From Wall Street to Warhol: Profiling the Modern Print Collector

Live TradingFloor

The profile of the modern print collector has changed dramatically. Where once the art market was dominated by older, traditionally educated buyers, today’s print collectors are digital-first, professionally diverse, and globally connected. MyArtBroker’s Print Collectors’ Survey offers the clearest snapshot yet of who these individuals are, what drives them, and how their collecting habits are reshaping the market.

A new demographic driving the print market

The data shows a broad and evolving collector base. Nearly half of respondents (46%) are based in the UK, reaffirming London’s role as a global hub for prints and editions. Europe follows with 26%, and the US with 20%, while smaller groups of collectors in the Middle East, Australia, and Canada show the beginnings of international expansion.

This geographic spread mirrors the reach of the digital print market itself. Online accessibility has broken down traditional borders, allowing collectors to research and acquire works across continents. What’s particularly striking, however, is the professional diversity behind these numbers.

The strongest representation came from Tech & Engineering (20%), Creative & Cultural industries (18%), and Finance, Law & Real Estate (14%) — sectors united by analytical thinking, disposable income, and an appetite for transparency. For many in these industries, editioned prints are a natural fit: tangible assets underpinned by data, with liquidity and comparability built in.

Gender balance is shifting — but not evenly

While the market remains male-dominated overall, the survey reveals a significant generational rebalancing. Across all respondents, 79% identified as male, 18% as female, and 3% as non-binary or preferred not to say. Yet among collectors under 40, 55% identified as female, non-binary, or preferred not to say — making this the most balanced group in the survey.

This shift matters. It signals a new phase in collecting where access is no longer tied to established wealth or gendered networks. As younger and mid-career collectors gain capital, the market is likely to become more inclusive, both culturally and structurally.

The professionalisation of collecting

Today’s print collectors are informed, self-directed, and pragmatic. They rely less on intermediaries and more on data. For many, platforms like MyArtBroker serve not just as a marketplace, but as a research ecosystem — providing live market insights, historical pricing, and authentication guidance.

The overlap between professional skillsets and collecting behaviour is clear. Those working in technology bring a comfort with digital tools; those in finance and real estate apply valuation logic to their acquisitions. Meanwhile, creative professionals — from designers to filmmakers — often view collecting as an extension of their cultural literacy, not simply as investment.

This convergence has raised expectations across the board. Collectors want accuracy, access, and control — the same qualities they demand from other investment categories. That shift has driven the rise of platforms offering real-time data, valuation transparency, and collection tracking tools, such as MyPortfolio.

Generational divides and digital comfort

The Print Collectors’ Survey shows that digital access has reshaped every generation, not only the youngest. While 95% of collectors under 40 entered the market after 2010, half of those aged 40–49 and 45% of those aged 60–69 did too. The appeal of online access, transparent pricing, and liquidity spans all life stages.

Older collectors remain central to high-value holdings — more than 40% reported collections worth over £100,000 — but they increasingly use digital tools to manage and track them. This growing digital comfort has helped dissolve long-standing barriers between generations of collectors.

A balance of passion and pragmatism

Despite growing financial literacy, passion remains the heart of collecting. 51% of respondents said “love of the work” was very important to them, and nearly 80% placed it in their top two motivations. But passion today is informed by data. Collectors may buy with their hearts, but they monitor value with precision.

This hybrid mindset has elevated the status of prints and editions within the wider art market. Editioned works offer both creative fulfilment and measurable performance — attributes that resonate with a generation that values both emotional connection and transparency.

From passive ownership to active management

The modern print collector doesn’t simply own art; they manage portfolios. The rise of valuation technology, online trading data, and collection management platforms has made it possible to treat art ownership more strategically.

The Trading Floor exemplifies this evolution. By providing visibility into live supply and demand, it turns a previously opaque market into one that functions more like an exchange — where data drives decision-making and opportunity.

This reflects a broader cultural shift: collecting is no longer about connoisseurship alone, but about confidence. Knowledge, transparency, and comparability now define success.

A market shaped by its collectors

The Print Collectors’ Survey underscores one key truth — the print market is not slowing, it’s evolving. Growth may not always be visible in auction headlines, but it’s evident in the depth, diversity, and sophistication of its collector base.

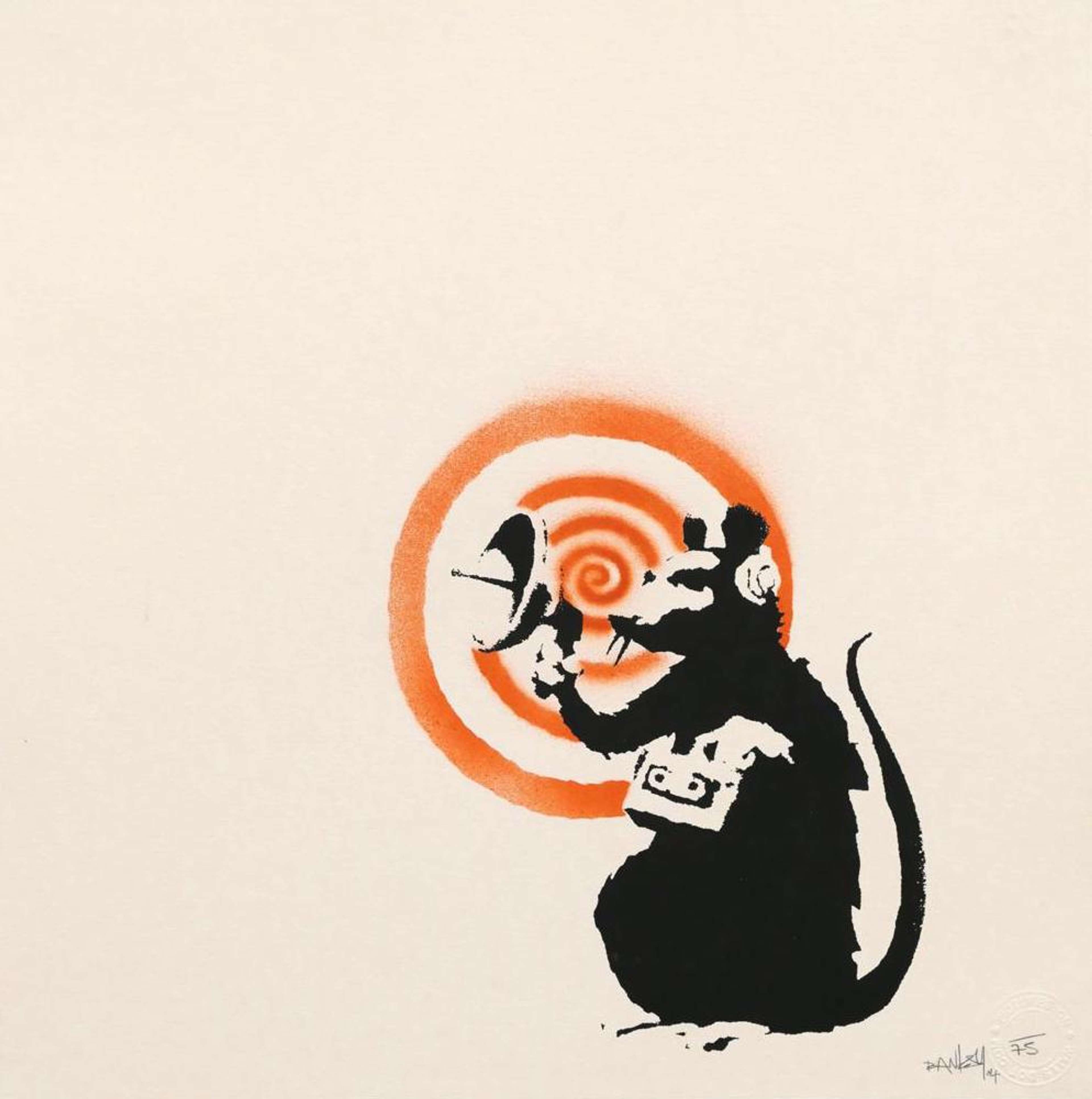

These collectors are engineers and creatives, founders and financiers. They are as comfortable with a spreadsheet as they are with a Hockney or a Banksy. Above all, they are shaping a market that mirrors their values: transparent, informed, and accessible.