The Quiet Bear Market: Why Banksy Prints Are the Smart Collector’s Buy in 2025

Live TradingFloor

When people talk about Banksy’s market, they tend to reach for clichés: “the bubble burst,” “the shine’s worn off,” “collectors have moved on.”I think that’s the wrong reading.

What’s really happened over the past three years is compression. Prices have come down, yes, but the speculative froth has cleared. What’s left is a quieter, more rational market: the kind that seasoned collectors recognise instinctively as a buying moment.

We’ve seen this pattern before. In 2019, just before the pandemic boom, Banksy prints were trading at modest, sustainable levels, MyArtBroker was the primary and only online Banksy brokerage and deals were good and steady. Within eighteen months, they tripled in value. Those who bought in the trough didn’t just profit, but they secured pieces of cultural history at a fraction of what they’d be worth two years later.This year the chart looks eerily similar. Only this time, the market is wiser, leaner, and more structurally sound.

At MyArtBroker, we track every Banksy print that changes hands, both publicly and privately within our network. After a four-year correction, values are stabilising. Volumes are down, but sell-through rates are holding above 80%. That’s a selective and stable market.

Average prices for signed works have settled around £28,000, with unsigned around £10,000. Those figures are roughly where they were pre-pandemic, when the market was healthy and liquid. The difference now is that there are far fewer speculative sellers, and far more informed buyers.

When you zoom out over a ten-year horizon, the volatility of the COVID years looks like a brief distortion in an otherwise upward trajectory. The market has essentially reverted to its long-term mean, only this time, with a global collector base, institutional credibility, and a decade of sustained cultural relevance behind it.

The Macro Backdrop: Volatile, But Favourable

We’re operating in a strange economic moment right now. Inflation has proved sticky; central banks are cautious; and traditional investment vehicles have lost some of their shine. Global growth is sluggish, and for many investors, portfolios built on equities and property feel heavy and exposed.

Yet tangible assets, those you can live with, move, and enjoy, are quietly outperforming. Even as the Knight Frank Luxury Investment Index has softened slightly, sub-£50K artworks have shown resilience, precisely because they sit below the speculative ceiling of trophy-level art and above the noise of low-end collectibles.

Banksy fits perfectly into this band. His market has matured from a hype cycle into something resembling a blue-chip asset class in miniature, a bit volatile in the short term, but underpinned by cultural value, scarcity, and global liquidity.

No new prints have been released since 2017 (one outlier being Agile, produced in 2022). Authentication remains tightly controlled through Pest Control. And younger collectors, particularly those in their thirties and forties, continue to view Banksy as the most recognisable, relatable artist of his generation. Supply is fixed; demand is generational. That combination doesn’t come along often.

Scarcity as a Structural Advantage

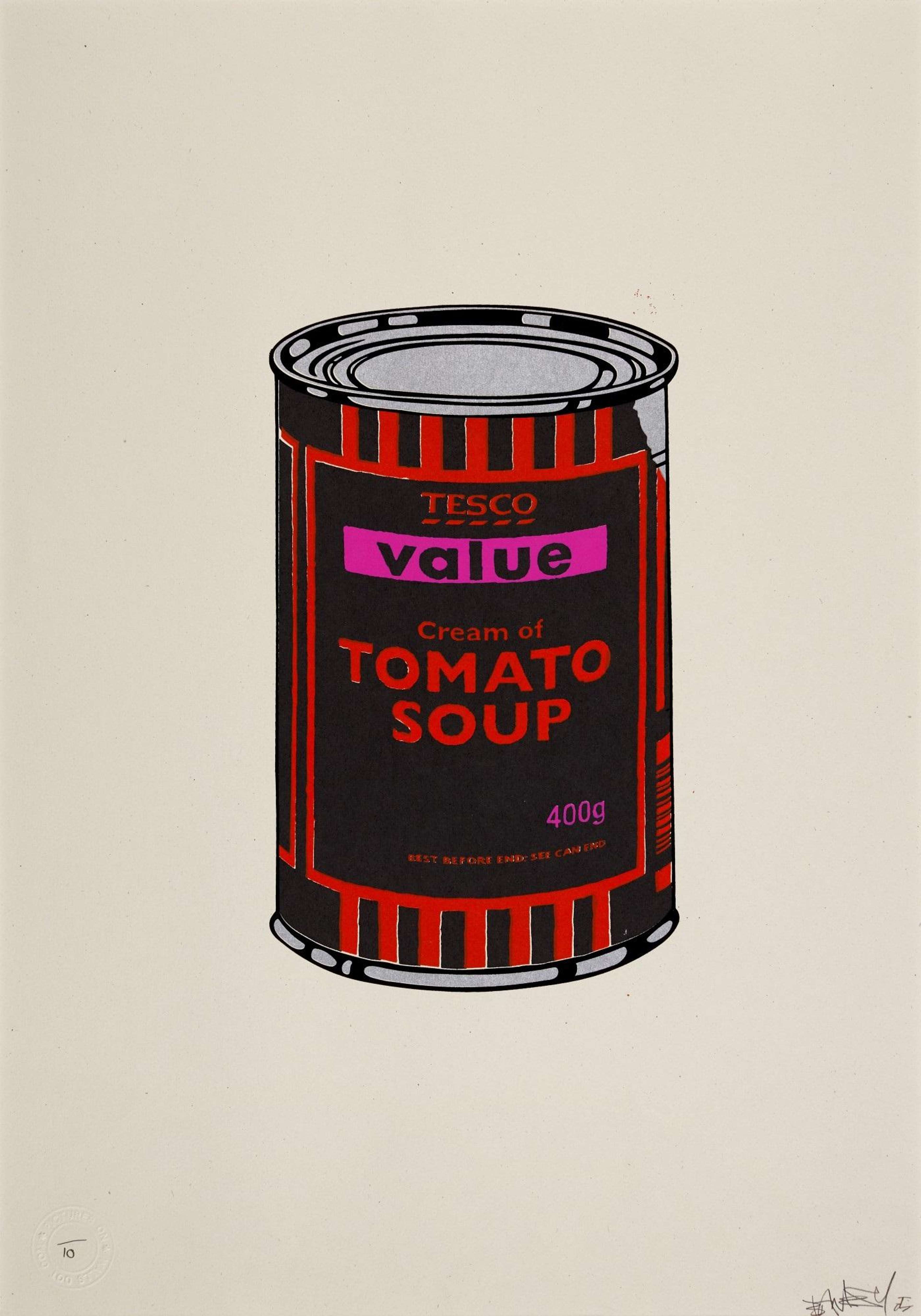

Scarcity is the single most important and least understood feature of Banksy’s market. Between 2002 and 2017, he released fewer than 30 distinct print editions, many of which exist in editions of 150 or fewer. Compare that to Warhol, Hirst, or even Lichtenstein, and the scale of scarcity becomes obvious.

There’s also attrition to consider: works lost, damaged, or destroyed over time. The active trading pool of many popular editions is already significantly smaller than their original run sizes. For every print listed publicly, several more sit locked in private collections, unlikely to resurface for years.

That means when you do see a strong, authenticated example, particularly of iconic imagery like Flower Thrower, Love Rat or Girl With Balloon, you’re not just buying at a discount; you’re securing one of a finite number of museum-grade works in circulation.

Collectors under 45 now make up nearly a third of global buyers at the major auction houses. This is a generation raised online, fluent in the language of memes, and deeply attuned to social and political commentary. Banksy speaks their language.

He is, arguably, the first true artist of the Instagram age, able to command attention outside the gallery system while maintaining critical legitimacy. His following of over 13 million isn’t a vanity metric; it’s a live audience of potential collectors, lenders, and advocates.

We see this in the data. Demand in Asia has risen sharply over the past 24 months, with Hong Kong and Singapore emerging as active hubs for private sales. Western buyers, meanwhile, are behaving more strategically, focusing on condition, colourway, and provenance rather than chasing headlines.

This is a disciplined market nothing like the frenzy of 2021. The collectors active now are informed, patient, and long-term in outlook, the exact qualities that underpin sustainable growth.

Understanding the Bear Case, And Why It’s Overstated

Every smart investor knows that opportunity and risk are inseparable. The Banksy market carries its share of friction: slow authentication, high transaction costs in some areas like auction, and lingering caution after the pandemic bubble.

But those risks are largely priced in. The crash already happened. The market shed 40–60% of its speculative premium between 2022 and 2024. What’s left is the intrinsic layer: works with cultural and visual power, authenticated, well-documented, and now trading at historically rational levels.

Yes, Pest Control can take time, but it also provides a protective moat around the market. Yes, transaction fees are real, but they apply equally to every serious collecting category, from watches to vintage cars. And yes, liquidity is selective, but the top Banksy editions still trade faster and more transparently than most post-war prints in their price bracket.

Strategy: Smart Collectors Perspective

The collectors we speak with daily aren’t chasing bargains; they’re building positions. They’re spreading purchases across 6–12 months, targeting the £20,000–£100,000 range, and prioritising editions with verified provenance and clean condition.

They’re also thinking about exits before they buy: factoring in costs, insurance, and resale channels. The playbook looks exactly like strategic portfolio management.

Banksy prints occupy an unusual middle ground between cultural artifact and financial instrument. They’re liquid enough to trade, rare enough to hold, and meaningful enough to live with. That trifecta is what gives them endurance, and why the current bear market is better described as a consolidation phase.

At MyArtBroker, we’re seeing seasoned collectors quietly returning to the market, often for the first time since 2020. They’re not buying because it’s trending; they’re buying because it’s undervalued.

The Long Game: From Hype to Maturity

The manic highs of 2021 were never sustainable, and the correction that followed was both necessary and healthy.

What we have now is a recalibrated ecosystem: fewer flippers, more informed buyers, and pricing that aligns with the artist’s true stature. In other words, a market capable of serious long-term growth.

There are moments in every cycle when the noise fades and patience pays. This, I believe, is one of them. For collectors who missed the early 2010s, or hesitated during the frenzy of 2021, the reset of 2025 offers a second chance, perhaps the last at this level, to enter the Banksy market intelligently.

It’s a quiet bear market, yes. But sometimes the quietest moments are where the smartest moves are made.