The Intersection of Art & Finance

Banker © Julian Opie 2014

Banker © Julian Opie 2014Market Reports

The art world and market has long been viewed as an exclusive space, accessible only to ultra-wealthy collectors. However, recent developments in technology are rapidly changing this paradigm, democratizing access to art and finance alike. Blue chip art is a parallel asset class, and with increasing accessibility and transparency, the space is set to grow. The history of the art market has been fascinating, but steeped in exclusivity and a lack of transparency. The convergence of art and finance has emerged as a captivating intersection, with innovations such as blockchain, AI, and NFTs (non-fungible tokens) transforming the way we create, trade, and invest in art.

The Convergence of Art and Finance

Digital platforms have brought about new ways of investing in art, such as fractional ownership and online marketplaces like ours. This has enabled more people to access the art world and invest in unique pieces, with an unparalleled degree of transparency. Moreover, digital platforms have made it easier to track the value of art and monitor its performance as an asset class. MyArtBroker's online print portfolio tool, MyPortfolio, is the only dedicated print market index in the world through which one can buy, sell, and track demand and supply in real time.

Where Art Meets Finance

The convergence of art and finance has been greatly impacted by advancements in technology, particularly in the use of blockchain and cryptocurrency. These technologies have provided greater transparency and security in art transactions, as well as increased accessibility to the market. Investing in art can provide diversification to investment portfolios and the potential for high returns.

The integration of finance and art has also led to new business models, such as fractional ownership and online auctions. These changes in the industry have created new opportunities for both art collectors and investors. It is important for individuals in both fields to stay informed about these developments to make informed decisions surrounding their investments. Where art meets finance, we can see a shift towards a more tech-centric future that offers benefits for all involved parties.

MyPortfolio © MyArtBroker 2023

MyPortfolio © MyArtBroker 2023How is MyArtBroker Contributing to the Future of the Art Market?

MyArtBroker, as an online platform, is changing the game when it comes to the intersection of art and finance. We connect art buyers and sellers, providing greater transparency and accessibility in the art market. Technology has made it easier for investors to buy and sell shares in art collections, making art a more liquid asset. On our trading floor, you can track the supply and demand for blue chip prints and editions from our private network - in real time. Unlike the murky world of auction, our new online platform gives unprecedented transparency: allowing collectors and investors to see exactly where opportunity lies in the market.

Likewise, MyPortfolio affords collectors unique insight into the value growth of their portfolio. By inputing the purchase date and original price of an artwork, MyPortfolio members can track the value growth of original prints and their portfolio at large. Though we do not have a crystal ball - nor can we impart financial advice - this tool gives you the data-driven means to make the most informed decisions when it comes to managing your portfolio.

Art Investment Strategies in the Digital Age

As technology continues to transform the art market, investors are finding new ways to strategise their art investments. One of the most significant changes is the use of digital platforms that allow investors to research and track art trends and prices - like MyPortfolio. By diversifying your portfolio and collecting blue chip artworks across established artist markets, you maximise the potential for return.

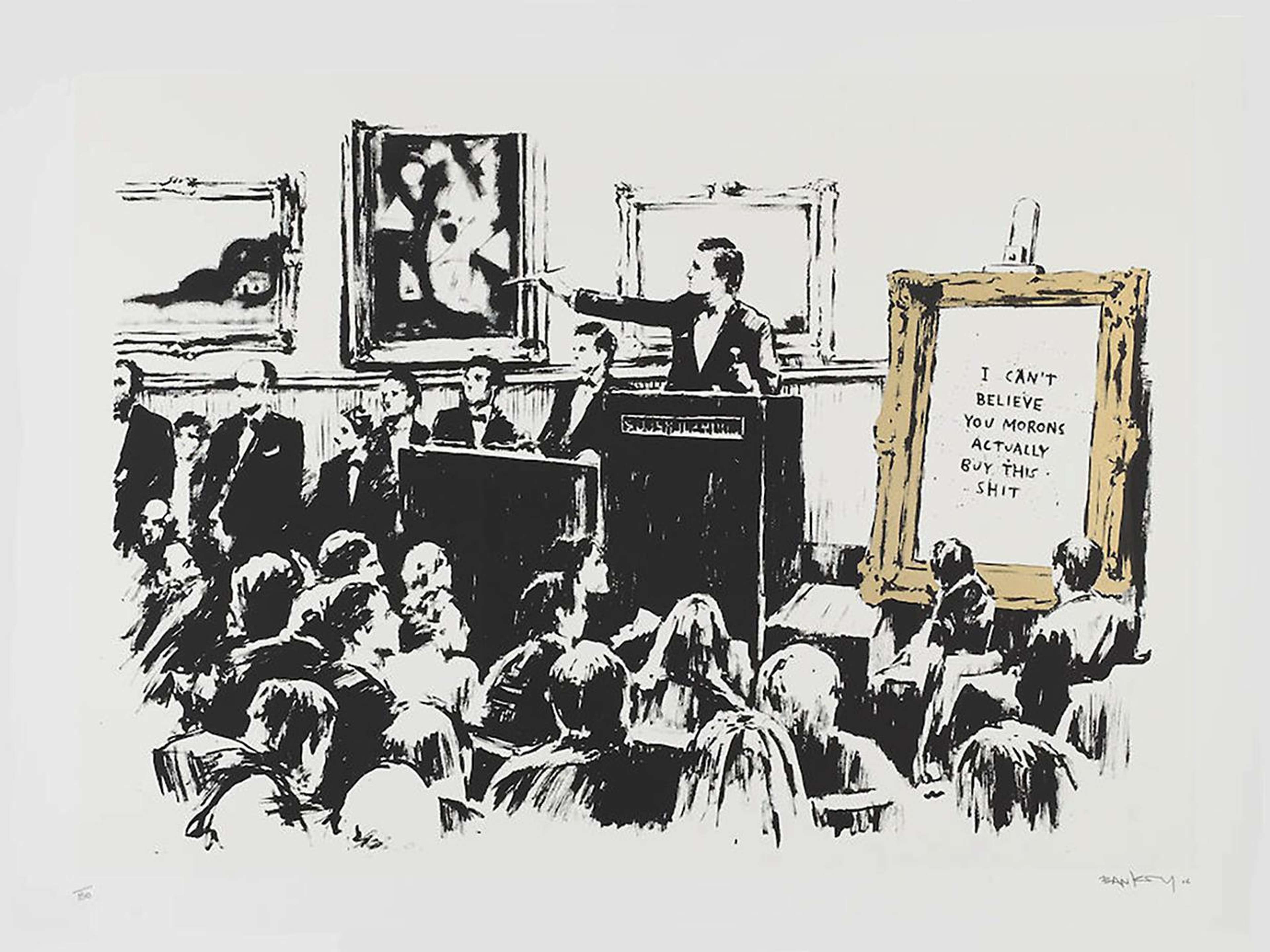

Blockchain technology is also increasingly used for secure and transparent art transactions. Eminent artists like Banksy and Damien Hirst are now accessible to a wider range of potential investors, thanks to NFTs and Metaverse.

Find out about the other Blue Chip Artists Who Joined The Metaverse here.

Technology & Art Authentication

Blockchain technology and - more recently- AI is being explored as a way to authenticate artworks and prevent fraud. This could revolutionise the art market by making it easier for buyers to verify an artwork's provenance and ensure that they are getting what they paid for. These digital avenues of authentication pose the opportunity to increase transparency and trust within the art market.

Art authentication has always been crucial. In a world where fakes and forgeries are rife, and most authentication boards no longer exist, new technology could aid in provenance tracking. Though AI certainly isn't advanced enough to authenticate artworks without human expertise, it could certainly assist in the analysis of artworks before they appear on the market.

Blockchain: The Future of Art Ownership and Trading?

By providing a secure and transparent way to track the ownership and provenance of artworks, blockchain technology could help ensure the privacy of art market transactions. Blockchain stores tamper-proof records of every transaction, making it easier for buyers to authenticate the artwork's ownership history. Additionally, smart contracts can automate the sale and transfer of art, eliminating intermediaries from the process.

Fractional ownership of artworks through tokenisation has also become a trend in the art world. This new investment opportunity allows collectors to purchase a small share in an expensive piece of art, giving them a chance to profit from its appreciation over time.

Find our more about NFTs and The Future of Art Collecting here.

Art Investment Funds & Fractional Ownership

Investing in art has traditionally been reserved for the ultra-high net worth because of the high cost of artworks. However, art investment funds and fractional ownership have opened up new opportunities for both art collectors and investors. Art investment funds allow investors to diversify their portfolio with art by investing in a range of artworks while fractional ownership allows multiple investors to own a share of an artwork, making it more accessible for smaller investors.

Disrupting the Traditional Art Market

Thanks to recent developments in technology, art has become more accessible for a broader range of collectors and investors participating in the market. High net worth individuals from the world of finance are becoming increasingly enthusiastic about art as a way to increase their capital. In an interview with New York Times, Evan Beard - a national art services executive at Bank of America's U.S. Trust - mentioned that a number of his clients routinely guaranteed works at Sotheby's, Christie's and Philips.

With space opening up for new art investors, it has never been easier to start your own blue chip art collection with cutting-edge technology by your side. MyArtBroker is proud to champion this new era of the art market, by demystifying the landscape of investing in art with our data, technology, and industry experts.