A Seller’s Guide To David Hockney

Market Reports

Key Takeaways

How to Sell a David Hockney Print in 2025

- Confirm edition type (artist’s proof, trial proof, standard edition) and verify publisher and signature details

- Identify whether your print sits in a benchmark series (Arrival of Spring, Moving Focus, Swimming Pools) or a higher-liquidity tier

- Review recent David Hockney auction results and print prices within your exact series

- Assess print condition carefully – margins, fading, and restoration history directly affect value

- Align route to market (auction vs private sale) with rarity, demand depth, and seller fees

David Hockney print value reached record levels in 2025, with total sales exceeding £15.9 million – up 169% year-on-year. Demand remains concentrated around key series such as The Arrival of Spring, Moving Focus, and Swimming Pools, while proof works and complete sets continue to command premiums.

How Much Is My David Hockney Print Worth in 2025?

Hockney print value in 2025 varies significantly by series, edition type, and recent auction performance. While total market sales reached record levels, individual print prices differ depending on whether a work sits within a benchmark series or within the more actively traded liquidity tier of his market.

For sellers, this means headline market growth does not automatically translate into record pricing for every print. Valuation depends on where your specific work sits within its series hierarchy and how recently comparable impressions have traded.

Before seeking a valuation, sellers should identify:

- Series

- Edition type (standard edition, artist’s proof, trial proof)

- Recent comparable auction results

- Condition and documentation

David Hockney Arrival of Spring Print Value After the 2025 Sotheby’s Sale

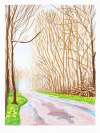

The most visible pricing shift occurred within The Arrival of Spring, where Sotheby’s dedicated white-glove sale established new six-figure benchmarks. However, those results were driven by a rare combination of matching edition numbers, timing, and provenance.

For sellers, it is important to note that Arrival of Spring includes more than 60 individual compositions, and value is not uniform across the series. Works that are fresh to market tend to attract stronger demand, particularly when they have not traded recently.

Certain compositions and colour balances are also more sought after. Impressions with distinctive pathways, roadway elements, or strong reflections in water puddles have historically performed well.

In practice, valuation depends on the specific image, condition, and recent comparables – not solely on the headline results achieved at auction.

David Hockney Moving Focus Print Value

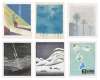

Moving Focus is Hockney’s largest print collection and represents a distinct creative period of the 1980s, centred on perspective – expressed through interiors, architectural exteriors, and stylised portraits. This cohesion within variety supports sustained demand across the series.

Average values for Moving Focus prints increased by 7% in 2025, with several individual works resetting benchmarks. Hotel Acatlán: Second Day achieved a new record, while An Image of Celia – offered as a printer’s proof – also set a fresh high. Tyler Dining Room similarly reached a record result.

The value of Hockney’s Moving Focus prints is strongest where composition, scarcity, and condition align. While the series offers breadth, standout impressions – particularly proofs or visually distinctive works – tend to outperform standard editions.

David Hockney Swimming Pools Print Value

By comparison, Hockney Swimming Pool print value remains anchored by its status as the artist’s most iconic and sought-after motif. The category is highly liquid, but pricing is shaped by condition and collector colour preference across multiple variants – which allows lateral movement between comparable pool compositions rather than a single upward price track.

Because Swimming Pools sit within a deeper liquidity tier, results are more sensitive to competing supply and positioning. Strong condition, clean margins, and visually preferred colourways consistently achieve stronger outcomes.

Artist’s Proof and Trial Proof Value in David Hockney Prints

Proofs and complete sets remain rare across Hockney’s print output. Trial proofs, printer’s proofs, and full portfolios can command premiums, but their infrequency means comparable data may be limited. When they do appear, outcomes are often determined by specialist placement rather than broad exposure.

Edition size, proof designation, and documentation can significantly influence valuation, particularly at higher price points.

Is Now A Good Time To Sell A David Hockney Print?

The current market represents a favourable moment for sellers of Hockney prints. The Hockney print market delivered record total sales value, with first-half trading more than doubling 2024 levels. Demand remains concentrated in established series, but pricing strength is increasingly shaped by positioning, condition, and edition structure rather.

Institutional visibility is also reinforcing confidence. Recent high-profile moments – including the LVMH-curated presentation, the forthcoming Serpentine exhibition, and Hockney’s planned painted window intervention at Turner Contemporary reflecting a sunset landscape – keep him firmly in the cultural spotlight. These projects sustain attention around his landscape-based and digital works, including the iPad drawings that underpin series such as The Arrival of Spring.

For sellers, this combination of strong market performance and sustained institutional presence supports active demand. Well-presented works within recognised series remain attractive to buyers, though disciplined pricing and route-to-market decisions are still central to achieving optimal results.

How to Authenticate a David Hockney Print Before Selling

Authenticity in Hockney’s print market is established through recognised market standards rather than formal certification. Unlike some artists, Hockney’s works are not typically accompanied by certificates of authenticity, and their absence does not undermine value. Buyers instead assess provenance, edition structure, and documented production history.

The David Hockney Foundation

The David Hockney Foundation maintains an extensive archive and supports scholarship, but it does not issue certificates. A comprehensive catalogue raisonné is currently in preparation and will formalise reference material for the artist’s editions once published. Until then, authentication rests on established documentation and market-recognised publishing history.

Verifying provenance in Hockney prints is done through identifying gallery representation. Works acquired through long-standing representatives such as L.A. Louver, Annely Juda Fine Art, or Galerie Lelong carry significant weight. Edition details – including signature, numbering, and publisher blind stamps from workshops such as Gemini G.E.L., Petersburg Press, Editions Alecto, and Tyler Graphics – provide further confidence. For higher-value prints, particularly proofs or complete sets, clear documentation becomes increasingly important, as comparable data may be limited and scrutiny correspondingly higher.

Ensuring that a print’s edition status and provenance are accurately understood before entering the market reduces uncertainty and protects value, particularly at the upper tiers of Hockney’s print market.

David Hockney Print Condition and Conservation

Condition plays a meaningful role in the resale value of a Hockney print, but it must be assessed in context. Hockney’s printmaking spans traditional lithography and etching through to digital and experimental processes, meaning that variations in paper tone, surface texture, or minor undulation are often inherent to the work rather than defects. For a broader overview of how condition affects pricing across editions, see our guide to art print condition and restoration.

The greatest risk to value typically arises from over-intervention. Trimming margins, aggressive cleaning, or undocumented restoration can materially reduce desirability, particularly for works from established series. Where condition issues are present – such as foxing, fading, or paper instability – conservation should be undertaken only with specialist advice and full documentation.

Stable, well-preserved works consistently achieve stronger outcomes, but originality is often more important than cosmetic perfection. Protecting margins, avoiding prolonged light exposure, and maintaining appropriate storage conditions remain the most effective long-term safeguards.

Where Can I Sell My David Hockney Print In 2025?

Choosing where to sell a Hockney print can materially affect net outcome. In a structured market such as Hockney’s, pricing, timing, visibility, and fee structure all influence final results. Sellers typically consider auction, private sale, or gallery placement – each operating with different levels of risk, control, and cost.

Should I Sell My David Hockney Print At Auction Or Private Sale?

Auction provides public visibility and the potential for competitive bidding, particularly for rare or highly recognisable Hockney prints. However, published estimates, recorded buy-ins, fixed sale dates, and seller commission all affect net outcome. Buyer’s premiums and public underperformance can also influence market perception.

Private sale offers discretion, pricing control, and targeted buyer engagement. Works are introduced directly to qualified collectors rather than exposed to open bidding. This approach is often effective for Hockney prints within established liquidity tiers, where depth of demand exists but public volatility is unnecessary. Without published estimates or recorded buy-ins, pricing remains flexible and outcome-focused.

For a detailed breakdown of how auction fees, seller commission, and pricing control differ across routes, see our guide to auction vs private sale for art prints.

Why Sell Your David Hockney Print with MyArtBroker

Selling a Hockney print requires accurate valuation, controlled placement, and access to qualified buyers. As a specialist platform for blue chip prints, we combine Instant Valuation technology with expert-led analysis to provide data-driven Hockney print valuations grounded in live auction results and private sale demand. This structured approach supports informed pricing and targeted private sale placement designed to maximise net outcome.

Specialist David Hockney Print Valuation

Each print is assessed individually using live market data, recent auction results, and private sale comparables. Series position, edition type (standard, artist’s proof, trial proof), condition, and trading frequency are evaluated before route to market is recommended. Sellers can also track real-time demand signals and comparable listings through our Trading Floor, where active buyer interest for Hockney prints is visible.

For collectors managing multiple works, MyPortfolio provides ongoing visibility into print value trends, auction results, and collection-level performance, supporting informed timing decisions before sale.

Private Sale Model with 0% Seller’s Fees

We specialise in private sale placement and charge 0% seller’s fees. Unlike auction houses, there are no public estimates, no recorded buy-ins, and no seller commission deducted from the final price. This structure protects pricing control while ensuring that agreed results reflect the seller’s net return rather than headline optics.

Targeted Global Buyer Network

With an international network of active collectors, institutions, and repeat buyers, works are introduced directly to relevant demand rather than exposed indiscriminately. This targeted approach is particularly effective in the Hockney print market, where series positioning and buyer familiarity materially influence outcome.

If a print is better suited to auction or alternative placement, we provide impartial guidance based on current supply and demand conditions.