Banksy & Blue-Chip Contemporary Prints as Alternative Assets

Girl With Balloon (Gold) ⓒ Banksy 2004

Girl With Balloon (Gold) ⓒ Banksy 2004Market Reports

Banksy prints first came to the market in 2002. After a natural lag, the secondary market started heating up in the early 2010s and experienced what can only be described as an astronomical rise over the COVID-19 period. The investors who cashed in on this move all have one thing in common: they are not afraid of holding alternative assets in their portfolio.

Our 2023 Print Market Report offers expert opinions on the prints and multiples market over the last five years, including specific insights into the Urban & Contemporary, and Banksy markets.

Traditional vs. Alternative Assets

Like non-fiction books and extra-terrestrials, alternative assets are defined by what they are not: traditional. As such, it is important to understand traditional assets and portfolios before moving on to their younger and cooler sibling.

The list of traditional assets is short and sweet: cash, real estate, stocks, and bonds. A traditional investor likely holds cash in a bank account, real estate in the form of a home, and what we call a ‘60/40’ portfolio: 60% of their money in stocks and 40% in bonds. The idea is that stocks go up in the good times and bonds act as a safety net in the bad times, in addition to providing a modest but steady income through their yield.

We are very much in the “bad times” right now, but the 60/40 portfolio has not been doing what it says on the tin: bonds and equities have been moving down in sync over a prolonged period, leaving the model without any of its upside and little of the downside insurance.

While some investors are still holding out hope for 60/40, many are starting to look towards alternative assets to diversify their flagging portfolios. They are spoiled for choice: the alternative universe is practically infinite, with typical examples including private equity, hedge funds, commodities, crypto, a plethora of structured products, and collectibles – including art.

While it is likely that we will observe a wider shift towards alternative assets, how did those investors who already held these investments – and already held Banksy prints – perform over the last ten years?

Fig 1. Alternative Assets vs Contemporary Blue-Chip Artists

Fig 1. Alternative Assets vs Contemporary Blue-Chip ArtistsPerformance of Banksy vs. Traditional & Alternative Assets

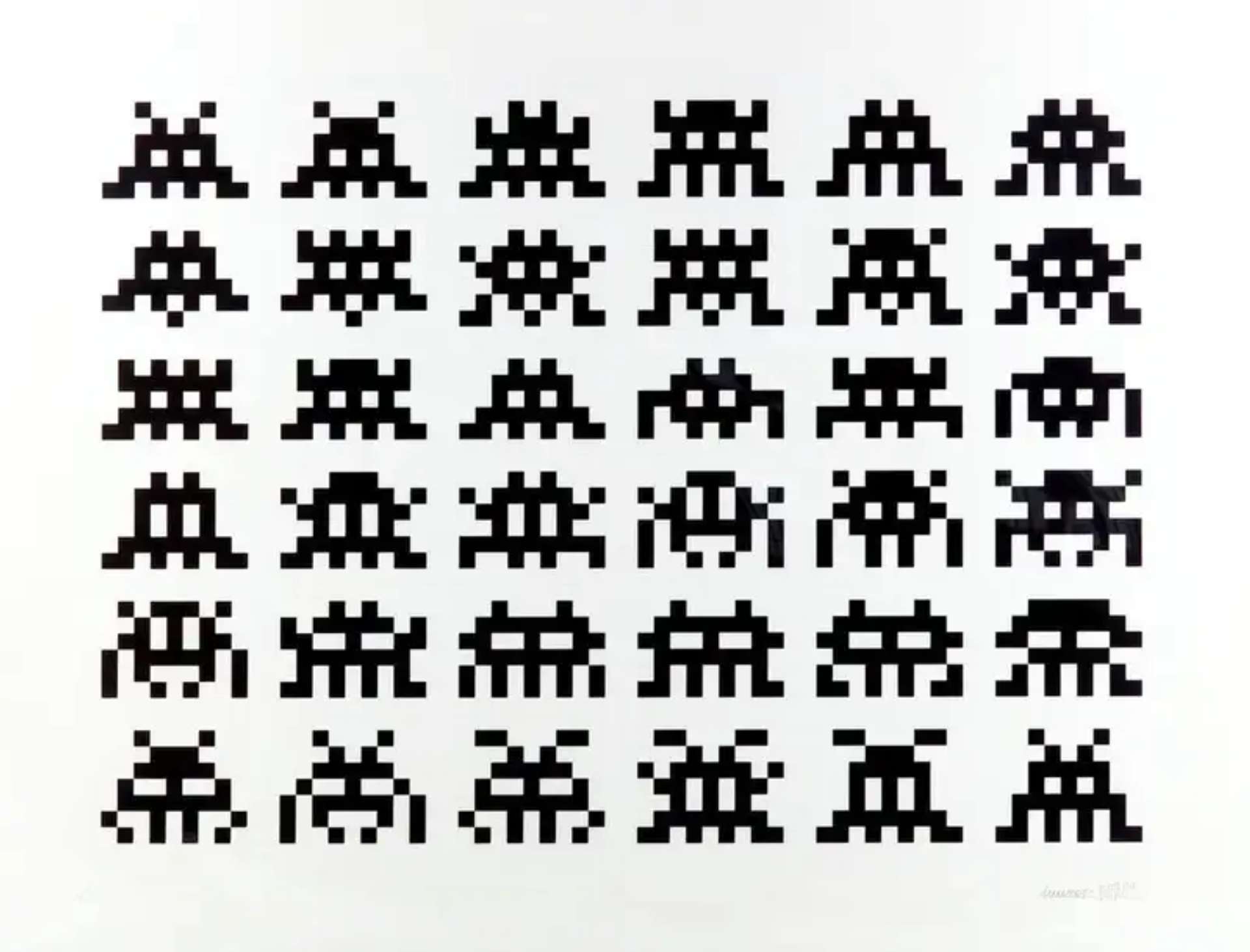

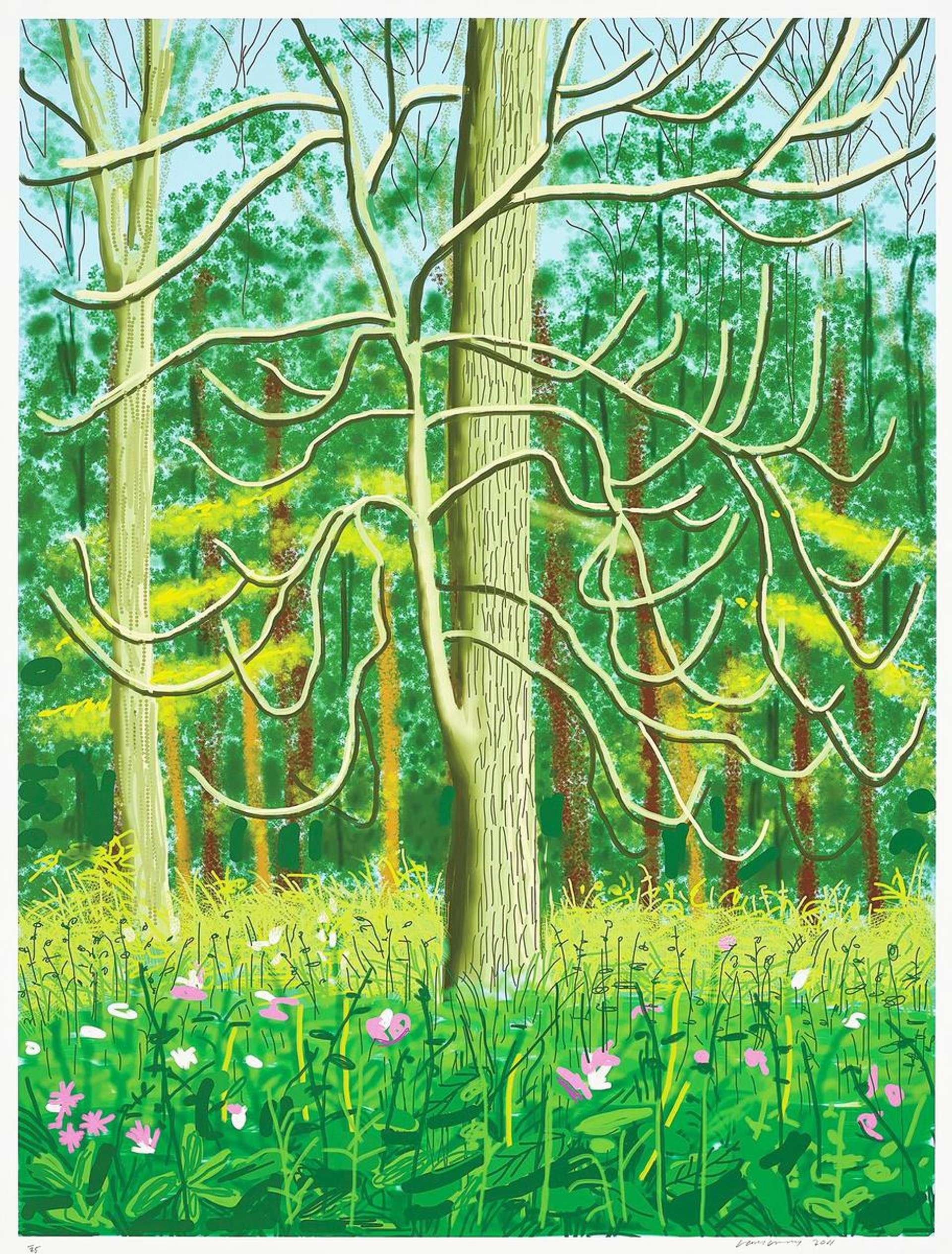

Fig. 1 illustrates the indexed performance of Banksy prints against a selection of other alternative assets: a REIT (Simon Property Group), a gold ETF (GLD), an oil ETF (USO), a hedge fund tracker (ADAIX), and a private equity tracker (PSP). It also includes a basket of other contemporary blue-chip artists including Damien Hirst, Bridget Riley, David Hockney, Harland Miller, Stik, Invader, KAWS, and Julian Opie. The performance against crypto is on another chart below. Where possible, ETFs were selected as a representation of an easily accessible and widely traded modern product.

Fig. 2 Alternative Assets vs Crypto

Fig. 2 Alternative Assets vs Crypto The chart speaks for itself: crypto and Banksy prints have outperformed to a huge degree, and although growth in contemporary blue-chip artists’ prints was more modest, it still outranks the remaining alternative assets. If we look at periods of market stress – namely COVID-19 in 2020 – the most noticeable dip was in the REIT and private equity tracker. Both crypto and Banksy prints saw a period of outsize growth, but while crypto crashed back down, Banksy print prices merely took a small dip and then stabilised.

Fig 3. Traditional vs Banksy and Contemporary Blue-Chip Artists

Fig 3. Traditional vs Banksy and Contemporary Blue-Chip ArtistsFig. 3 shows the performance of Banksy prints against a selection of traditional assets: an emerging market ETF, a high yield bond ETF, a Dow Jones ETF, NASDAQ ETF, FTSE 100 ETF and UK gilts. Again, we see a strong outperformance from Banksy prints, although here, the NASDAQ outperformed other contemporary blue-chip artists. The NASDAQ mostly consists of tech stocks, which had a good run over COVID-19, but we can see that this was tempered almost back to 2020 levels towards the end of the observed period.

When we look at the COVID-19 period for traditional assets, we can see that nearly all of them took a dip at the beginning of the pandemic, with some coming back stronger (such as the NASDAQ) but others remaining sluggish (such as emerging markets assets). However, most of them trended back towards 2020 prices by the beginning of 2022.

A key difference between observing alternatives and traditional is the lifespan. The assets in the alternative sample have not been around for long – the oldest one is the Simon Property Group REIT, which dates back to 1993, and the others all came to the market in the early 2000s. This is useful in that it gives us a more like-to-like comparison with the relatively young Banksy print market and highlights just how significant the price growth has been.

Hypothetical Investment Portfolios

Having established the strong growth of Banksy prints over the last ten years, the question is what the returns would look like on an individual portfolio level.

Composition of Traditional Investment Portfolio

Composition of Traditional Investment Portfolio Historical Compounded Cumulative Returns on Traditional Investment Portfolio

Historical Compounded Cumulative Returns on Traditional Investment PortfolioIn the first example, we can see a traditional portfolio composition. Indeed, this has performed strongly, as evidenced by the historical compounded cumulative returns chart. However, if we add Banksy prints and other contemporary blue-chip artists to the mix, we can see even stronger returns.

Composition of Investment Portfolio with Banksy Prints and Contemporary Blue-Chip Artists

Composition of Investment Portfolio with Banksy Prints and Contemporary Blue-Chip Artists Historical Compounded Cumulative Returns on Investment Portfolio with Banksy Prints and Contemporary Blue-Chip Artists

Historical Compounded Cumulative Returns on Investment Portfolio with Banksy Prints and Contemporary Blue-Chip Artists Composition of Investment Portfolio with Alternative Assets

Composition of Investment Portfolio with Alternative Assets Historical Compounded Cumulative Returns on Investment Portfolio with Alternative Assets

Historical Compounded Cumulative Returns on Investment Portfolio with Alternative AssetsMoving on to alternative assets, we can see that returns in this hypothetical portfolio would have been greater than if holding only traditional assets. It is also compelling to see that while traditional asset returns dropped off at the beginning of 2022, alternative assets have remained relatively stable. Adding Banksy and other contemporary blue-chip artists impacts the figure less significantly here given how strong the performance is, but still gives it a notable lift.

Looking to sell your contemporary art print? Get a valuation here.

Composition of Investment Portfolio with Alternative Assets, Banksy Prints and Contemporary Blue-Chip Artists

Composition of Investment Portfolio with Alternative Assets, Banksy Prints and Contemporary Blue-Chip Artists Historical Compounded Cumulative Returns Investment Portfolio with Alternative Assets, Banksy Prints and Contemporary Blue-Chip Artists

Historical Compounded Cumulative Returns Investment Portfolio with Alternative Assets, Banksy Prints and Contemporary Blue-Chip ArtistsLooking Forward: The Future of Banksy Prints as Alternative Assets

The data suggests that investors who held alternative assets did better than those who would have held a traditional portfolio – and even more so those who sold Banksy prints. But what does this mean moving forward? While the performance has been strong, Banksy print prices did take a dip after the pandemic, not to mention the dreaded warning that “past performance is not indicative of future results.”

The dip is best viewed in the context of the Banksy print market’s lifespan. Like many other alternative assets, it is still relatively young – but what we are observing with the dip is the first sign of cyclicality, and the first sign of the asset maturing. In a brave new world where 60/40 is no longer fit for purpose, potential investors can take comfort in the relatively modest dip: unlike crypto, the asset is stabilising rather than moving erratically.

There is also much to be said for the price movement in other contemporary blue-chip artists – while it may not have been as impressive as the rocketing Banksy prices, it shows that the wider market has the ability to show stable growth in periods of stress.

With this in mind, it may well be an opportune time to shift away from 60/40, and look towards the alternative universe.

Our market reports have all the latest insights and analysis on the Banksy and contemporary print markets.

Download our complete 2023 Print Market Report here, to explore expert opinions on the prints and multiples market over the last five years.

Discover more about Banksy's market over the past 5 years here.

Discover more about investing in the prints and multiples market here.