Artists To Watch: The Contemporary Print Market in 2022

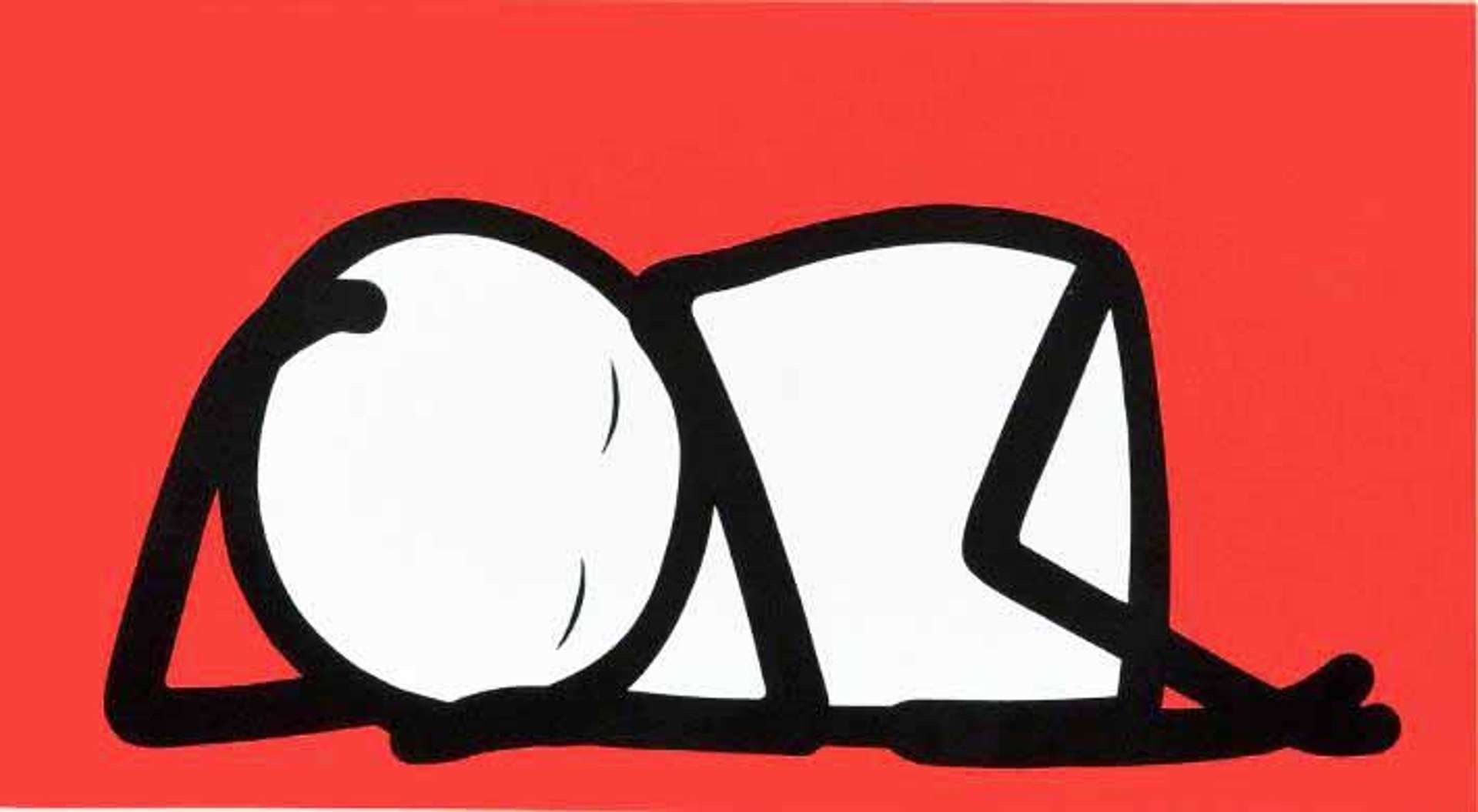

Sleeping Baby (red) © Stik 2015

Sleeping Baby (red) © Stik 2015Market Reports

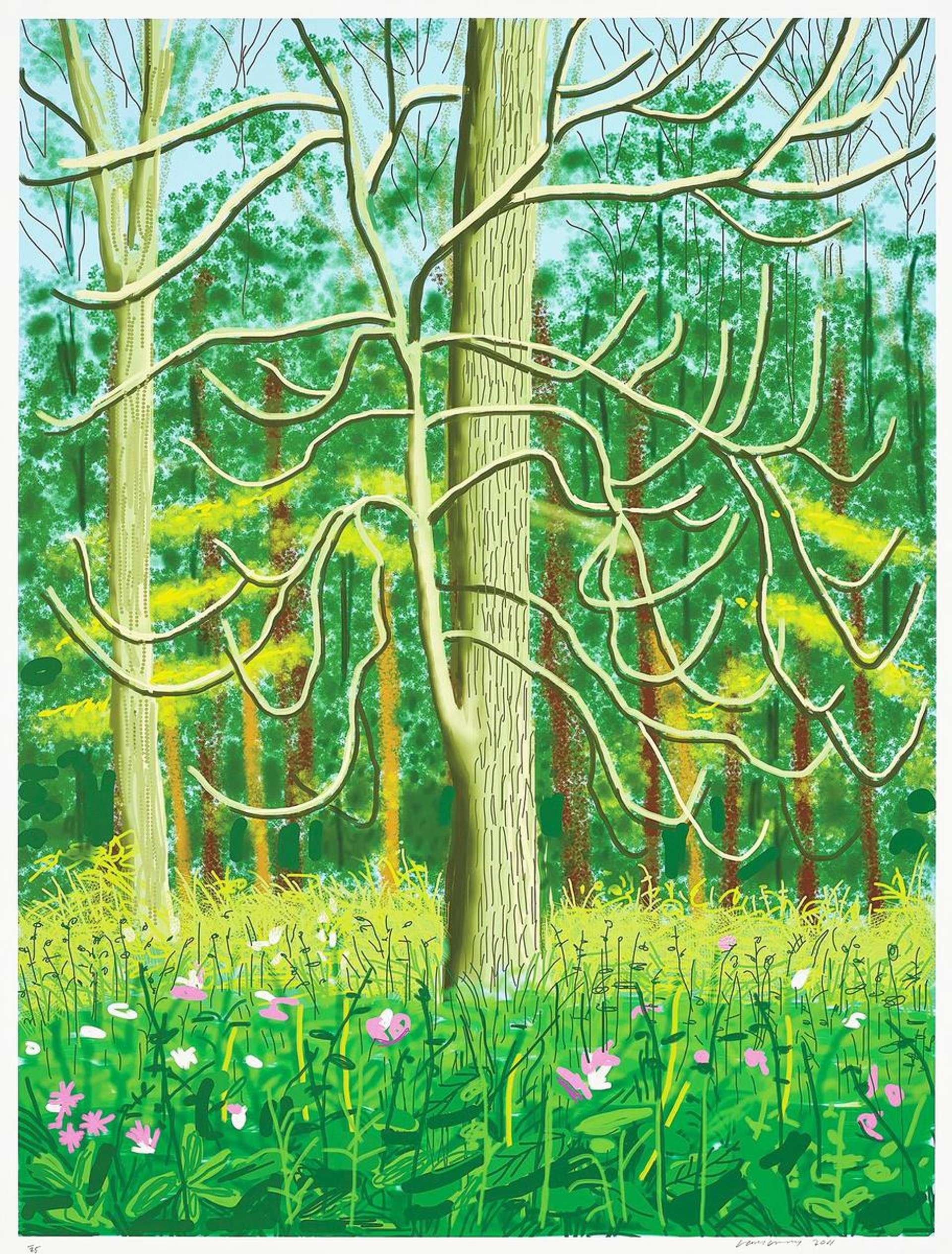

In 2022, the likes of Banksy, David Hockney and Damien Hirst have continued to dominate the contemporary print market in terms of profit, price, and value increases.

Yet despite their unwavering hold over buyers, sellers, and auction houses the world over, these three titans of contemporary art have some hotly-tipped talents on their tails.

Who are these ever-emerging artists on the market? Street artists STIK and Invader, and typographic wit, Harland Miller.

Another deep dive into the complexities of the contemporary art market, this article takes a look at three artists to watch for 2022.

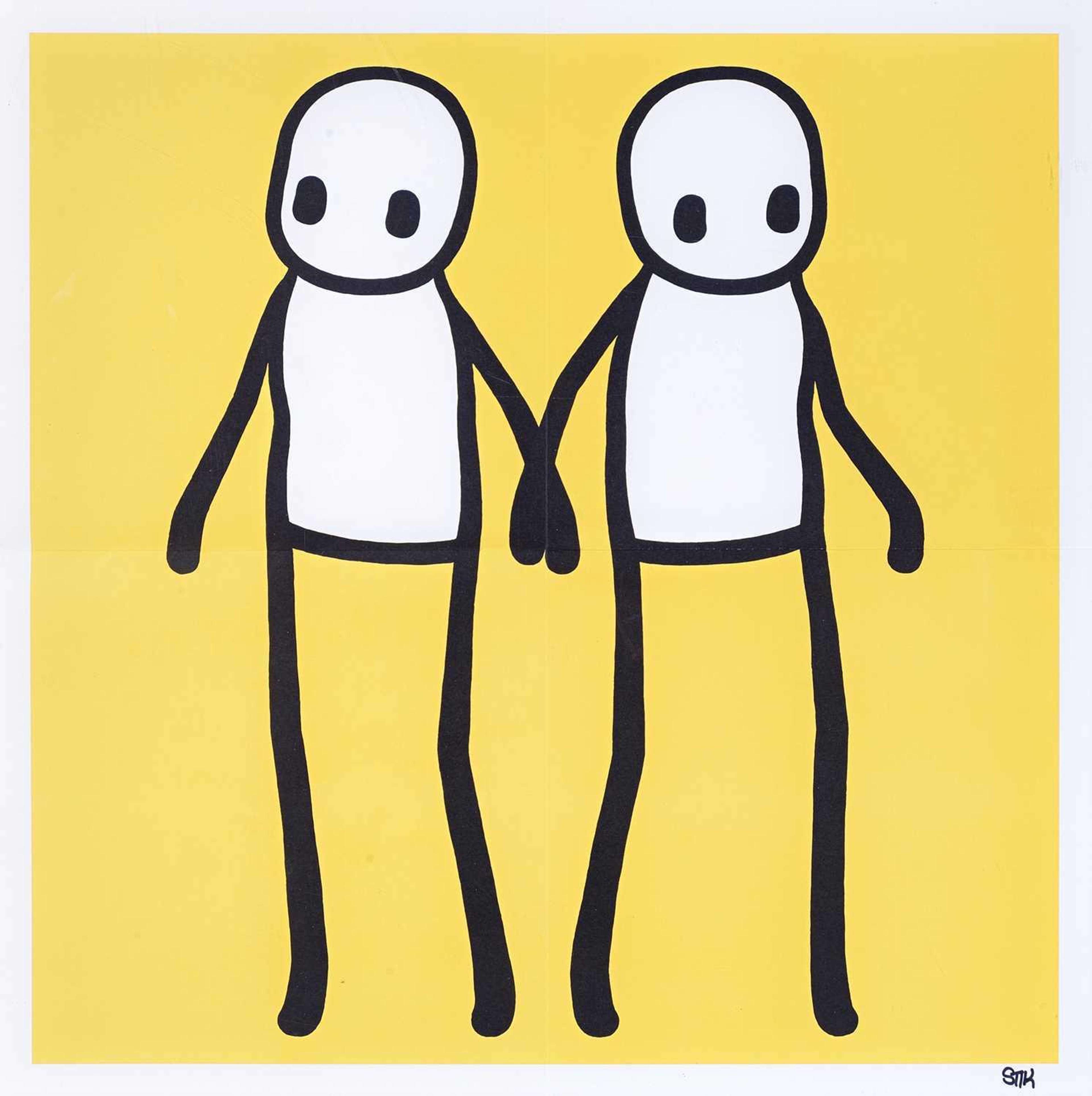

STIK

From the Streets of Hackney to Christie's

Once part of a large group of innovative young artists peppering the streets of London's East End with their graffiti-like creations, which they used to protest against rapid urban development and gentrification, STIK has been active since 2001.

Over 20 years later, London-based STIK is one of 2 contemporary street artists capturing the attentions of the commercial art market and art world right now.

Experiencing renewed interest in his work since 2020 - when 42% more of his artworks were offered at auction than in the previous year - STIK is famed for his bold stick-figures and use of block colour backgrounds.

These motifs started off as part of the artist's in situ graffiti murals but which now feature in his readily available, limited edition prints.

Painted in 2014, Big Mother - a 125-foot-long mural featuring two of his stick-figures - onto the side of the Charles Hocking council estate in Acton, West London - is one of STIK's best-known works.

Like many of his creations, the piece explored bold narratives of urban resistance and solidarity, and mounted a critique of gentrification, urban exclusion and displacement.

Making a bold entrance into the contemporary art market in recent years (in September 2020, the maquette for a STIK sculpture entitled Holding Hands realised £287,500 at auction), proceeds from the artist's prints have often supported charities and social causes in his hometown of London, and in locations as far flung as Jordan and New York.

In 2020, for example, the artist produced 100,000 prints of his well-known piece Holding Hands, gifting them to Hackney residents for their kindness during the coronavirus pandemic. These prints were designed to be sold to provide financial support for those in difficulty.

Contemporary Art Market Performance in 2022

So far, in the first half of 2022, STIK's artworks have appeared in 22 auction lots and realised a total of £163,487.

Between 2016 and 2021, the artist's work has experienced percentage growth of 663.2%, based on the total value of sales in these years.

Although the market for STIK prints is much smaller than that of the big three - Banksy, Hockney and Hirst - it's still a good place to go for investors: in the last 5 years, investors in STIK prints would have seen an average return of 149.5% on their investments.

Although supply is lower than in top markets (with only 22 prints going through auction in the first half of 2022), demand for STIK prints remains high due to the high prices they command at auction.

Top Auction Price

The top price paid for a STIK print in the first half of 2022 was £32,760 for Diva (2009), which sold at Christie’s London auction house in March.

The 1116 x 380 mm screen print depicts one the artist's signature characters, looking sheepishly to its right and set against an orange background.

Invader

Invading Space and the Art World

A French Street Artist inspired by Japanese arcade games of the 80s and his long-held goal of 'invading space' (get it?), Invader has gone from strength to strength in recent years.

Although little is known about Invader’s true identity, we do know that he is a graduate of Paris’s prestigious École des Beaux-arts art school, which once played home to the likes of performance artist Marina Abramović, Gustave Moreau, Ingres, Seurat, and Rodin.

A motif at the heart of Invader’s œuvre are ‘alien’ characters called 'Invaders'. These were taken from Tomohiro Nishikado’s world-famous arcade game, Space Invaders, which were based on drawings made by H.G. Wells for his world-famous novel, War of the Worlds (1898).

Although known for mounting his tile-based artworks in locations ranging from Paris and Miami to Djerba (Tunisia) and even the International Space Station (ISS), Invader has produced a large number of unique, saleable ceramic works as well as a large variety of original prints.

Auction Appearances and Growth in 2022

So far, in 2022 Invader's artworks have appeared in a total of 24 lots across a number of auction houses. Auction sales of Invader's pieces have totalled £188,264 in first half of 2022.

So, if we take a closer look at the numbers, Invader's percentage growth based on the total value of sales in the 2016-2021 period is equivalent to 2624.6%.

Investment Returns and Price Ranges

Though Invader prints and 'Invasion Kits' do not have the highest values per artwork in the contemporary market, they do represent some of the most significant returns in the last five years - 340.6% from the end of Q2 2017 to the end of Q2 2022.

Why are Invader artworks so attractive to the investor? Invader has something to offer for contemporary art investors of budgets big and small.

In 2022, for example, the print Versailles (blue) (2018) sold for £4,730, whilst the ceramic Invasion Kit 2 Blue Octopus (2003) for a stunning £25,200. The growing Invader market offers buyers with a range of price points to begin their collection.

Harland Miller: The Art World King of Deadpan

A writer and a contemporary artist, Yorkshire-born artist Harland Miller places text and image at the centre of his creative practice.

Starting out as the owner of a punk rock record store in his native York, Harland Miller studied at Chelsea School of Art.

Moving from York to New York following his time at art college, Miller created the alter-ego International Lonely Guy - an embodiment of his exciting but isolating experiences as a Yorkshire lad living in amongst the chaos of the nascent West Village art scene of the 1980s.

The artist, known for his large scale oil paintings, later lived in Berlin just prior to die Wende - the fall of the Berlin Wall. It was here that German art inspired him to explore typography, something he'd been told to steer clear of back in London.

Working as an artist since the 1980s, Miller is famed not only for his humorous re-workings of Penguin book covers ('Incurable Romantic Seeks Dirty Filthy Whore'; 'Gateshead Revisited'), but for his novels.

Slow Down Arthur, Stick to Thirty and First I Was Afraid, I was Petrified were both published in 2000, receiving critical acclaim.

Miller's first European solo show was entitled In Dreams Begin Monsters and was held at Palacio Quintanar, Segovia, Spain in 2015.

Auction Appearances, Growth, and Solo Exhibitions

Under the hammer, Miller's prints have been performing particularly strongly, appearing in a total of 34 lots and realising £476,591 through auction in first half of 2022.

The total value of Miller sales in the period between 2016 and 2021 is equivalent to a percentage growth of 2397.1%.

Recent solo exhibitions at White Cube Bermondsey and York's emerging artist gallery, The York Art Gallery, have seen an increase in demand for Miller's prints this year.

Another reason behind Miller's solid and consistent market performance is the recent publication of a revised edition of In Shadows I Boogie - a commercially popular monograph featuring the artist's complete works issued by publishing powerhouse, Phaidon.

Top Auction Prices

In April 2022, Miller's 2015 silkscreen print Love Saves the Day achieved $100,800 at Phillips auction house in New York, almost doubling its pre-sale estimate of $40,000-$60,000. This was the highest auction price realised by a Miller print in the first half of 2022.

Conclusions?

For those with smaller budgets, the artworks of Miller, Invader, and STIK offer a great place to invest.

Although dwarfed by the steadfast success of Hockney, Banksy, and Hirst, these artists are ones to keep an eye on because one thing is sure: attracting a string of new and established collectors from around the world, their value looks set to increase in the comings months and years.

Browse our STIK, Invader, and Harland Miller prints for sale or get a valuation here.

Read our Contemporary Art Report and discover more about art investment.