From Clicks to Connoisseurship

Grapes (complete set) © Andy Warhol 1979

Grapes (complete set) © Andy Warhol 1979Live TradingFloor

We live in a paradoxical moment for collectors. Buying art has never been easier. Preserving connoisseurship has never been harder.

A generation ago, to buy a Hockney print you’d walk into Christie’s or Sotheby’s, catalogue in hand, surrounded by the world's leading specialists and register to bid at the bids office, stay for the sale. Today, with a swipe of a phone, a collector can discover a David Hockney print on Instagram, track its auction history across multiple databases, and complete the transaction online in minutes. Convenience is off the charts. The risk? Flattening expertise.

This tension, between clicks and connoisseurship, is defining the future of collecting. Technology has democratised access, but it has also created a marketplace where nuance risks being lost. For collectors, this means both unprecedented opportunity and heightened responsibility.

At MyArtBroker, we believe the future of the secondary market will belong to those who can strike the balance: embracing the scale of technology while preserving the trained eye, specialist insight, and trust that underpin long-term collecting.

Why Expertise Still Matters

Never before has information about art been so instant, abundant, and searchable. Today, more auction data is available online than a collector of 20 years ago could have dreamed of. With AI, it is now possible to mimic knowledge - to process millions of datapoints, create instant valuations, or generate synthetic “expertise.”

But the reality is that while AI can map patterns, it cannot replace judgment. The trained eye still matters. The relationship between collector and specialist still matters. And in prints - more than almost any other category - that expertise is decisive.

Prints require some of the most nuanced connoisseurship in the art market. Paper condition, edition size, printer’s marks, signature type, provenance, even seemingly small details like a watermark or embossing can dramatically shift value. An algorithm may identify the price trajectory of a Warhol screenprint, but only a specialist can tell you whether the condition is strong enough for the work to perform well in the current market.

This is not a theoretical problem. In recent years, we have seen blue-chip prints aggressively traded in retail galleries at inflated prices, with collectors later discovering that their works were worth significantly less at auction. Where connoisseurship is sidelined, trust in the market suffers.

The Rise of the New Print Collector

One of the most exciting shifts of the past decade has been the rise of a new demographic of print collectors. Millennials and Gen Z, often priced out of the original works market, are increasingly turning to editions.

For these digital-native buyers, prints are not a “stepchild” category - they are central. They offer access to blue-chip names like Hockney, Banksy, and Warhol at entry points that feel accessible. They also provide the kind of transparency and comparables that align with how younger collectors approach luxury categories like watches, wine, or handbags.

In a survey we ran on social media, Gen Z respondents described the traditional art world as “fundamentally out of touch” and “near impossible to participate in.” But when it came to prints, they saw opportunity: clear data, access to recognised names, and the possibility of both enjoyment and investment.

This trend is visible in our own collector base. Over 35% of MyArtBroker collectors are also luxury collectors. They are comfortable tracking value, comparing data, and weighing scarcity - but they also expect to be educated, not just sold to.

A Case in Point: David Hockney

Take Hockney, perhaps the quintessential modern prints artist. His works span lithographs, etchings, and iPad drawings, with edition sizes ranging from 25 to 250.

On the surface, tracking value appears straightforward. Yet each factor - from the reputation of the printer to the fragility of the paper - can significantly shift price. A pristine impression from a desirable series may command double the value of one with even light foxing.

Our in-depth Hockney market report showed just how influential these details can be. Institutional exhibitions and catalogue raisonné updates have repeatedly driven demand for specific editions. Meanwhile, collectors who bought into the right series a decade ago have seen returns that rival many asset classes.

Transparency is vital, but specialist interpretation is irreplaceable.

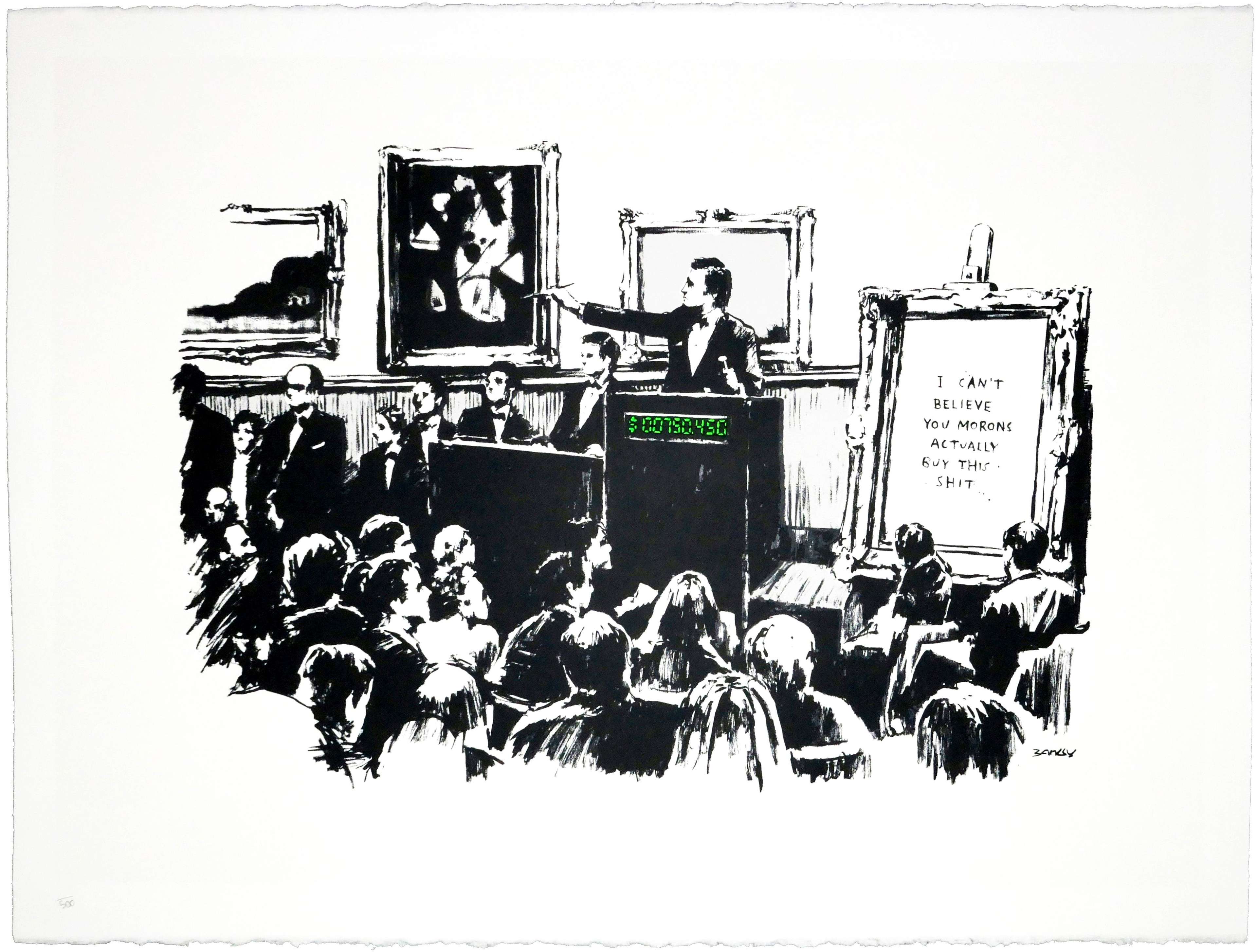

The Banksy Buyer’s Market

If Hockney represents the establishment of the print market, Banksy represents its volatility.

In July 2025, we published an investment memo arguing that Banksy prints were in a rare buyer’s market. Prices had corrected by up to 40% from the 2021 peak, largely due to macroeconomic uncertainty, a vastly over-saturated market, and speculative trading. For serious collectors, this presented an opportunity.

But timing was everything. Identifying whether a Banksy Girl with Balloon in a particular colourway was underpriced required more than scraping auction data. It required contextualising sales against broader economic conditions, interpreting edition nuances, and reading collector sentiment.

Here again, the convergence of data and connoisseurship made the difference. For collectors navigating a volatile market, having transparent valuation tools paired with a specialist advisor proved crucial.

How Technology Can Help

So how do we meet the expectations of this new generation - collectors who demand transparency, speed, and data - without sacrificing the connoisseurship that builds trust?

Our answer at MyArtBroker has been to combine cutting-edge technology with specialist oversight.

- Instant Valuation Our algorithm draws on more than 400 auction houses and 30 years of results. It processes auction sales, private sales, unsold works, edition structures, condition variants, even macroeconomic indicators. The output is closer to what a financial quant might build for a trading desk than a traditional art valuation.

- MyPortfolio Collectors can track the real-time performance of their holdings, monitor auction outcomes, and receive alerts on works in their collection. For one New York-based collector we interviewed, this kind of live portfolio tracking was essential. “I don’t need to know every sale,” he told us, “but I want to be alerted when it matters — when a comparable to one of my works sells, or when my valuation shifts.”

- Trading Floor Our private marketplace flips supply and demand to the front end of the website. Collectors can see where demand exists, and sellers can position works accordingly. Transactions are guided by specialists to ensure fair outcomes.

- MAB100 A counterpoint to inflated retail claims, our index provides a transparent benchmark for fair market value across the most actively traded prints.

Each of these tools is designed to empower collectors. But they are never standalone. Every valuation, every transaction, every interpretation is ultimately supervised by a human specialist.

The Role of AI - and Its Limits in Art Specialism

Artificial intelligence is often cast as a threat to creativity and specialism. In reality, its greatest potential in the art market lies beneath the surface: in modernising the infrastructure that underpins valuation, logistics, insurance, and marketing.

In valuations, AI helps us clean dirty data - removing bias, incomplete comparables, and market manipulation. It allows us to build smarter, faster, more transparent benchmarks. But it is always sandwiched between human judgment.

As the CEO of Convelio noted recently in The Art Newspaper, mistrust of technology is a limiting stance for a market that has already endured significant volatility. We agree. Used responsibly, AI is not a replacement for the connoisseur. It is an extension of them.

The Future Collector

The demographic shift is already underway. In 20 years, Baby Boomers - who currently make up more than half of the million-dollar-plus market - will be dead, and as such will no longer be driving sales. Millennials will dominate, with Gen Z close behind.

These collectors are growing up with AI in the way previous generations grew up with home computers. They expect to check the value of an artwork as easily as they can check the value of a stock. They want clarity, access, and education.

But they also want authenticity. They want to know that behind the data there is an expert who can help them navigate condition issues, provenance gaps, and market context.

The balance is delicate. Too much reliance on technology risks stripping away the connoisseurship that underpins trust. Too little risks leaving the next generation disengaged, turning instead to adjacent luxury markets that already speak their language of data, scarcity, and liquidity.

Why Balance Is Everything

Clicks can bring people in. But connoisseurship keeps them there.

At MyArtBroker, our mission is to build the bridge between the two. Over the past 15 years, we’ve learned that the strongest collectors are not those who buy the most works, but those who buy with confidence - confidence built on transparent data and trusted advice.

If the art market can lean into technology while remaining fanatical about expertise, we won’t just preserve the secondary market for prints. We will scale it. We will open it to a generation who grew up believing the art world was closed to them.

And in doing so, we will ensure that the next chapter of collecting is not defined by either convenience or connoisseurship alone, but by the powerful interplay between them.