The Competitive Nature Of Art Flexing

Girl With Lobster © Jeff Koons 2014

Girl With Lobster © Jeff Koons 2014Live TradingFloor

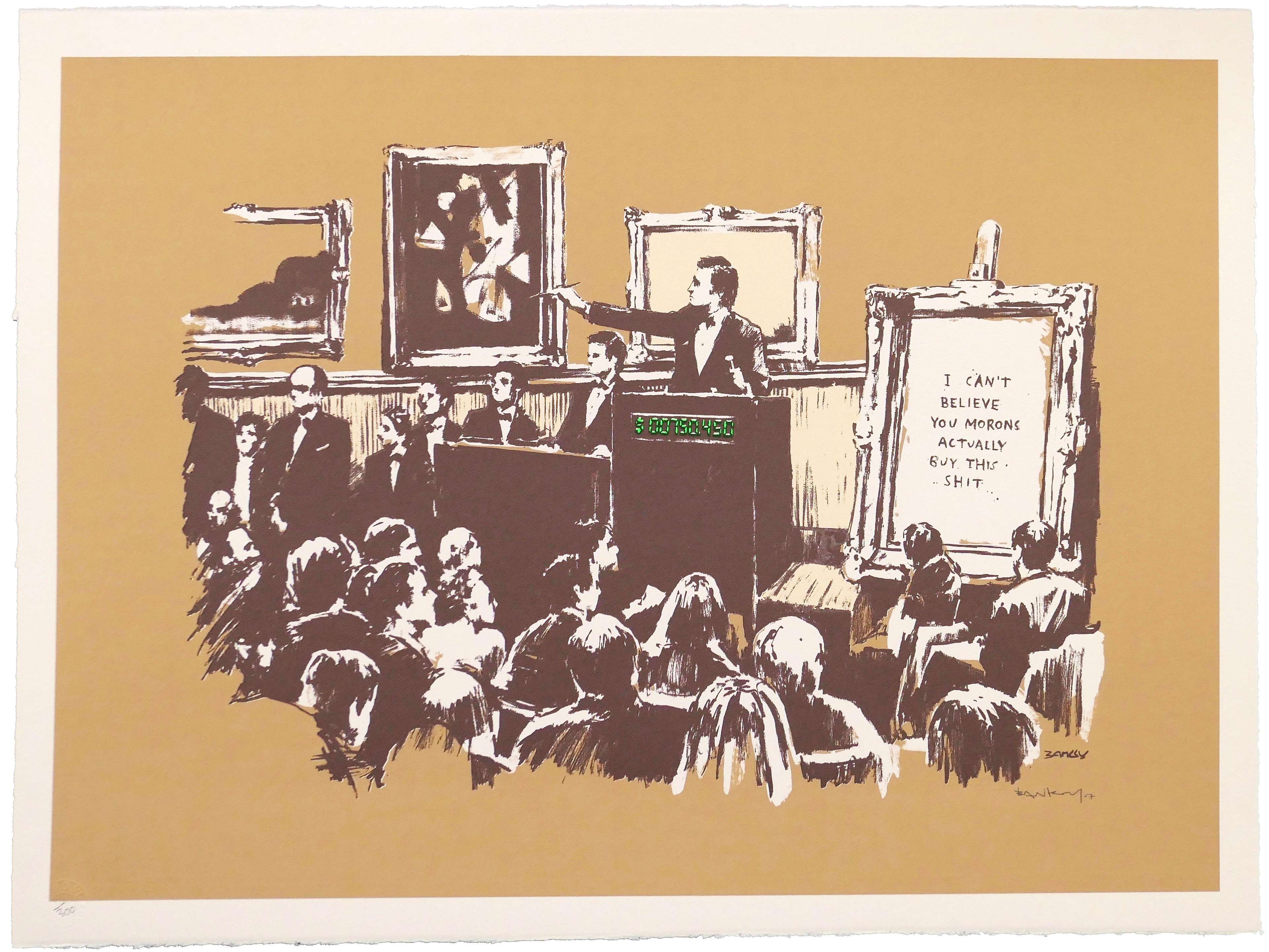

Auctions aren’t just marketplaces; they’re stages, a performance designed to manufacture urgency. That urgency feeds a modern instinct: to flex. In the art world, flexing is a public signal that you can outspend the room. Today, that impulse spills beyond paintings and into the broader ecosystem of prestige collectibles: watches, trainers, vinyls, even plush toys (yes, Labubu). The point isn’t merely ownership. It’s spectacle, scarcity and the hit of being seen to win.

The Art of Auctions: How Auction Houses Create Drama and Frenzy

Auction houses like Sotheby’s and Christie’s are masterful producers of theatre. Lot order, set estimates, impeccably timed pauses, and a room seeded with bidders all serve one goal: accelerate competition. Catalogues frame works as destiny rather than inventory; the saleroom (and livestream) supplies the chorus. The result is not just price discovery but momentum creation — each bid a public signal that inflates appetite.

In a market now wired for real-time optics, that theatre travels across categories. Blue-chip canvases share oxygen with “hot” editions and culturally loaded collectibles. The houses still set benchmarks, shape trends and police provenance — but they also bottle excitement. Done well, the spectacle elevates artists and artworks; done carelessly, it burns them. Either way, it’s consequential. Which is why art advisory still matters: decoding comps, separating depth of demand from one-night heroics, and keeping clients out of performative bidding wars disguised as destiny.

Feeds The Frenzy: How Hype Becomes a Comparable

Flexing relies on visibility, scarcity and speed. Make something hard to get, release it fast, offer variants, and let hyper-online communities amplify it. People want it because everyone else wants it. When pieces like this hit auction, the hype turns into a public price. That makes sellers look smart, but it’s riskier for buyers: you might be paying mainly for a story that fades quickly. Flexing needs an audience. If the crowd loses interest, the flex loses power — and prices follow.

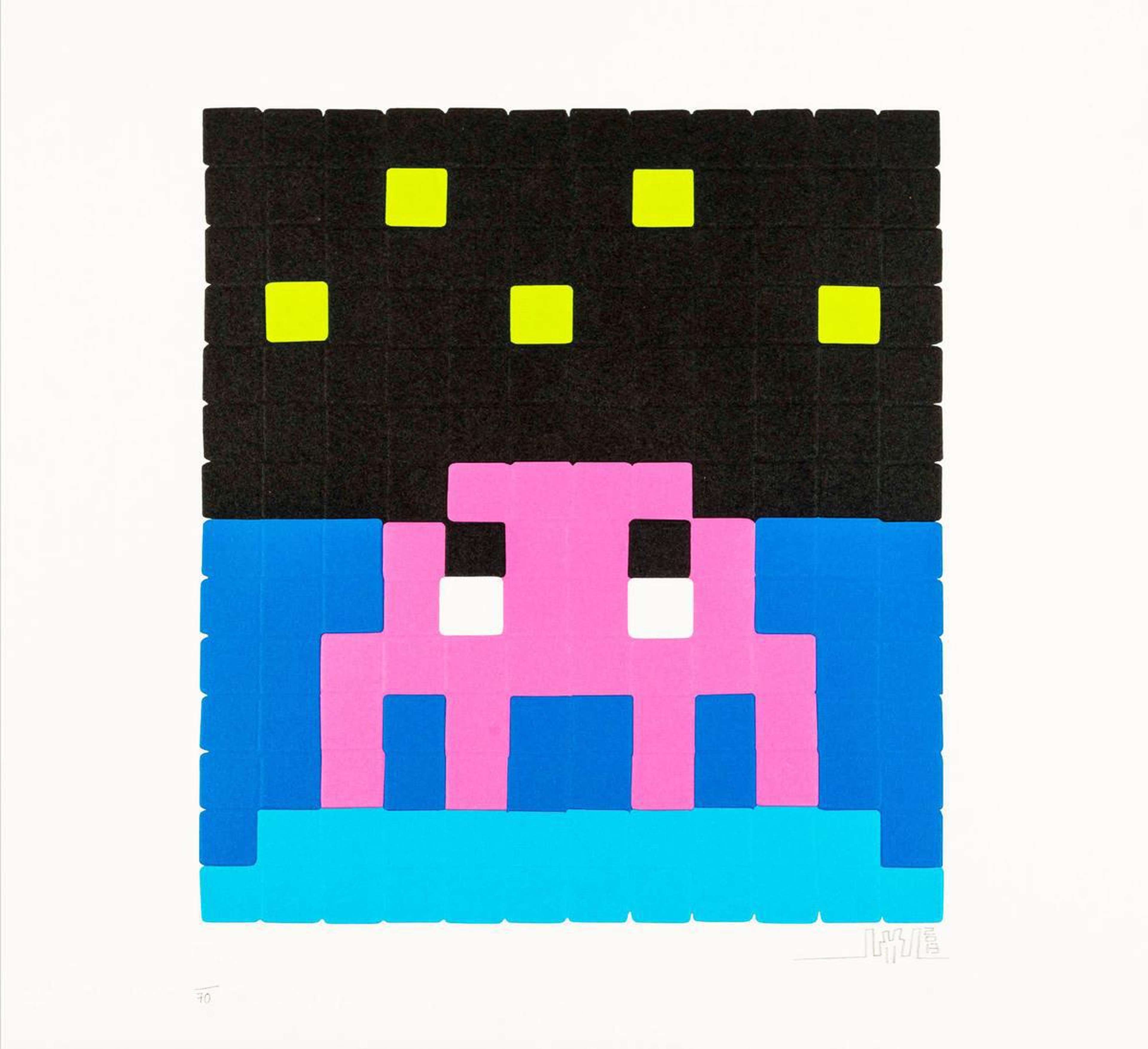

Flexing Meets Collectibles

The same tricks that drive a seven-figure painting also drive “blind-box” toys. Make something hard to get, release it fast, offer lots of small variations, and let online communities hype it. People start wanting it because everyone else wants it. Labubu is the poster child for this. It’s cute, limited, and instantly recognisable — so it becomes a status token.

The Collaboration between Auction Houses and Galleries

In the art world, the collaboration between auction houses and galleries is a common theme. This partnership creates a dynamic ecosystem where artworks are showcased, promoted, and ultimately find their way into the hands of collectors.

Auction houses and galleries work symbiotically. Galleries serve as the initial platform for artists, nurturing their talent, and introducing their work to the public. Often offering programmes and support to emerging artists, these spaces provide a nurturing environment where artists can develop their style and gain recognition. By hosting exhibitions and representing artists, galleries play a crucial role in establishing their reputation and market presence.

Once an artist has an established audience, auction houses work to catalyse the sale of artworks. Auction houses curate specialised sales and auctions that generate excitement and competition, propelling the value of artworks to new heights. Partnerships between auction houses and galleries allow for a seamless transition from gallery representation to the auction stage, expanding an artist's exposure and potential market.

Successful collaborations between auction houses and galleries have had a profound impact on the art market. For instance, in 2022 Phillips mounted an exhibition called “New Romantics” at Seoul’s Lee Eugean Gallery. The show coincided with Frieze Seoul and KIAF, leading to a major sale at Phillips Hong Kong two weeks later.

Notable partnerships have resulted in groundbreaking sales, record-breaking prices, and increased visibility for artists. By working together, auction houses and galleries ensure a steady supply of artwork so that the art market continues to flourish.

Extraordinary People © The Connor Brothers 2020

Extraordinary People © The Connor Brothers 2020Private Auctions: Behind Closed Doors

Beyond the spectacle and grandeur of auction houses, there is another set of art transactions that takes place away from the limelight: private auctions. These exclusive events offer a different approach to buying and selling artworks, providing a more intimate and discreet setting for collectors and investors.

Private auctions take place behind closed doors, often in elegant galleries, prestigious residences, or confidential venues. The guest lists are carefully curated, comprising a select group of collectors, art enthusiasts, and industry insiders. This exclusivity adds an air of secrecy and allure to the proceedings, attracting individuals with reputations in art collector circles.

Private auctions also offer something auction houses do not: the opportunity for in-depth discussions and negotiations. In this intimate setting, participants have direct access to the artwork, allowing them to closely examine the pieces they are interested in. The absence of a larger audience can create a more relaxed atmosphere, fostering more considered bargaining and personal connections between buyers and sellers.

For the high-end art collector, there is also a level of discretion at private auctions. Participants can discreetly acquire or sell artworks without the public scrutiny often associated with public auctions. This confidentiality allows for strategic acquisitions, particularly when building a private collection or exploring investment opportunities.

That said, the market impact of private auctions is disputed. While some insist that private auctions feed into the overall health of the market, there is an issue with transparency in the private setting. The secrecy around inner circle dealings tends to mean exact figures don’t reach the open market, which can affect fair competition at general auctions.

On top of that, private auctions compound the art world’s issue with exclusivity and barriers to access. Invite-only events tend to draw in the art-collecting elite, which equates the process of buying art with a luxury-level price tag.

Certainly, notable private auctions throughout history have seen exceptional artworks change hands, often at staggering prices. In 2020, Sotheby’s sold a nine-foot-tall Alberto Giacometti sculpture in a secret bid where the starting price was $90 million.

While public auctions attract attention and generate excitement, private auctions offer a different experience for those seeking exclusivity, confidentiality, and a more personalised approach to acquiring or selling artworks. Away from the frenzied bargaining that takes place at public auctions, art flexing isn’t as relevant—but these private sales do come at the cost of exclusivity and expense. The art market accommodates both realms, catering to the diverse preferences and requirements of collectors and investors.

How Art Auctions Shape Artists’ Careers and The Art Market

As one of the key marketplaces for artwork, auctions have a profound impact on artists and the broader art market. The outcomes of auctions can significantly shape an artist's reputation, career trajectory, and overall perception of their work.

When an artist's artwork achieves high prices at auction, it often garners attention and raises their profile in the art world, attracting the interest of collectors, galleries, and institutions. The buzz generated from auction successes can propel an artist's career to new heights, opening doors to prestigious exhibitions, commissions, and collaborations.

Conversely, the disappointment of an artwork failing to meet expectations at auction can have repercussions. Known as 'burned' artwork, it may create a perception of decreased market interest or devalue an artist's body of work. Artists must navigate the competitive nature of auctions and carefully consider the timing and presentation of their artworks to ensure optimal results.

Auctions also play a crucial role in shaping the broader art market. The prices achieved at auctions, especially for blue-chip and highly sought-after artworks, establish benchmarks that influence the valuation of similar pieces. Auctions serve as a barometer of the art world, reflecting its ever-evolving dynamics and the shifting tastes and preferences of collectors.

The results can spark trends, drive prices upward, and create a sense of urgency among collectors and investors.

The Pandemic Effect

Of course, the art market doesn’t exist in a vacuum. Like many other industries, it experienced significant disruptions during to the global pandemic. As a historically in-person format, auction houses had to quickly adapt to the new realities and find innovative ways to continue their operations.

One of the most notable impacts of this was the shift to online platforms. With in-person gatherings and events restricted, auction houses rapidly expanded their digital presence, hosting virtual auctions and implementing robust online bidding systems. This transition allowed bidders from around the world to participate remotely, broadening the reach and accessibility of auctions.

The increased reliance on online platforms presents both challenges and opportunities. Namely, auction houses have had to invest in secure technology to facilitate smooth online bidding processes. Now competing with other online marketplaces, auction houses have also had to enhance their digital marketing efforts to engage potential buyers in a crowded digital space.

Despite the challenges, the art market demonstrated resilience during the pandemic, with online sales surging in various sectors. Auction houses embraced the digital shift and found creative ways to replicate the excitement and drama of live auctions through virtual experiences. Through technologies such as live streaming, interactive bidding, and virtual exhibitions, auction houses managed to provide a rich and immersive environment for collectors.

A new focus on flexibility has permeated other areas of auction house operations. The pandemic prompted increased support for clients, with some houses implementing extended payment terms as well as enhanced shipping and logistics services. In place of experts at the scene, many auction houses provided virtual consultations to facilitate smooth transactions in a time of uncertainty.

As the art market continues to recover and adapt to the changing landscape, the lessons learned during the pandemic are likely to shape the future of auctions. The digital advancements and online presence established during this time are expected to remain integral to the auction house model, offering a blend of in-person and virtual experiences to cater to a diverse range of collectors and investors.

Fundamentally, the pandemic served to prove the continuing relevance of a traditional institution. Auction houses have proven their resilience and adaptability, and their continued evolution will undoubtedly contribute to the growth and accessibility of the art world in the post-pandemic era.

Navigating the Art Auction World: Insights and Tips from MyArtBroker

Buying or selling in today’s market shouldn’t feel opaque. At MyArtBroker, we specialise exclusively in prints and editions and combine real specialists with market data to give you clear, fair-value decisions at every step. It’s tech-driven, human-first support: real-time valuations, personalised advice, and a streamlined route to sale or acquisition that puts you in control.

Get an Instant Valuation for your print in real time, then choose how to proceed. We operate on 0% seller’s fees, transparent terms and end-to-end handling — valuation, marketing, negotiation, logistics, secure payment — so you know your net before you commit. For buyers, our prints-and-editions focus means pricing against real market data and nuance - series context, paper, colourways.

When timing matters, we’ll steer you between auction and private sale. Auctions bring theatre and speed but also calendars, fees and public risk; private sale prioritises control, targeted matching and discretion — and in prints, it often matches or beats auction outcomes without the overheads. MyPortfolio ties it together: track values live, benchmark against thousands of data points and act at the right moment — with a specialist on hand to turn data into decisions.