The Power of Art Flexing

The Art World © The Connor Brothers 2021

The Art World © The Connor Brothers 2021

Interested in buying or selling

work?

Live TradingFloor

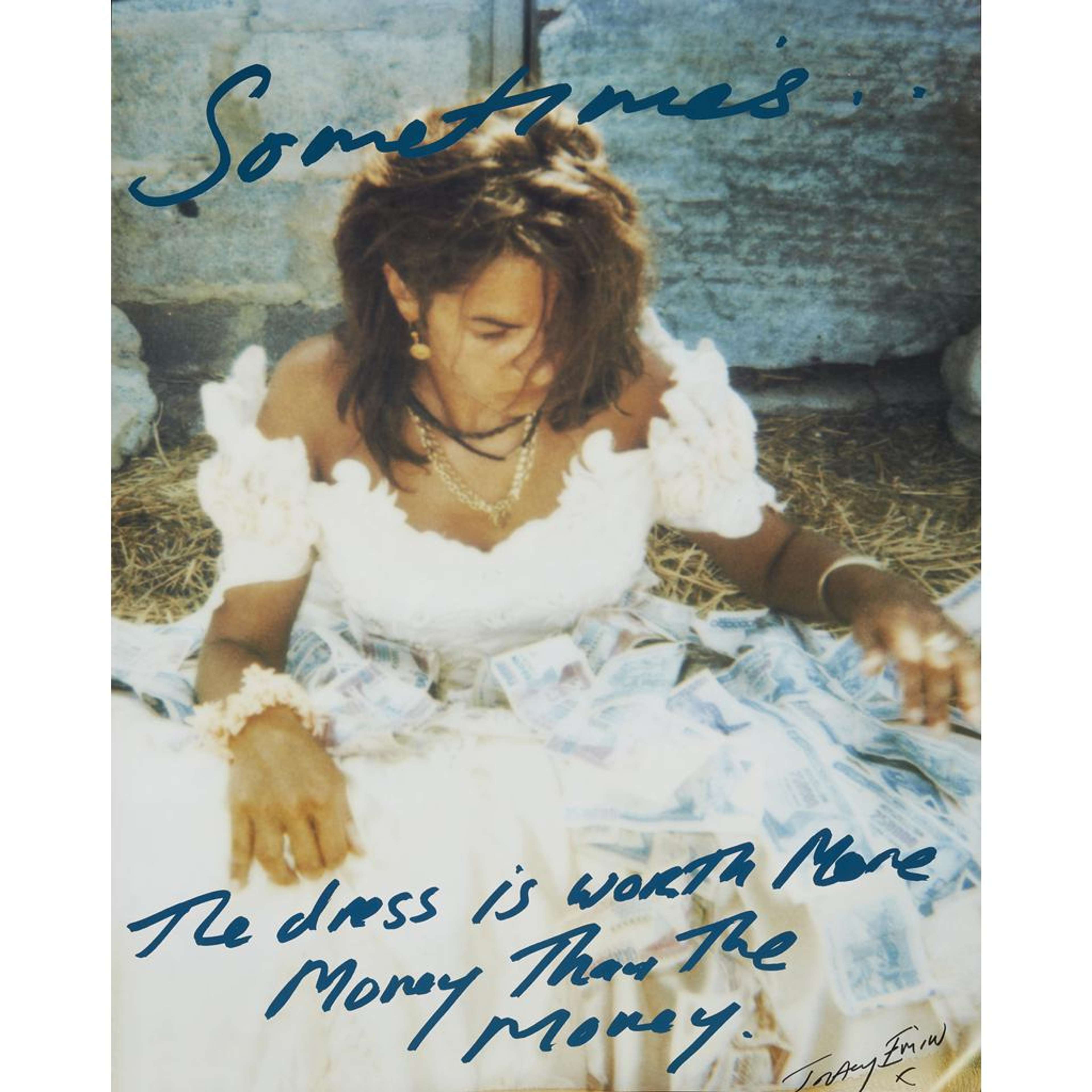

Art has long been intertwined with expressions of wealth and social status, serving as a medium through which individuals showcase their affluence and cultural capital. In recent years, a cultural phenomenon known as “art flexing” has gained traction, captivating the attention of art collectors and enthusiasts alike. This captivating intersection between art and wealth is not only a reflection of opulence, but also carries cultural implications and raises ethical concerns. As we delve into the fascinating world of art flexing, we’ll unravel the dynamics between art, luxury goods, and consumption, shedding light on the relationship between cultural status and the acquisition of fine art.

While art has a strong place in our culture as a medium for creative expression, fine art is a luxury good. Artworks can be highly valuable, and collecting them requires significant financial resources and cultural capital. Plus, art is meant to be exhibited. Often, art collections are displayed in private homes or public exhibitions, allowing collectors to showcase their wealth and status to a wide audience. This has made art a popular medium for flaunting wealth.

Today, the profound impact of social media has created new audiences for art flexing. Modern collectors can also leverage digital platforms to flaunt their prized possessions to a wider audience. From billionaire magnates showcasing their blue-chip art acquisitions on Instagram to borrowing billions against their art portfolios, extravagant displays of wealth also occupy the modern art landscape in the digital realm.

Art flexing is not solely about ostentatious displays; it also touches upon the financial aspect of art ownership. Art is increasingly viewed as a lucrative investment, with collectors considering the potential financial benefits that art can provide alongside the aesthetic and cultural value it holds.

Technology has also disrupted the finance of art ownership, with the clearest example being the rise of non-fungible tokens (NFTs) and digital assets. By challenging traditional notions of ownership, they are revolutionising art collecting and offering new avenues for artists and collectors alike.

Of course, there are some ethical concerns that surround the notion of art flexing - namely, the perpetuation of wealth inequality and the all-out commodification of art. Flaunting wealth through million-dollar art collections reinforces existing power dynamics and excludes less affluent individuals from accessing art and cultural experiences. However, the phenomenon of art flexing is not a one-sided coin. While commodification is rife, there is also an evolving landscape of art collecting that gives more space to those previously excluded from it. Women collectors and emerging artists represent a new generation of art collectors who are reshaping the art world and challenging traditional power structures.

Art flexing may be a prominent cultural phenomenon, but many remain set on appreciating and sharing art without resorting to ostentatious displays of wealth. By acknowledging the issues inherent in the intersection of art and wealth, many commentators are making way for a more nuanced dialogue: one that celebrates the intrinsic value of art while preserving its cultural significance.

The Intricate Relationship Between Art and Affluence

The connection between modern art and the rich is not a recent phenomenon. Over the years, fine art has become an integral part of the luxury lifestyle, providing a means for the wealthy to distinguish themselves and assert their social status.

One of the reasons modern art holds such allure for the wealthy is its exclusivity. Rare and highly sought-after pieces from renowned artists command astronomical prices, making them accessible only to those with substantial financial means. In this context, the ownership of a prestigious artwork becomes a tangible representation of one's wealth and cultural capital.

Plus, modern art tends to align with the evolving aesthetic tastes of affluent collectors. Innovative forms challenge traditional artistic boundaries, appealing to individuals who seek to exhibit their refined and discerning taste. The acquisition of modern art signals a level of sophistication and cultural prowess, allowing collectors to position themselves as tastemakers within elite circles.

Additionally, modern art serves as a valuable investment vehicle for the rich. The art market, with its potential for high returns, attracts wealthy individuals looking to diversify their portfolios. Blue-chip art in particular has proven to be a robust asset class, with prices soaring over time. By investing in art, collectors not only appreciate its aesthetic value but also capitalise on the potential for significant financial gain.

Art acquisitions often extend beyond the boundaries of personal enjoyment, intertwining with the spheres of fashion and lifestyle. The art world and the world of luxury goods frequently intersect, with collaborations between artists and fashion brands fetching high price points. In high society, exclusive art events and exhibitions also become glamorous social affairs, further cementing the bond between art and the wealthy elite.

The concentration of art ownership among a select few can perpetuate social inequalities, limiting access to artistic experiences and opportunities for emerging artists. Amid this backdrop, the function of art as a promoter of inclusivity and cultural diversity is at risk of becoming obsolete.

Collecting for Love or Status: What Drives Art Collectors?

The undeniable intersection of art and wealth doesn’t preclude the fact that many collectors are motivated by genuine love and appreciation for art. Certainly, for many collectors, the primary motivation behind their art acquisitions is passion, much like any other meaningful possession. Art serves as a form of personal enrichment, and the act of acquiring art is an intimate and personal journey. Plenty of collectors are driven by a genuine love for the artistic process and the desire to build a collection that reflects their unique tastes and sensibilities.

That said, the impulse of status and social recognition is rife within the art collecting realm. For its cultural, academic and symbolic value, art has long been associated with prestige. Owning valuable artwork facilitates a certain level of recognition and influence within the art world and wider society. Here, collectors are able to establish themselves as connoisseurs, patrons, or tastemakers, solidifying their position in elite circles and institutions.

Plus, the pursuit of status within the art world extends beyond mere ownership. Notable collectors are usually active participants in the art community, receiving invites to exclusive events, auctions, and exhibitions. In these settings, relationships between collectors and artists, curators, and gallery owners are able to flourish. By aligning themselves with a prominent network or acquiring significant works, these collectors reinforce their status and reputation, contributing to the overall narrative of their art collections.

Whatever their chief incentive, there’s no denying that art collectors play a crucial role in the art world's ecosystem. Their expertise and financial support are often necessary resources for the cultivation and preservation of artistic talent. In turn, this means that collectors hold significant influence over the art market. Their preferences and acquisitions shape trends, influence artists' trajectories, and impact the valuation of artworks. Both economically and culturally, the choices made by collectors have far-reaching consequences.

The Great Wealth Transfer: A Seismic Shift in Art Collecting

One of the largest transfers of wealth in history is currently underway - and the art world is experiencing it too. As older generations pass down their art holdings down to younger relatives, this shift looks set to radically change the demographics of art collecting. It promises profound implications for the art market, shaping the motivations, practices, and preferences of the next generation of collectors.

As affluent collectors age, they are faced with decisions regarding their art collections. Some will choose to sell a portion or even their entire collections, resulting in a surge of newly available artworks on the market. This influx of supply could have a knock-on effect for valuations and market dynamics, with potential ramifications for artists, galleries, and auction houses.

Simultaneously, those who have inherited art assets will form a new generation of collectors. These younger collectors bring fresh perspectives, tastes, and priorities, reshaping the landscape of art collecting. For many of these younger collectors, art is not just a reflection of wealth and status but also a means of self-expression and identity.

Equally, the value orientations of these younger collectors are markedly different to their predecessors. Younger collectors, more attuned to environmental concerns and social impact, may prioritise artworks that align with these issues. This shift could influence the demand for specific artists or themes that address pressing societal issues, perhaps even altering the conventions of the market itself.

The arrival of the digital era has also meant that younger generations are used to engaging with art in different ways. Online platforms, virtual exhibitions, and social media have expanded access to the art world, allowing collectors to discover emerging artists, connect with like-minded individuals, and engage in global conversations about art and culture. Technology has also facilitated the democratisation of art, breaking down geographical barriers and providing opportunities for underrepresented artists to gain visibility.

While the great wealth transfer presents the problem of enduring generational wealth, it may also provide an opportunity for intergenerational dialogue and collaboration. Seasoned collectors will be in a position to share their knowledge with the next generation, preserving the cultural heritage and artistic roots of iconic works. At the same time, younger collectors may bring fresh perspectives and innovative approaches that can invigorate and challenge established norms.

Image © Sotheby’s / Haircut © Ai Weiwei 2019

Image © Sotheby’s / Haircut © Ai Weiwei 2019Displays of Wealth: From Billionaires on Social Media to Borrowing Billions Against Art Collections

Art collectors have consistently found extravagant ways to showcase their wealth. Ranging from flaunting prized artworks on social media platforms to leveraging art as collateral for substantial financial transactions, the displays of affluence within the art world are certainly a spectacle.

While many have enjoyed curating images of their lives on social media, collectors have often used these platforms as virtual galleries with an unlimited audience. Billionaires and elites have been known to share images of their blue-chip artworks, private exhibitions, and exclusive art events, creating a virtual window into their lavish lifestyles. Instagram, in particular, has become a popular platform for these displays, allowing collectors to curate their image and engage with a global audience. In the digital realm, the art collection becomes a status symbol, garnering attention, followers, and reputation.

Beyond the virtual realm, collectors have also been leveraging their art collections as collateral for significant financial transactions. With art values soaring and the art market gaining traction as an investable market, wealthy individuals have turned to art-backed loans. These loans allow collectors to unlock the value of their artworks without selling them, using the art as collateral for borrowing substantial sums of money.

These art-backed loans enable collectors to access capital for various purposes, such as expanding their art portfolios, funding business ventures, or addressing liquidity needs. Beyond the obvious issue of perpetuating existing wealth structures, this practice also raises ethical concerns regarding the commodification of art. As loan collateral, it’s hard to see how art retains its cultural relevance, becoming solely a financial asset.

Add to this the increase in art transactions, which has surpassed traditional private sales and auctions. Billionaires and collectors have been known to engage in multi-million dollar art deals, often conducted behind closed doors. These dealings not only consolidate the financial status of the individuals involved but also contribute to the inflation of art prices on the open market.

While displays of wealth in the art world are not new, the advent of social media and the increasingly intertwined relationship between art and finance have amplified their visibility. These displays raise important questions about the cultural and economic implications of art flexing.

The Financial Case for Art: Exploring Art as a Financial Asset

For high-net-worth individuals, art is a compelling alternative investment. Major banks and investment funds have validated the potential for art to generate significant returns, serving to diversify traditional investment portfolios. As a result, art has emerged as a unique alternative asset class that offers both financial and aesthetic rewards.

One of the key advantages of art as a financial asset lies in its potential for long-term appreciation. Over the years, certain artworks, particularly those by blue-chip artists, have experienced substantial value growth. The promise of a sound investment has attracted collectors who see art as an opportunity for capital appreciation and wealth preservation.

Additionally, art ownership offers something that traditional financial assets do not: tangibility and personal enjoyment. Unlike stocks or bonds, art can take on a personal and emotive role in the owner's life. This dual nature of art as both an investment and a source of aesthetic pleasure sets it apart from other financial assets.

That said, the art market can also be subject to fluctuations and speculative trends. Art valuation can be subjective, influenced by factors such as an artist's reputation, market demand, and critical acclaim. As a tangible asset, art also requires storage, insurance, and maintenance costs, carrying liabilities of damage, deterioration, and theft. Insuring valuable art collections against these risks is crucial, adding another layer of expense to the ownership investment avenue.

NFTs and the Future of Art Collecting

Complicating the financial aspect of art ownership is the emergence of non-fungible tokens (NFTs). Made possible by advances in financial technology, NFTs have sparked a significant shift in the art world, offering new possibilities for artists, collectors, and the concept of ownership itself.

NFTs are unique digital assets that use blockchain technology to certify authenticity and establish ownership of digital creations, such as artwork, music, and videos. For artists, they have opened up a world of opportunities, enabling them to trademark and monetise their digital works in a global market. Sold as limited edition digital pieces, an NFT grants buyers exclusive ownership rights. This has revolutionised the way art is bought, sold, and collected, as they provide a secure and transparent method of proving ownership and provenance.

NFTs present an interesting twist in the narrative of art flexing. While not as easy to exhibit, NFTs offer the chance to diversify their art portfolios as they acquire and trade digital artworks. In a realm that blurs the boundaries between art, technology, and culture, NFTs also provide collectors with verifiable ownership and the ability to track the history of ownership transfers. This can be a source of value since it adds additional layers of security and authenticity.

By popularising an open and transparent market, NFTs are undeniably shaping the future of art collecting. Blockchain makes it much harder for NFTs to be dealt with in closed circles. For emerging artists, the NFT marketplace is somewhere they can gain recognition and establish value for their digital creations.

As technology continues to advance, it is likely that NFTs will evolve and expand further, influencing the way we perceive and consume art. The impact of NFTs on traditional art forms, the art market, and the concept of ownership will continue to unfold, presenting both opportunities and challenges for collectors and the broader art community.

Next-Gen Collectors: Women and Emerging Artists Shaping the Art World

The art world is undergoing a transformative shift as a new generation of collectors comes to the fore. These next-gen collectors, which include an increased number of women, are reshaping the dynamics of the art market.

Women, in particular, have played a pivotal role in shaping the art world as advocates for emerging artists. Historically underrepresented in the art market, women are now asserting their influence and making significant contributions as both collectors and patrons. Their involvement has brought fresh perspectives, diverse tastes, and increased support for female artists and artists from marginalised communities.

Emerging artists are championed by the new generation of collectors in general. Reflecting the realities and experiences of their time, these collectors seek out artists who push boundaries, challenge conventions, and offer fresh perspectives. Among this incoming audience, the cultural capital and social relevance that emerging artists bring to the art world cannot be understated.

As women and emerging artists continue to shape the art world, their impact will transcend the transactional aspects of art collecting. By influencing the art market, driving demand for contemporary art, and challenging conventional notions of prestige and value, the phenomenon of art flexing may become less prolific. While the influence of art collectors is unshakeable, the role of the collector may evolve into one that provides avenues for artists to develop their practice and make meaningful contributions to the cultural fabric of society.

Conscientious Collecting: The Art of Flexing Without Flaunting

The relationship between art and wealth is long established, but new developments in the world of collecting hold promise of dismantling a rigid system. From the relationship between art and wealth to the influence of social media and the rise of NFTs, the art world is witnessing a significant shift in how collectors showcase their affluence.

As collectors seek to appreciate and share their art without appearing ostentatious, there are certainly ways to engage in the art world with subtlety and cultural sensitivity. Primarily, this has to do with seeing past the financial basis of art trading. Collectors can look to the intrinsic value of artworks as well as the financial value by engaging with artists, attending exhibitions, and supporting emerging artists as well as established ones.

As key facilitators of artistic production, art collectors have an important role and a broad sphere of influence. Collectors can also engage in philanthropic initiatives that support art education, preservation, and accessibility. By investing in programs that provide opportunities for underrepresented artists and communities, collectors can help to offset some of the inequalities generated by the expense and elitism of the art world.

This also extends to the public consumption of art. Art flexing is often intertwined with exclusivity, where huge private collections only perpetuate the issue of accessibility. Collectors have been known to partner with institutions to encourage public engagement with art, loaning artworks for exhibitions or even donating them to permanent collections.

When it comes to collecting art, not all flexing is flaunting. Art collectors can appreciate and share their collections while fostering a more inclusive and vibrant community. Seeing past the financial appeal of art gives collectors a stake in something much bigger: the ability of art to inspire, challenge, and unite us.