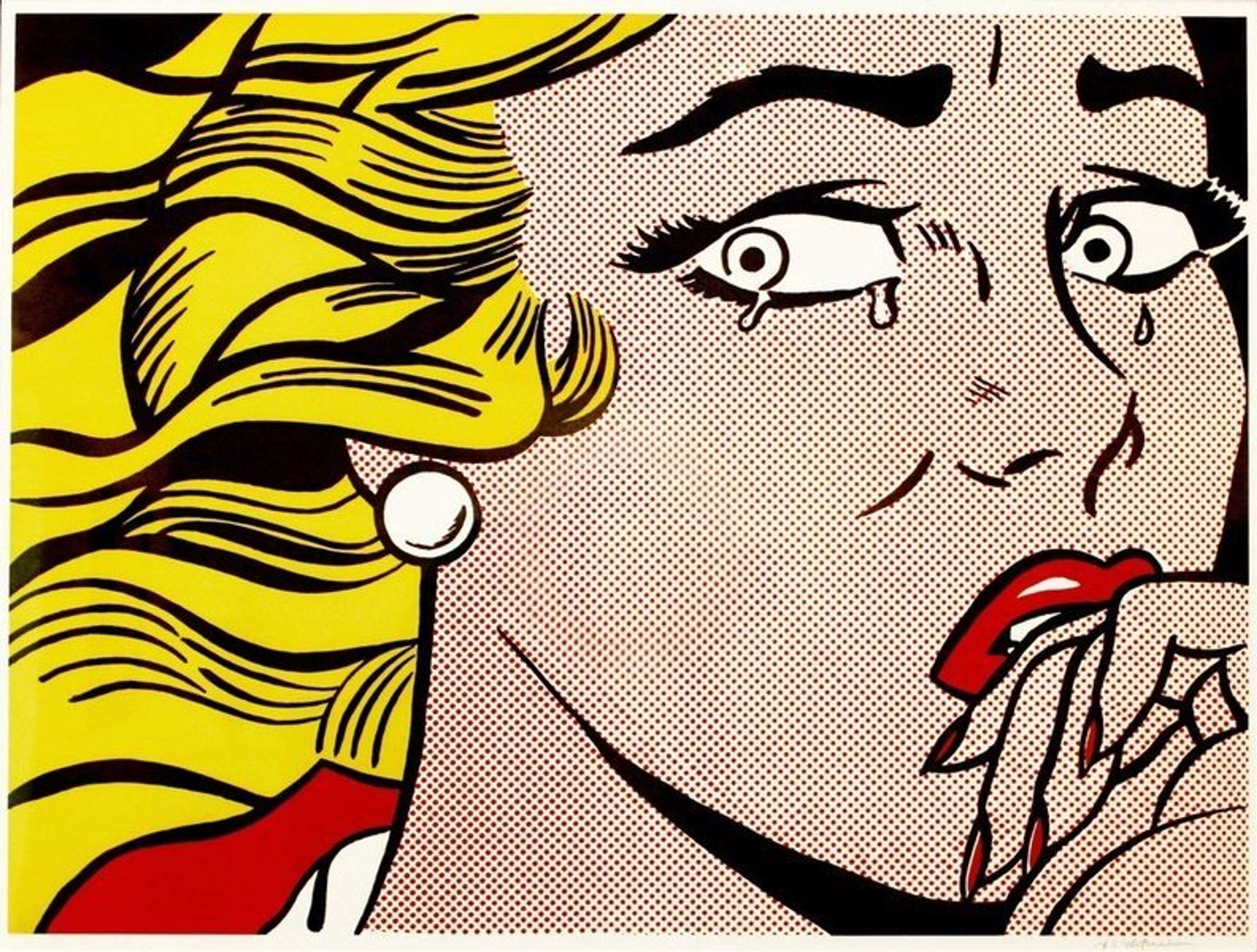

Crying Girl © Roy Lichtenstein 1963

Crying Girl © Roy Lichtenstein 1963

Interested in buying or selling

work?

Market Reports

From transcending language and cultural barriers, to provoking emotions and stirring up nostalgia - art has power like nothing else. But art isn't about aesthetics, it’s also a lucrative investment opportunity. And when taking on investing, it’s important to understand that it is not solely driven by numbers and names.

Understanding the Role of Emotions in Art Investing

An awareness of the emotions at play in shaping our investment decisions is crucial to make informed and profitable choices. Emotions have the potential to cloud judgement, and instigate irrational decisions, be it through greed or excitement. Thus, recognising and managing these feelings is essential.

By gaining an understanding of the market trends, pricing patterns, and history of the artwork at hand, investors will be able to stay informed and rational - and more capable of making successful art investments and decisions regarding their collections. Here at MyArtBroker, we are aware of this and want to discuss the many things that impact investment decisions, as well as delving into the psychology behind the act of investing. Though emotions are, of course, crucial when investing in passion assets like art, we strive to help you navigate the complex world of art investing - with confidence.

Art Market Trends & How They Impact Investment Decisions

Keeping a close eye on art market trends is essential in making informed investment decisions. By undertaking thorough research of artists and artwork prior to making an investment can really help mitigate risk. Market trends are often driven by emotions - for example, sudden popularity of certain artists or styles of work may lead to fluctuations in price and demand and exciting investment opportunities. And though these opportunities may be enticing, it's always best to not let the fear of missing out influence investment decisions. By steering clear of sweeping investing in trends, and instead diversifying an art portfolio - collectors can ensure maximum returns while keeping the risk low.

A key way in which collectors can go about understanding marketing trends is by keeping track of the individual streams such as: art market data, historical sales data, auction results and the overall health of the art market. At MyArtBroker, we place the supply and demand of our private network directly onto the front end of our site on our trading floor. Though we cannot offer financial investment advice, we have a plethora of resources that can help guide and educate potential investors - including our unique print market index that informs MyPortfolio. When making an investment in art, it is always wise to seek professional advice from trusted specialists - like our brokers - to provide valuable insights into the trends shaping the market.

By combining data-drive analysis with emotional intelligence, collectors and investors can navigate the ever-dynamic art market and make the most informed, profitable, and rational decisions possible.

Rational Investing: Making Informed Decisions

If approached rationally, investing in art can be a profitable venture. Emotions play a vital role in art investment, which is important but can also lead to buyer remorse. By developing a clear investment strategy led by research and analysis, you are likely to make some informed decisions. It is important to prioritise the strategised plan you have set for yourself, over emotional decision making - and diversification is a great strategy to take on.

Diversification is a great way of staying rational in your decision making, as well as attaining an interesting variety of work in your collection. This variety whilst stretching your portfolio, spreads risk and minimises the impact of any single artworks performance on your portfolio. Thereby, investing in artworks from different artists, styles and periods can help mitigate the risk of downturns in the art market, and increase the potential for profitable returns.

Another crucial aspect of rational investing is having a strong grasp on the factors that affect an artwork's value. Artist reputation, historical sales data, condition, provenance and demand are all catalysts to keep in mind. Conducting investigations on the authenticity and condition of the artwork , and further seeking expert opinions on the valuation of the piece, can provide a solid foundation for making rational investment choices.

Find out more about how to value art in our recent Guide To Art Pricing & Appraisals.

MyPortfolio © MyArtBroker 2023

MyPortfolio © MyArtBroker 2023Art Portfolio Management: Diversification, Valuation & Risk Management

To succeed in art investing, there are several key elements to keep in mind, and one of the most important is that of effective portfolio management, in which diversification, valuation and risk management are all encompassed.

With our new online platform, MyPortfolio, you can build and track your portfolio of blue chip prints in real time - in one place. By inputing the date of purchase and the price you acquired your print for, MyPortfolio calculated the value growth since purchase. You can also view the value growth of your entire portfolio, driven by our unique print market index which blends public and private sales history. As aforementioned, we can't advise you on how and what art to invest in. However, with MyPortfolio you can see the market trends in your portfolio and where opportunity lies.

Risk management through careful research and looking ahead to the long term investment horizon will aid collectors in steering clear of emotional bias and impulsive decisions. By having those long term strategies in place, your emotions are less likely to derail you and the success of your collection. By maintaining close contact with industry specialists can also provide peace of mind, which is why MyArtBroker champions the personal relationship between collectors and our brokers.

The Psychology of Art Investing

Art investing can be a complex and emotional process, but understanding the psychology behind it is key to making rational decisions. Rational judgement can often be clouded, which can then lead to biased decisions. Emotional attachments to certain pieces can cause issues when it comes to buying and selling. Recognising biases such as over-attachment, is essential in avoiding errors and pointless risks. In setting clear goals when collecting and investing in art, you can stay profitable and successful.

With a rational approach, you can make profitable investments in the market without getting overwhelmed by emotion or biases.

Achieving Success in Art Investment

Investing in art is a unique and exciting venture that is both financially and aesthetically rewarding. It is therefore crucial for art collectors and investors to understand how emotions come into play. By adopting rational investing strategies, conducting thorough research, diversifying your portfolio, and managing risks, investors can increase their chances of success in the market while simultaneously minimising risks.