Love Rat © Banksy 2004

Love Rat © Banksy 2004

Banksy

270 works

Banksy’s ubiquitous rat stencils have scurried across city walls and official prints for over two decades, becoming one of the artist’s most enduring motifs. Early in his career, Banksy began tagging urban spaces with small black-and-white rats – creatures traditionally viewed as vermin – and elevated them into witty messengers of anti-establishment critique. By painting rats, Banksy found a surrogate self-portrait: much like the anonymous graffiti artist, rats are hunted by the authorities, operating under the cover of darkness.

Cultural and Political Symbolism of the Rat

Across cultures, rats carry complex symbolic weight. They have been associated with uncleanliness, clandestine survival, and even trickery. (Tellingly, “rat” is an anagram of “art,” a coincidence Banksy humorously claims he only noticed after the fact.) For Banksy, the rat serves as an allegorical tool to illuminate human vices and societal flaws. His rats are often anthropomorphised – shown wielding signs, wearing necklaces or using human tools – placing them in satirical situations that mirror our own. Each stencilled rat carries a piece of Banksy’s political or social commentary, representing “street artists, rebels, the downtrodden masses and anyone who feels rejected by society”.

The rat’s ability to infest and persist in hostile environments is key to its symbolism. “Rats exist without permission. They are hated, hunted and persecuted… And yet they are capable of bringing entire civilisations to their knees,” Banksy wrote in Wall and Piece. This admiration for the lowly rodent echoes in his art: rats in Banksy’s works stand for the power of the little people to disrupt the mighty. They are emblems of anti-authoritarianism and rebellion, scurrying beneath the notice of the powerful until it’s too late. Banksy was influenced in this choice by French stencil pioneer Blek le Rat, who began spraying rat images in Paris in the 1980s. Blek viewed rats as “the only free animal in the city”, an urban creature that could symbolise freedom on city walls. Acknowledging this inspiration, Banksy quipped, “Every time I think I’ve painted something slightly original, I find out that Blek le Rat has done it as well, only 20 years earlier” . In return, Blek le Rat praised Banksy’s work as the next evolution of urban art rather than mere imitation.

Love Rat – Banksy’s First Rodent Rebel

One of the earliest and most famous examples of Banksy’s rat is Love Rat, which first appeared as a street stencil in Liverpool and then became Banksy’s first rat in print form in 2004. In this image, a black-and-white rat holds a paintbrush, having just painted a dripping red heart on the wall. At first glance, Love Rat looks like a simple message of love, but the heart is bleeding, with red paint trickling like blood. Banksy himself jokingly pitched this design as “ideal for a cheating spouse,” hinting at the heartbreak beneath the romantic veneer. In this way, the Love Rat embodies the duality often present in Banksy’s work: simultaneously spreading love and exposing pain.

Executed in Banksy’s signature monochrome stencil style with a single shock of red, Love Rat set the stage for the rat as a versatile messenger. It reminds us that even the smallest creature can deliver biting commentary. As the inaugural rat print (released in an edition of 150 signed and 600 unsigned copies).

Gangsta Rat – A Satire of Street Culture and Authority

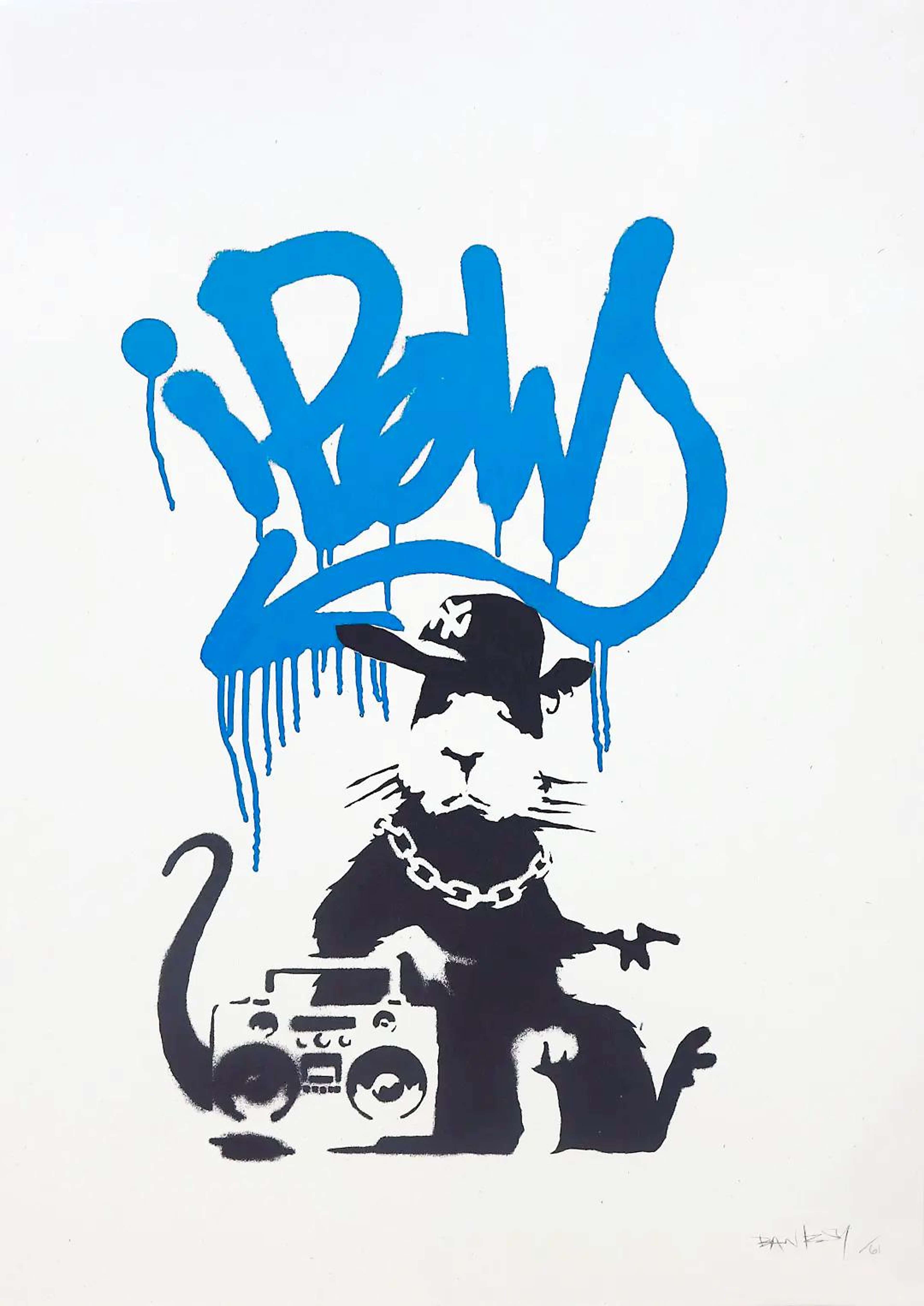

Following on Love Rat’s tail, Banksy introduced Gangsta Rat in 2004, blending urban music iconography with the rat’s cheeky persona. In this stencil, a rat stands upright wearing a New York Mets cap and a chunky chain necklace, toting a boombox at its side. Behind the rat, the tag “iPow” is sprayed on the wall – a tongue-in-cheek mashup of Apple’s ubiquitous “i” branding with a nod to Pictures on Walls (POW), the print collective that published many of Banksy’s early editions. Gangsta Rat is both a homage to the 1980s–90s hip-hop graffiti scene and a sly dig at how commercial culture co-opts urban rebellion, turning street cred into a commodity.

Banksy initially released Gangsta Rat as a screenprint in a red colourway (150 signed, 350 unsigned) in 2004. Notably, this rat went on to have seven different colour versions as AP editions, more than any other Banksy rat print. As is the case with any edition proof prints, which come in lower edition numbers and therefore bear a more covetable rarity, these works typically hold a higher value than regular prints from the same edition. The AP blue edition of Gangsta Rat, for instance, is currently valued between £100,000-£150,000 according to our pricing algorithm, and originates from an edition of 61.

Over a decade later, in 2015, Banksy even revisited Gangsta Rat by issuing new limited editions in pink, green, blue, orange, and grey hues exclusively for VIP guests at his Dismaland installation. This rare re-release demonstrated the enduring appeal of the character. Banksy also painted Gangsta Rat murals on city streets – from Farringdon in London to Los Angeles and New York – embedding the image in real urban settings as well as in collectors’ portfolios.

Radar Rat – Watching the Watchers

In Radar Rat, Banksy tackles the theme of surveillance and the surveillance state through his ever-resourceful rodent. First stencilled on London walls around 2002, this design shows a rat standing on its hind legs, equipped with a military-style headset and holding a radar dish as if eavesdropping on the world. Later released as a very limited print (75 signed editions) at Banksy’s Santa’s Ghetto shop, Radar Rat is among the artist’s rarest rat editions. In this piece, the humble rat turns the tables on authority: rather than being surveilled, the rat is doing the surveilling. It’s a clever reversal that highlights Banksy’s distrust of government monitoring and mass surveillance in modern life.

The imagery suggests that while society’s powerful listen in on citizens, an underground movement (embodied by the rat) might be listening back, gathering information to subvert the system or simply to survive in it. Given rats’ reputation for clever survivalism, the Radar Rat can be seen as an avatar of the small rebel using the oppressor’s tools against them. Banksy underscores this with a caption from his writings: “Rats are the triumph of the little people, the undesirables and the unloved… Despite the best efforts of the authorities, they have survived, flourished and brought entire civilisations to their knees”. In other words, even under the gaze of CCTV and government ears, the rat (and by extension, the dissident voice) will find a way to persist and confound those in power.

The Placard Rats – Small But Mighty Protest

Perhaps the most explicitly political of Banksy’s rodents are the Placard Rats – a trio of designs featuring rats holding protest signs. Released as prints in 2004, each edition shows a rat wearing a peace-sign medallion and hoisting a placard emblazoned with a slogan in blood-red lettering. The three variants form a series: Get Out While You Can, Welcome to Hell, and Because I’m Worthless. In these works, Banksy’s rats become pint-sized activists, delivering punchy one-liners that critique consumerism and the corporate “rat race.”

The phrase “Because I’m Worthless” is a direct subversion of L’Oréal’s famous marketing slogan “Because I’m Worth It,” flipping a message of personal empowerment into a statement of disillusionment. The rat bearing this slogan stands as a cog in the machine – a worker deemed worthless by a money-driven society. Similarly, Get Out While You Can borrows its warning from a book about escaping the rat race, imploring viewers to break free from soulless corporate toil. Welcome to Hell greets us with grim humour, suggesting that the modern corporate world (or perhaps modern city life itself) is a kind of hell – a theme underlined by the rat’s incongruous peace necklace amid the violent red scrawl of the text.

Together, the Placard Rats encapsulate Banksy’s anti-capitalist and anti-establishment sentiments. These small creatures boldly hold up signs of protest, implying that even the meek can raise their voice against injustice. Not just confined to prints, the placard-wielding rats have appeared as murals on city streets as well, becoming some of Banksy’s most recognisable street interventions. With their dripping red letters and ironic juxtapositions (peace symbols and hellish warnings), the Placard Rats deliver Banksy’s message that dissent need not come from a towering figure – even a tiny rat can shake up the status quo.

Choosing a Banksy Rat

For more guidance on how to choose the right piece, take a look at our Banksy Buyer’s Guide, where we offer an in-depth individual analysis on Banksy works and how certain factors have influenced their market price over the years, as well as useful tips on how to accredit an original Banksy.

When it comes to embarking on a new Banksy investment or reaping the returns of a successful previous one, MyArtBroker’s group of leading experts are ready to start a conversation and ensure you’re met with your best match through our world-wide network of collectors, specialists, dealers and galleries.

How can I sell a Banksy Rat?

If you’re looking to sell art by Banksy, click the link and we can help. We employ a number of techniques and practices in order to give a realistic and achievable valuation on any art listed on myartbroker.com. We analyse the demand for the work in question, take into consideration previous sales and auction valuations, we assess the current gallery valuation and monitor the current deals taking place via MyArtBroker every day. We regularly advise sellers on a price bracket for their artwork completely free of charge.

Dedicated Rat Race © AMBA

Dedicated Rat Race © AMBABanksy’s Alter Ego?

Across Banksy’s oeuvre, the rat has effectively become the artist’s alter ego and an ever-evolving symbol of underground resistance. Between 2000 and 2013, Banksy painted at least 30 rats in cities from London to New York, and he continues to unleash these critters in new contexts. During the COVID-19 lockdowns, Banksy famously turned his own bathroom into a canvas for stencilled rats wreaking playful havoc – complete with one rodent sneezing onto the mirror – as a commentary on quarantine life and creativity under confinement. Shortly after, he surreptitiously entered a London Underground carriage (disguised as a cleaner) to spray-paint rats using face masks as parachutes or carrying sanitiser, in a piece titled If You Don’t Mask, You Don’t Get. In an ironic twist, that pandemic-themed mural about public health was swiftly cleaned away by real Transport for London staff – a fate that perfectly illustrates the cat-and-mouse game between the guerrilla artist (or guerrilla rat) and the authorities.

In 2023, Banksy returned to the rat when creating the visuals for his most recent exhibition, CUT & RUN. The exhibition logo and poster depict a mischievous-looking rat, holding a blade at the centre of a red outlined circle. Running with the craft knife, the rodent fully assumes its role as Banksy’s alter ego. In the same year, Banksy presented fellow graffiti writer AMBA with a signed print titled Rat Race, featuring a rat running inside a red stop sign, mimicking a hamster wheel – a poignant commentary on the monotonous cycle of modern life. The imagery serves as a metaphor for the relentless grind of the ‘rat race,’ highlighting themes of societal pressure and the pursuit of success.

This particular image is strikingly similar to one owned by legitimate Banksy owners. Since 2020, Banksy’s Pest Control-issued certificates of authenticity have contained half a Di-Faced Tenner beside a rat running in a coffee mug ring. Acting as a seal of authenticity in this context, the rat has become the most quintessential of all of Banksy’s recurring motifs, and the one which the artist relies on to cement his authorship.

Even as Banksy’s art has grown in fame and value, his rat remains a steadfast symbol of mischief and truth-telling from the margins. The rodent that sneaks in through the cracks of society is an apt stand-in for a street artist who infiltrates the establishment art world while lampooning it. Banksy’s rats speak to the idea that those who are unnoticed or underestimated can hold significant power – whether by spreading inconvenient truths, surviving against odds, or sparking change in a complacent world. Through love-torn romantics, “gangsta” DJs, subversive engineers, and protesting everymen, the rat in Banksy’s work has proven endlessly adaptable as a vehicle for the artist’s anti-authoritarian and socially conscious themes. Ultimately, the enduring presence of the rat motif – from early 2000s street walls to present-day prints and public stunts – underscores its significance as Banksy’s unofficial mascot of rebellion: a tiny creature with a massive voice that continues to challenge authority, champion the underdog, and charm the public all at once.