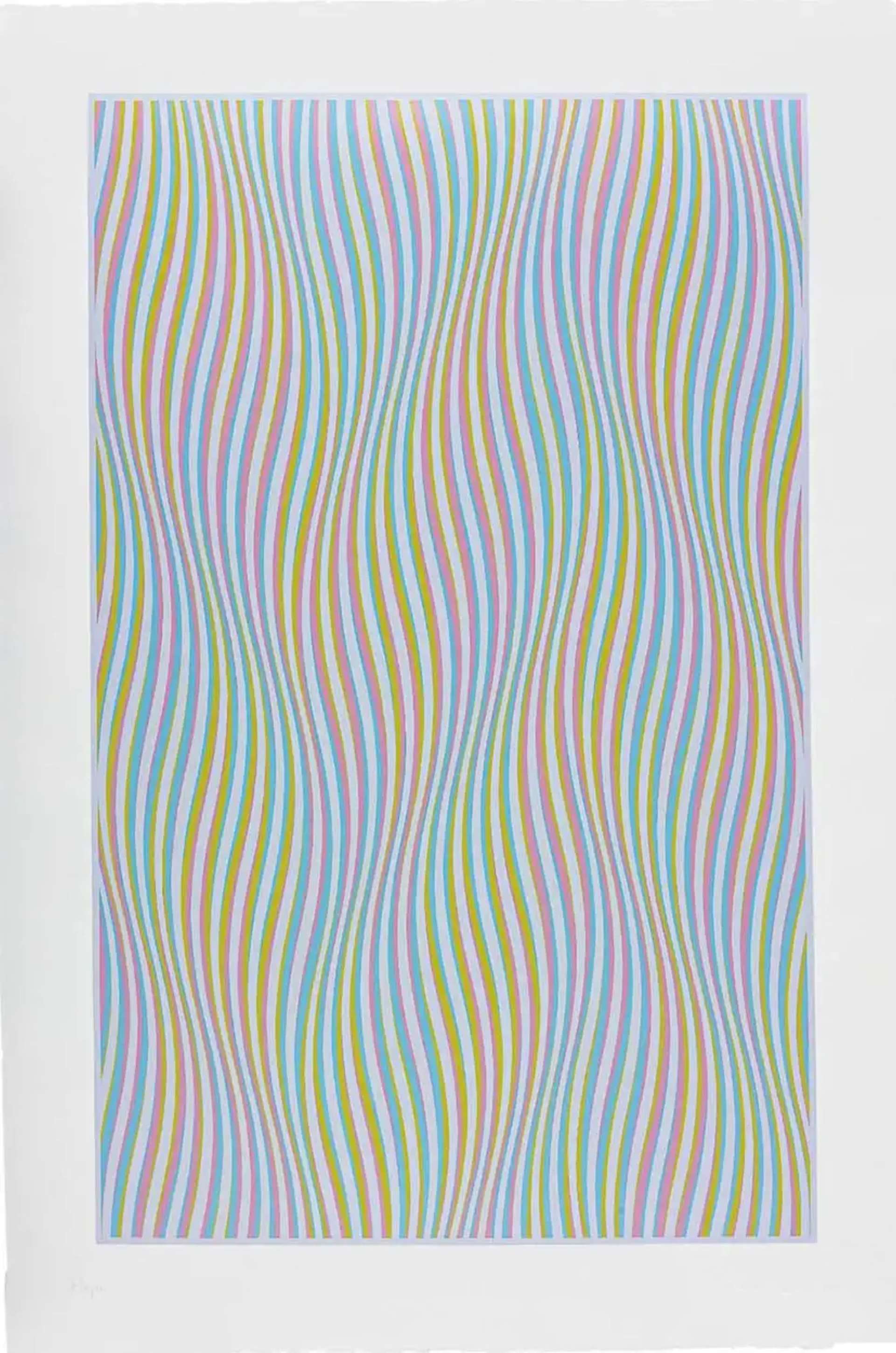

Fragment 3 © Bridget Riley, 1965

Fragment 3 © Bridget Riley, 1965

Bridget Riley

112 works

Thinking about diversifying into the prints and multiples market? A Bridget Riley print could be a good investment opportunity if you are looking to move into alternative asset classes. Our most recent report shows that Riley’s print market is continuing to mature and grow as we move into 2023. In this article we look at the Riley print market data in detail.

Download our complete 2023 Print Market Report here, to explore expert opinions on the prints and multiples market over the last five years.

Is a Bridget Riley print a good investment?

At the age of 91, Bridget Riley continues to be one of the art world's leading innovators. Riley’s market has had steady rates of growth over the last five years, despite the low volume of her prints on the secondary market. In the last 12 months total print sales in the Riley market have reached £814,041. The compound annual growth rate over five years in this market is steady with both transaction volume and appreciation playing their part in a 10% growth in market size and 6% growth in ASP.

Riley’s prints are also attracting a growing international audience. In 2020, the UK was the largest market for her prints with 81% of sales, while the US had 10% and other countries accounted for 9%. In 2021, the UK’s market dominance decreased to 79%, while the US had grown to 7.5% and other countries to 13.5%.

The reduction in viable assets elsewhere, with more traditional tradable assets like gold, oil, stocks and shares facing turmoil amid economic instability, have encouraged investors to diversify.

Riley Prints vs Gold, Oil, Property, Stocks & Shares

Our data shows that a Bridget Riley print could be a viable investment to diversify typical investment portfolios, consistently showing higher returns over a 10 year period in comparison to gold, oil, property and UK shares. The Riley market overall may be a better place to make money, especially when considering the cost of storing a print in comparison to the upkeep of any property investment portfolio. Some areas like the oil market are no match for the potential returns to be made in the Riley print market right now, and the same goes for equities.

The only area that currently outstrips the Riley print market is Amazon. This is not surprising given the domineering position of Amazon in the e-commerce market, and its strategy of acquiring brands in other markets.

Bridget Riley vs Amazon

Bridget Riley vs Amazon  Bridget Riley vs Gold

Bridget Riley vs Gold Bridget Riley vs Oil

Bridget Riley vs Oil Bridget Riley vs Property

Bridget Riley vs Property Bridget Riley vs UK Shares

Bridget Riley vs UK SharesHow much do I need to spend on a Bridget Riley print?

The cost of a Riley print depends on many factors, including its physical size, when the series was made, its rarity and edition size, as well as its condition and provenance (such notable previous ownership or if it was exhibited in a notable exhibition). But the average price is going up: from £4,886 in 2018 to £6,881 in 2019, to £7,442 in 2020, to £10,482 in 2021 and £12,334 in 2022 – an 18% increase in average sale price on last year.

Riley’s market is heavily influenced by the Fragment series, which over 5 years has represented 26% of the total sales value at 10% of the sales volume, and with an ASP of £27,858. Although attracting headline prices, the series has an ASP CAGR of 4%, in part due to a -5.6% drop YoY in 2022.

When Fragment is excluded, the market size CAGR increases to 16% with the ASP rising to 10.4%.

Are there Bridget Riley series that are more investible?

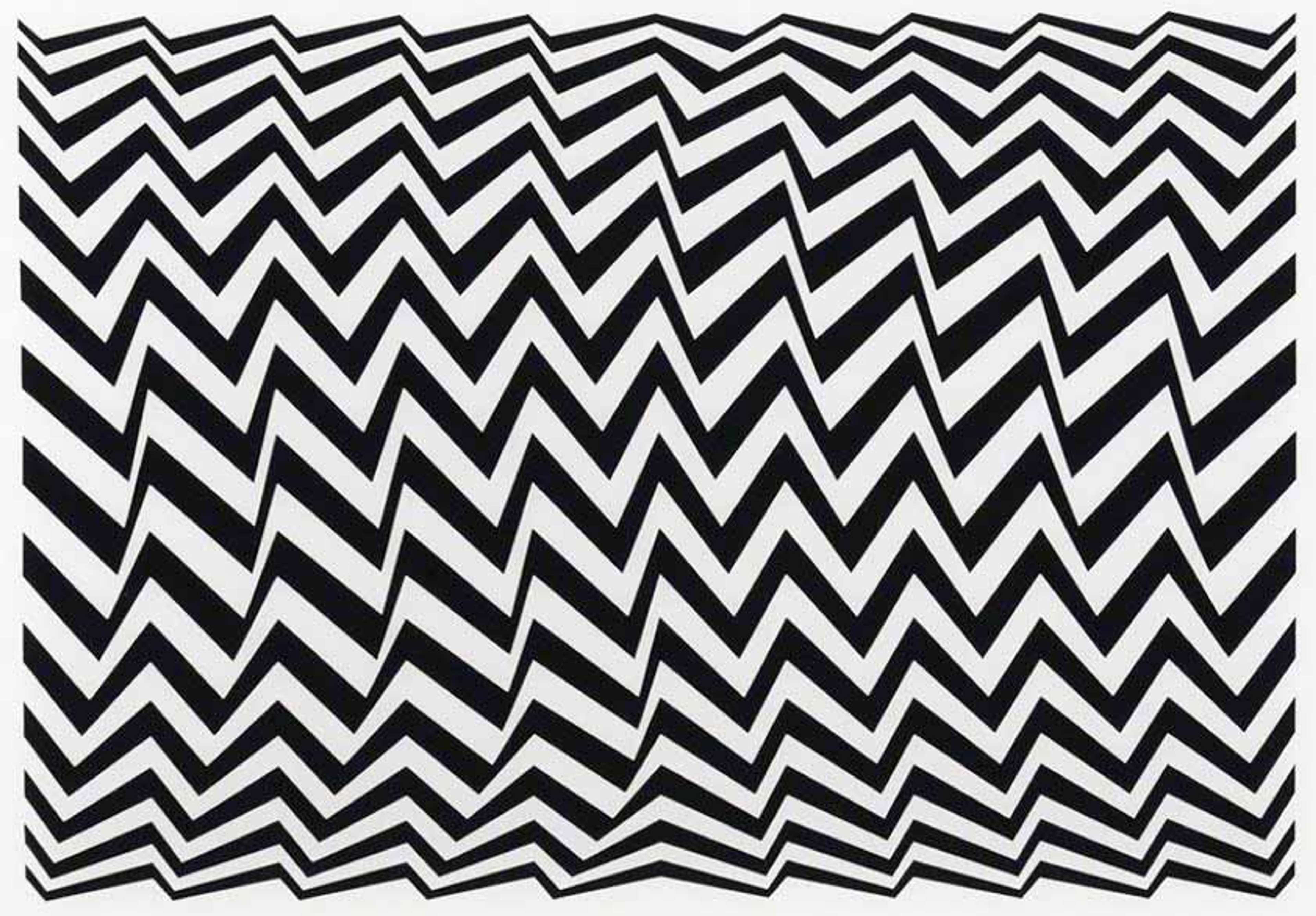

Our data shows that the most investable print of all Riley’s entire oeuvre is Elapse from 1982. The print is part of an edition of 260 and has seen the highest growth in value over five years when compared to the wider Riley print market. Elapse is an example of an artwork that has shown a high compound annual growth rate at 20% over five years and a 520% growth in value from 2017. If Elapse had been purchased at the average price in 2017, it would realise a return of 146% according to 2022 averages.

Second to Elapse is Untitled Wave, another of Riley’s Wave works that has experienced an approximate 300% growth in value since 2017. The chart below shows year on year % growth (£GBP) on individual Riley prints for 2017 vs 2022:

Bridget Riley Individual Prints: 2017 vs 2022 % Growth (£GBP)

Bridget Riley Individual Prints: 2017 vs 2022 % Growth (£GBP)Requesting a valuation of your Bridget Riley print

You can request a zero obligation, free valuation from our specialist team, no matter when you’re looking to sell your Bridget Riley print. Selling online increases the chance of your print reaching a global audience. The market for Riley’s prints is growing internationally: sales in the US have grown from 9% to 12% between 2020-21, while sales in countries beyond the UK and US have grown from 12% to 23%. MyArtBroker’s global network consists of over 30,000 collectors buying and selling works daily, as well as dealers, galleries and independent experts.

MyArtBroker charges a 0% fee to the seller. We offer the flexibility of selling online and the expertise of an auction house. Your personal broker will market your print to our global network of buyers, when you want and at the price you want to receive. We will vet potential interest to ensure they are genuine. In most cases, you can keep your print until you agree to a sale and, after the sale takes place, we will cover the cost of shipping. Get in touch with us if you are interested and we will talk you through the process.