MyArtBroker Talks: Art Investing: Worth The Trouble? A Response to Matt Capasso's State of the Arts

Marilyn (F. & S. II.24) © Andy Warhol 1967

Marilyn (F. & S. II.24) © Andy Warhol 1967

Interested in buying or selling

work?

Market Reports

In his recent white paper, titled Art Investing: Worth The Trouble?, Matt Capasso examined the advantages and disadvantages of investing in fine art. Capasso posits the question: “Is the art investing hype justified or are we just chasing a mirage?”. Charlotte Stewart sits down with MyArtBroker's Erin-Atlanta Argun to discuss Capasso's thoughts on the matter, and explore how MyArtBroker is making investing in art a more accessible and transparent experience.

Since its conception, the art market has been a notoriously opaque and difficult market to navigate. Despite its traditionally unpredictable nature, collectors and investors alike have turned to art as a sound alternative asset class. While the disadvantages explored by Capasso are indeed palpable, MyArtBroker are working towards building a more accessible and transparent secondary art market. In conversation with Erin-Atlanta Argun, we discuss Capasso's thoughts and consider how our online platform supports collectors looking to invest in bluechip prints and multiples.

Q: Erin-Atlanta Argun: We're looking at whether art is worth the trouble. While Capasso certainly made valid points when it comes to the primary market, we've got quite a lot to say when it comes to prints and multiples on the secondary market. Charlotte, what are your thoughts?

Charlotte Stewart: I will stress that this isn't a market for people looking for a nice, solid, steady investment. There are models like fractional investing, which allow you to play the game a little more like stocks and shares. We don't do fractional: this is 100% art ownership. You get to take the artwork home and love it and appreciate it. This is a market for people who enjoy the art.

EA: That's why we call it a passion asset, after all.

Q: EA: Capasso's first disadvantage is the fact that “fine art is highly illiquid, making collections difficult and time-consuming to sell in a pinch”. Would you agree?

CS: I agree if you're looking to liquidate your assets really quickly, there are much better places to go. However, I would argue that if you buy in the right market, there are areas where you can liquidate easily.

Say if you had £50,000 to spend and you chose to spend it on an emerging primary market artist, there is certainly a gamble involved. The difference with prints and multiples is that £50,000 allows you to buy across an extraordinary breadth of bluechip, era-defining artists. You have the ability to do very well in some areas, and experience corrections in others. While we are not financial advisors, there are strategic things collectors can do to allow themselves to cash out when they want to.

Q: EA: Capasso also goes on to say: “The sales channels for art are highly fragmented and market prices remain opaque”. At MyArtBroker, our platform is designed to offer unprecedented transparency and access. You're no longer having to wait and see what happens on the night at auction. This is something that you can take your time over, and wait for the best time to sell.

CS: Exactly, the art market is historically incredibly difficult to navigate. We've recently launched our Trading Floor which, in the simplest terms, picks up our network's supply and demand and places it on the frontend of our site. You can access - in real time - the pieces we have available for immediate sale, and the works wanted by our collectors. You can see exactly what our specialists can see: you can't really say fairer than that.

This is a game-changing piece of technology. Whilst there are a lot of people doing a huge amount of work in terms of data and tracking the market and across much larger section of the market than prints and multiples, there's no one else picking up their data and intel at this level.

Q: EA: Capasso says: “It takes time, sometimes months, sometimes years, to sell a collection entirely”. And yes, that is true, but our Trading Floor offers access to our network. We can connect you with that community of buyers and sellers who are interested in the artworks that you have, anytime.

CS: As much as we meet the need of being able to sell something immediately, we're not here to do that. With MyPortfolio, you can add the artworks you have to your two-factor authenticatd private dashboard and calculate return against the fair market value of your artworks in real time. You might not want to sell, but you can see where opportunity lies and track demand from our network.

The idea is that we're creating a connected community, where the opportunity is always open and the decision making is yours.

EA: And that's the crucial thing, isn't it? Putting that ownership of decision-making firmly in the hands of our collectors.

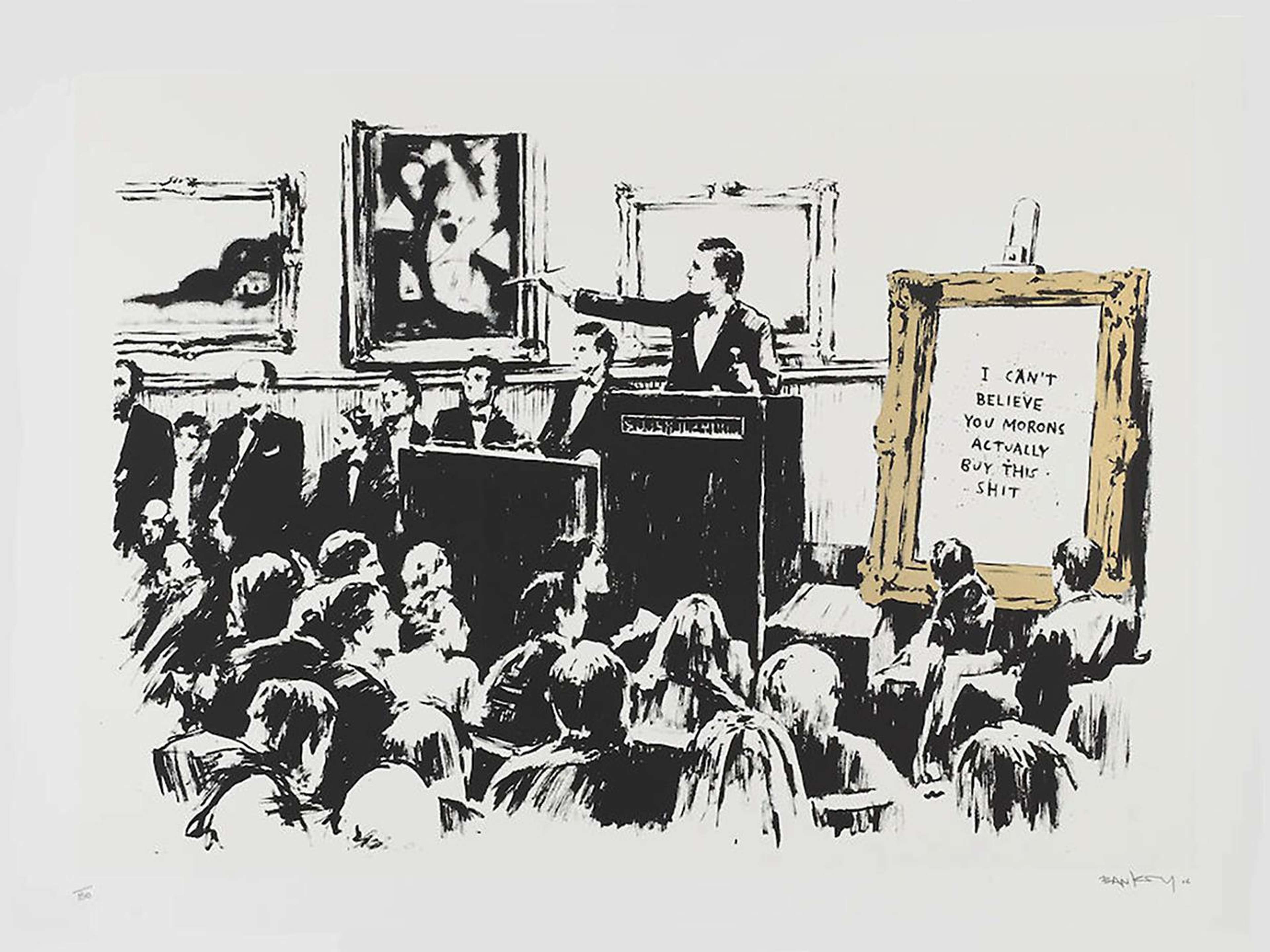

Q: EA: Another crucial disadvantage of art investing, according to Capasso, is that the art market lacks regulations. With art forgery scandals rife in the media, how do we stop this from happening when it comes to prints and multiples?

CS: Unfortunately, this is something we have to fight every day. It is one of the reasons we have not only our in-house specialists, but also third-party authenticators. We will often turn away artworks that don't come with enough provenance, even if they have been sold through reputable institutions. Condition is one of the reasons that MyArtBroker was founded, as Ian and Joe realised that there was no real understanding of condition and conservation when it came to Banksy prints.

If you want more regulation when it comes to the secondary market, with long sale history track records - both public and private - you can get that from us. There's no extra fee, and we have a pretty good nose for these things.

Q: EA: Capasso's final core disadvantage of art investing is that the art market is “volatile”. He says: “The art market is highly cyclical and volatile with prices fluctuating greatly based on the popularity of artists and styles.” This isn't entirely true at MyArtBroker, is it?

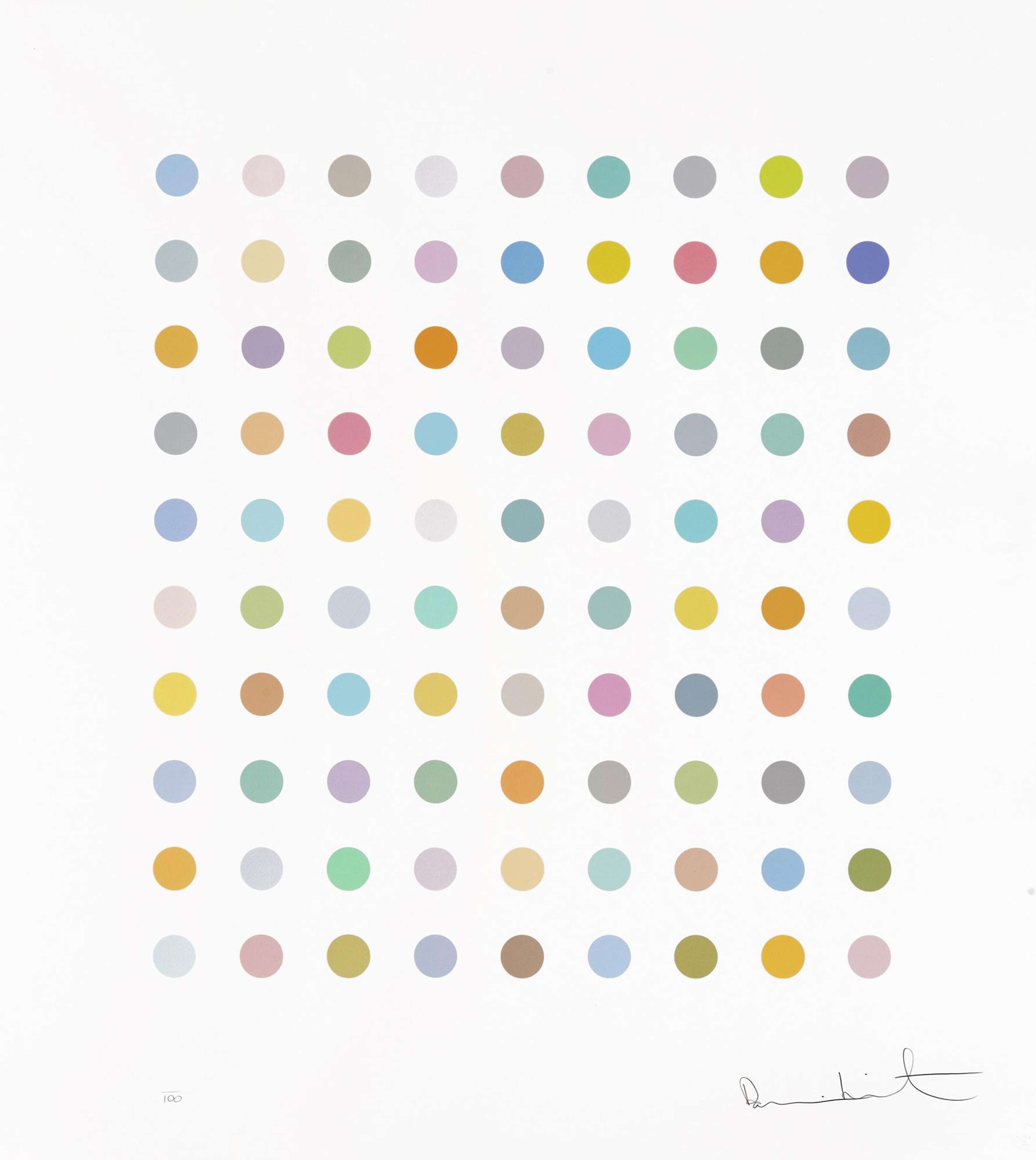

CS: The reason we work with our artists is because they are the most investable artists. The majority of our artists are deeply-established, with long value history.

We all have different appetites when it comes to how we want to invest, and how we want to collect. As we always end every conversation about art investing: buy what you love, and then you're never disappointed. Making money on an artwork is a bonus, but it's not why you collect. However, what better investment than something that brings you joy and cash?

EA: And don't put all of your eggs in one basket: prints and multiples allow you to do that in a way that originals perhaps can't. We have a lower price point to entry in this market, allowing you to buy across the board of different genres and artists. Buy what you love, and buy more of what you love if the opportunity arises.

Q: CS: So, is investing in art worth the trouble?

EA: I think it is, so long as you're investing in it for the right reason.

CS: You've hit the nail on the head. The fact is, there are a thousand ways to invest these days. Art is not just one of them. You have to enjoy the journey of collecting art: it needs to be a passion project.

Through our online platform at MyArtBroker, and the personal relationship you build when buying and selling, we provide an unparalleled level of transparency. I'd love to be challenged on that.